Don’t be fooled by occupancy rates, revenue growth, and other figures into assuming the South African hotel industry has recovered well following the devastating Covid-19 pandemic and load shedding. Beneath the surface, trouble is brewing.

This is highlighted in a new report by the Hospitality Asset Management Company (Hamac), in partnership with the business publication Tourism Update.

The South African Hoteliers Report, the first of its kind, shows that the figures do not tell the full story.

Read:

Iconic Hilton Durban shuts after hotel group yanks agreement

Hyprop’s Hyde Park Corner shopping centre sale falls through

“We have created this report because recovery on paper does not always match the reality on the ground. Behind every percentage of growth is a hotelier making tough calls; which repairs to delay, which staff to keep, how much cost to absorb before passing it on to guests who are already price-sensitive,” the foreword notes.

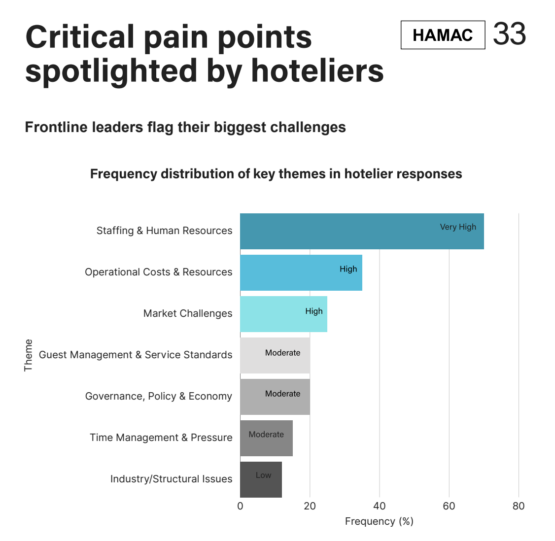

According to Hamac, the hotel sector is in the middle of a crisis regarding staff, profit margins and infrastructure.

The researchers used both quantitative and qualitative methods, engaging participants from across the country. About 42% of respondents were general managers, 36% operational managers, 17% owners, and 4% CEOs within the hotel industry.

The issues keeping them awake at night are as follows:

Profit margins under pressure

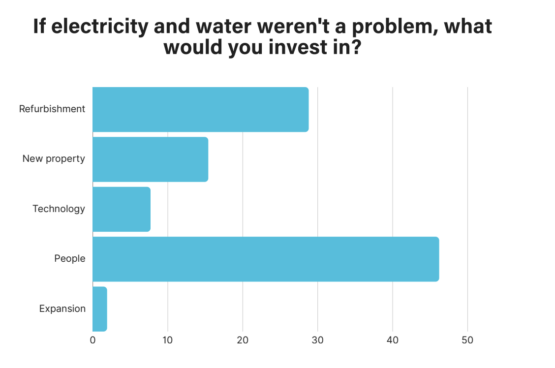

Rising prices are putting profit margins under pressure, with staff costs and utilities – especially electricity and water – being the biggest culprits.

Nearly 60% of respondents report no growth in profit margins compared with five years ago. A total of 28% say they have shrunk.

ADVERTISEMENT

CONTINUE READING BELOW

“Electricity costs were particularly noted as severe, an element critical to operations.

The combination of rising tariffs, load shedding, and the costs of generators or diesel backup has turned what were once manageable expenses into a near-universal operational crisis,” the researchers say.

They believe this pressure on profit margins is structural rather than temporary.

The significance of rising electricity costs was also reflected in Southern Sun’s results for the 2025 financial year.

Southern Sun CFO Laurelle McDonald reported: “The suspension of load shedding resulted in a saving of R36 million on diesel, offset by a R37 million increase in electricity costs, largely due to tariff increases.”

Read:

Southern Sun rising [Nov 2025]

Southern Sun October occupancy exceeds 2010 World Cup levels [Nov 2025]

She said the group continues to explore energy-saving initiatives and alternative energy sources to reduce long-term exposure to energy costs.

City Lodge, in its 2025 financial statements, noted that property costs rose by 13.1% due to higher utility expenses, “but [were] marginally offset by lower diesel consumption for generators”. The group has installed solar panels at 41 of its hotels.

Read: Tsogo Sun loses R30m on City Lodge disposal

Factors contributing to decline

According to the researchers, operating costs, regulatory pressures and volatile market conditions all contribute to this stagnation or decline.

ADVERTISEMENT:

CONTINUE READING BELOW

Two other significant factors that respondents identified as threatening profitability are commissions paid to online booking agencies and guests who book but do not show up.

This indicates how important it is to encourage direct bookings, have good cancellation policies, and carry out accurate forecasting, the researchers note.

Against this backdrop, many hoteliers are tightening their purse strings, postponing property upgrades, while also delaying spending on technology and expansion. The researchers warn that these measures are hindering the growth of the industry.

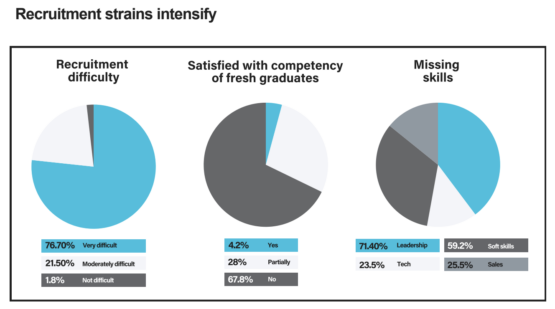

The study also shows that the industry is facing a staffing crisis that threatens its stability and future.

The problem is not only that it is virtually impossible to recruit new staff, but also that those entering the industry are not well-prepared for it.

It is also reportedly difficult to retain staff, and those who leave are overworked and underpaid, with little chance of promotion, while cultural differences and the fact that many positions are available in remote locations do not make it any easier.

Skills shortage

This increases the pressure on remaining staff, especially the leaders, contributing to burnout. The researchers describe this as a vicious cycle, resulting in a staffing gap that continues to widen.

According to owners and general managers, the skills shortage is not so much about technical skills, but attitude, behaviour and overall workplace readiness.

“Graduates may arrive with theoretical knowledge, but often lack the curiosity, commitment and personal initiative needed to translate that knowledge into performance,” the report states.

ADVERTISEMENT:

CONTINUE READING BELOW

Work ethic is another concern. Arriving on time, being reliable, and taking pride in one’s work are some of the problem areas, according to the respondents.

Listen: Entry-level job race intensifies amid skills shortages

The researchers conclude that this boils down to a lack of life skills and emotional intelligence – such as the ability to communicate effectively, handle pressure and show consideration for colleagues.

Without these skills, training does not mean much, according to respondents. However, the opposite is also true. If these aspects are present, it is not a problem for staff to learn the necessary technical skills.

Staff challenges

Low salaries, burnout and limited opportunities for advancement are cited as the main reasons staff resign, according to the research findings.

“These are not isolated problems but are interconnected, especially in an industry where profit margins are thin and investments in staff often takes a back seat to immediate operating expenses,” the researchers say.

Listen: Mounting crisis in SA’s hospitality sector looms

The report concludes: “The sector is not simply recovering. It is navigating a controlled crisis of staffing, margins and infrastructure.

“No single stakeholder can resolve these pressures alone.

“But, through coordinated action across people development, structural reform, targeted investment and collaborative planning, the sector can regain stability and unlock the growth potential that hoteliers are clearly ready for.”

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#hotel #industry #struggling #apparent #recovery