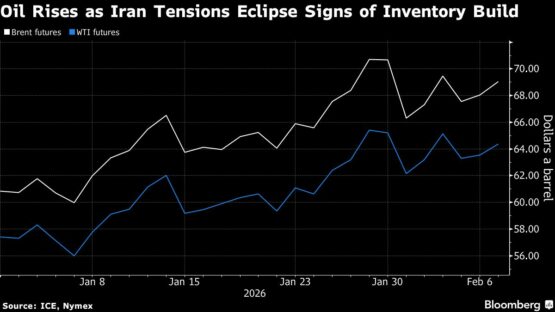

Oil gained as tensions in the Middle East focused on Iran outweighed a US industry report that pointed to a big rise in stockpiles.

Brent advanced above $69, after ending slightly lower on Tuesday, while West Texas Intermediate was near $65. Traders assessed a slew of reports, including one that the US was considering seizing tankers with Iranian crude, and a second that another aircraft carrier strike group could be sent to the region should negotiations over Iran’s nuclear program fail.

In the US, meanwhile, the American Petroleum Industry reported inventories swelled by 13.4 million barrels last week. If confirmed by official data, that would be the largest jump in barrel terms since November 2023.

ADVERTISEMENT

CONTINUE READING BELOW

Crude has advanced more than 10% this year supported by geopolitical tensions, including the latest US drive to reach a deal on Iran’s nuclear program. While initial talks have been positive, traders are concerned that a failure to reach an agreement may lead to US strikes, potentially jeopardizing oil flows from the OPEC member or drawing Iranian retaliation.

President Donald Trump has said that the leadership in Tehran “want to make a deal. I think they’d be foolish if they didn’t,” according to remarks to Fox Business. Later Wednesday, the US leader is due to meet with Israeli Prime Minister Benjamin Netanyahu at the White House to discuss the situation.

“Trump is pressuring Iran, stressing that if the negotiations go wrong, he will have to take very strong measures,” said Kim Kwangrae, a commodities analyst at Samsung Futures in Seoul. At the same time, the market appears to be disinterested in the changing inventory, Kim added.

| Prices: |

|---|

|

Ahead of meeting Trump, Netanyahu’s office said talks with Iran should be broader than the nuclear program, and also address the nation’s conventional long-range weaponry and regional proxy network. Last June, Israel, with US support, bombed uranium-enrichment assets in Iran during a brief war.

The Netanyahu visit “just adds headline risk,” said Haris Khurshid, chief investment officer at Karobaar Capital LP. “Unless it translates into concrete action, oil usually fades the initial move.”

ADVERTISEMENT:

CONTINUE READING BELOW

Iran is the fourth-largest OPEC producer, pumping an estimated 3.3 million barrels a day in January, according to a Bloomberg survey. Of that figure, the nation’s observed crude and condensate shipments totaled about 1.63 million barrels a day last month, vessel-tracking data show.

Traders will also look later in the session to a monthly report from OPEC on the outlook for the global market. That will be followed on Thursday by an analysis from the International Energy Agency, which has been warning that there’ll be a major surplus this year as supply runs ahead of demand.

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Oil #rises #tensions #Iran #eclipse #signs #inventory #build