Gold dipped below $5 000 an ounce, as traders booked profits from a gain in the previous session spurred by mild US inflation data.

Bullion fell as much as 1.1%, having climbed 2.4% on Friday, when a modest rise in the US consumer price index for January allayed concerns about a bigger jump and boosted the case for the Federal Reserve to trim interest rates. Lower borrowing costs typically benefit non-yielding precious metals.

ADVERTISEMENT

CONTINUE READING BELOW

With markets in China closed this week for the Lunar New Year holiday, liquidity is thinner than usual during Asian hours. Demand for precious metals in the country has been frenetic in recent months, prompting authorities in the retail hub of Shenzhen to issue a stark warning against “illegal gold-trading activities,” ranging from apps offering leverage to retail investors to online live streams promoting bullion sales.

“With China and parts of the broader Asian market on holiday, gold is likely to see thinner liquidity and a quieter tone in early-week trade,” said Hebe Chen, an analyst at Vantage Markets in Melbourne. Recent price moves reflect “orderly consolidation and light profit-taking” after the push above $5 000 that followed Friday’s US inflation numbers, she said.

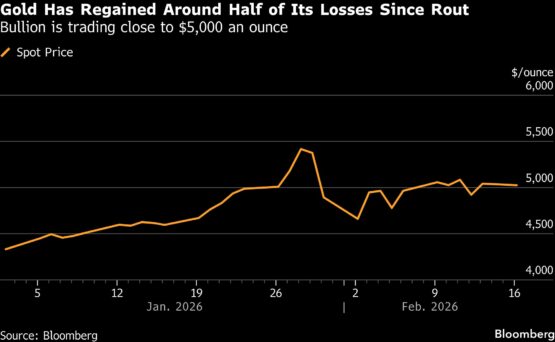

Gold surged to a record above $5,595 in late January as a wave of speculative buying drove a multiyear rally to breaking point. An abrupt, two-day rout at the turn of the month dragged it back below $4 500, but bullion has since regained roughly half of its losses in choppy trading.

Many banks expect gold to resume its upward trend, arguing that the drivers behind a multiyear rally remain in place — including geopolitical tensions, questions over the Fed’s independence, and a broader shift away from traditional assets such as currencies and sovereign bonds. ANZ Group Holdings said it expects bullion to hit $5 800 an ounce in the second quarter, joining a chorus of financial institutions that have forecast higher prices.

ADVERTISEMENT:

CONTINUE READING BELOW

“Structurally, the metal continues to demonstrate resilience — the macro backdrop has been firm but not disruptive, and technical support remains intact,” Chen said.

Spot gold fell 1% to $4 991.75 an ounce as of 11:10 a.m. in Singapore. Silver dropped 2.5% to $75.46 an ounce. Platinum and palladium also traded slightly lower. The Bloomberg Dollar Spot Index, a gauge of the US currency, edged up 0.1%.

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Gold #slips #traders #book #profits #mild #inflation #data