One of the country’s largest asset managers, Coronation Fund Managers, will scrap performance fees on five of its flagship funds that currently charge for outperformance.

These are its Equity, SA Equity, Top 20, Global Optimum Growth Feeder and Global Emerging Markets Flexible funds. Together, these funds have over R70 billion in retail assets under management (AuM).

Read:

Coronation earnings and dividend decline as tax windfall drops out

‘92% of Coronation funds outperformed their benchmarks’

The changes will be implemented from 1 October 2026 and all five funds will charge a fixed fee of 1.4% per annum (excluding Vat), regardless of performance. Institutional investors will pay a fee of 1.15%, while investments made on linked investment service provider (Lisp) platforms will pay 1%.

In the year leading up to the change (from 1 October 2025), retail investors will be charged the lower of the current variable performance-related fee and the new fixed fee. This will be accrued daily until 30 September 2026.

For the Coronation Top 20 fund (with nearly R34 billion in AuM), it says the “effective fee range during this period will be 0.50% to 1.40% per annum, depending on the fund’s performance”.

Previously, performance fees meant fees could be as high as 3% per annum.

In September as an example, before the change was implemented, the total expense ratio was 1.24%, which included a 0.99% fee for performance in line with the benchmark, plus 0.08% for outperformance over the last year. This fund delivered a return of 15.2% over a one-year period (as of 30 September) versus the benchmark’s 28.1% return, an underperformance of 12.9 percentage points.

The benchmark for the Top 20 fund is the FTSE/JSE Capped Shareholders Weighted All Share Index (C-SWIX).

Over the transition period, if the fund’s return (after fees and costs) is equal to that of its benchmark, a fee of 1% per annum will continue to be charged.

ADVERTISEMENT

CONTINUE READING BELOW

Under the revised performance fee structure, Coronation shares in “20% of the performance above the benchmark”, but this is now capped a maximum annual total fee of 1.4% per annum. It measures out- or under-performance over a rolling 24-month period.

When fund returns are below the benchmark over a rolling 60-month period, the base fee is discounted. Five years is a very long time to underperform.

For the Top 20 fund, this discounted fee for the retail class is 0.5% per annum, for the Equity and SA Equity funds, the discounted fee is 0.75% per annum, while for the Global Optimum Growth Feeder and Global Emerging Markets Flexible funds, the discounted fees are 0.85% and 1%, respectively.

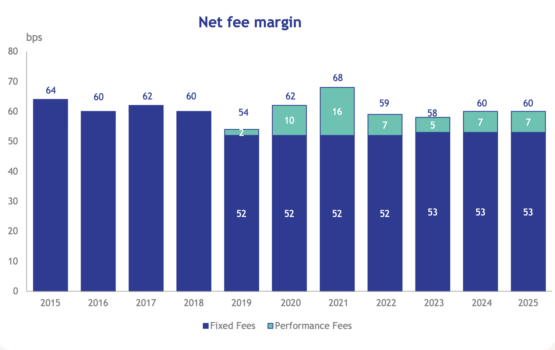

Despite what it describes as “ongoing industry fee pressures”, Coronation says it has delivered a “demonstrably resilient” fee margin over time.

Over the last decade, this has hovered near 60 basis points. In the 2025 financial year (to end September), its fee margin of 60 basis points was comprised of 53 basis points of fixed fees and 7 basis points of performance fees.

Source: Coronation annual results presentation

ADVERTISEMENT:

CONTINUE READING BELOW

Total revenue from fund management was R4.3 billion, of which R3.8 billion was (fixed) management fees, while performance fees were R487 million.

The latter grew by just 3% in the year (given relative underperformance against the JSE), while the former was up 11%. The bulk of these fees (68%) were earned in its Africa businesses, while the remainder in the international segment.

Read: Coronation warns of earnings drop after one-off tax case boost

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Coronation #scraps #performance #fees #Moneyweb