China’s most-valued company is losing favour with equity investors due to concerns that it is falling behind in the nation’s increasingly competitive artificial intelligence race.

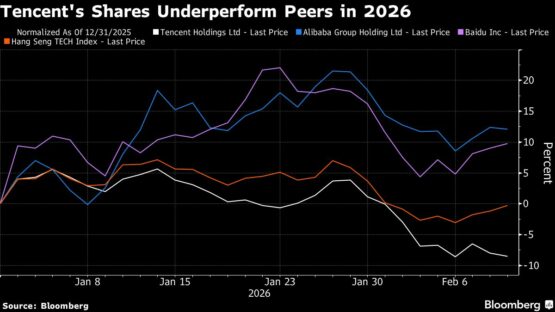

Shares of Tencent Holdings have slumped nearly 11% in Hong Kong this year, trailing a broader tech gauge. They fare even worse when compared to Alibaba Group Holding and Baidu — both of which have seen their shares rise in part due to optimism over their AI apps. In all, $173 billion in market value has been wiped out since Tencent’s stock reached a more than four-year high in early October.

Tencent’s owners are taking notice. Breaking with past practice, the company has joined an ongoing rush among tech firms to hand out so-called red packets to woo prospective users to their AI tools during the upcoming Lunar New Year break. Tencent plans to spend 1 billion yuan ($145 million) on the campaign.

| Company | AI Tool | Year-to-Date Stock Performance |

|---|---|---|

| Alibaba | Qwen | +11% |

| ByteDance | Doubao | Not listed |

| Tencent | Yuanbao | -11% |

| Baidu | Ernie Bot | +6.5% |

‘But investors seem disenchanted with the firm’s relatively conservative AI strategy. Unlike Alibaba and TikTok owner ByteDance, which have plowed billions into AI infrastructure and product roll-outs, Tencent has taken a more measured approach that focuses more on integrating AI into its core services like game publishing and the social media platform WeChat.

And to some, the proposed spending on red packets is also raising concern about profit margins.

“Margin risk is a reality now, in addition to losing the AI race to Alibaba and ByteDance,” said Felix Wang, tech sector head at Hedgeye Risk Management. “I’m worried about the new AI coupon war. Tencent catches my eye because usually they are not involved in these big spending wars.”

What Bloomberg Intelligence says:

“Alibaba, Baidu and Tencent’s $650 million Lunar New Year “Red Packet” AI promotions will further delay the sector’s path to profitability. The identical playbooks adopted by China’s leading AI firms — free products paired with cash giveaways — reflect a sector defined by cutthroat competition, leaving consumers as the primary beneficiary of the industry’s high-stakes drive for dominance,” Robert Lea, senior analyst

Tencent’s AI app is clearly lagging when it comes to adoption. The count of daily active users of ByteDance’s Doubao and Alibaba’s Qwen models reached 78.7 million and 73.5 million respectively as of Wednesday, far exceeding Yuanbao’s 18.3 million, according to the Shanghai Securities Journal, which cited data from QuestMobile.

The underperformance in 2026 comes after Tencent’s shares more than doubled in the previous two years, outstripping both Alibaba and Baidu over that period. The stock rallied nearly 44% last year on the back of robust earnings supported by a booming gaming business, as well as broader optimism toward the tech sector.

ADVERTISEMENT

CONTINUE READING BELOW

ADVERTISEMENT:

CONTINUE READING BELOW

Not everyone is bearish though. Analysts at Goldman Sachs Group said earlier this month that Tencent, along with Alibaba, continues to be the best positioned mega-cap stock on a one-to-three-year horizon within China’s internet space.

“Tencent could catch up if they execute well,” said Jian Shi Cortesi, a fund manager at GAM Investment Management in Zurich. “It’s huge and captive user base gives it an advantage to quickly gain a foothold in AI-related services.”

Meanwhile, pressure in the AI race is mounting amid a flurry of product launches ahead of the holidays.

Zhipu on Thursday released the latest iteration of its large language model, GLM-5, surpassing a rival offering from Moonshot AI unveiled just weeks ago. ByteDance has also won high praise for the performance of its new video model, Seedance 2.0, which is still in testing.

Zhipu’s shares soared 29% in Hong Kong on Thursday. The company also hiked the price of its GLM Coding Plan — similar to Anthropic PBC’s Claude Code, which is unavailable in China — by 30% this week to capitalise on surging demand.

Tencent’s stock, meanwhile, slid 2.3% to close at its lowest since August.

“The market probably just feels that the company isn’t being very aggressive in its AI transformation,” Julia Pan, an analyst at UOB Kay Hian Holdings , said of Tencent. “We really need to see some change in the narrative — for example, how AI gets embedded into different segments, and how AI applications contribute to performance — for its share price to recover.”

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Tencents #lag #fuels #173bn #stock #rout