Being contrarian solely for the sake of being contrarian is an awful investment strategy. Often the crowd is right when it punishes a stock, and catching a falling knife often means you just end up with an injury.

That said, when you can assure yourself of the quality of an underlying business, or the fundamentals of a sector or commodity, sometimes disagreeing with the market can be quite profitable.

Read:

Another way of viewing it is that cheap stocks are rarely found in places where the market agrees with you.

On that note, here is an interesting investment pick that has nothing to do with AI or gold.

And the market has recently lost interest in it, pushing its valuation down to, in my opinion, quite attractive levels.

Listen/read:

Bidcorp shares slide despite solid results [Aug 2025]

Bidcorp navigates financial growth amid global challenges [Aug 2025]

Bidcorp (BID) is a global foodservice business operating as a nimble, decentralised structure that empowers regional management in over 35 countries to operate entrepreneurial businesses.

This scale and agility has served the group well in the past and should continue doing so in the future.

The group’s core function is the efficient sourcing, value-adding processing, and delivery of a wide range of food, beverage, and related non-food products directly to professional customers – restaurants, hotels and institutions. This allows it to capture market share and drive growth through operational excellence as well as a strategic, persistent pursuit of bolt-on acquisitions.

ADVERTISEMENT

CONTINUE READING BELOW

Covid and consolidation

While Covid and lockdowns initially knocked this industry, Bidcorp used that time to consolidate and gain market share as smaller competitors collapsed.

Then food inflation picked up, and the combination of market share gains and higher nominal prices created a tailwind that caught the market’s attention.

This saw its share price rally hard.

Subsequently, this market attention has shifted elsewhere, post-lockdown ramp-ups are long gone, food inflation is benign, and, in the last year BID’s share price has drifted down around 8%.

This is despite revenues, cash flows and earnings remaining strong and continuing to grow.

Listen/read: ‘You’ve got to reward shareholders’ – Bidcorp CFO

In fact, if we specifically look at the group’s enterprise value to Ebitda (earnings before interest, tax, depreciation and amortisation), the stock is not just below mean valuation, it is below one standard deviation below mean and basically as cheap as it was at the outbreak of Covid.

Bidcorp EV/Ebitda

ADVERTISEMENT:

CONTINUE READING BELOW

Source: Koyfin, 3 December 2025

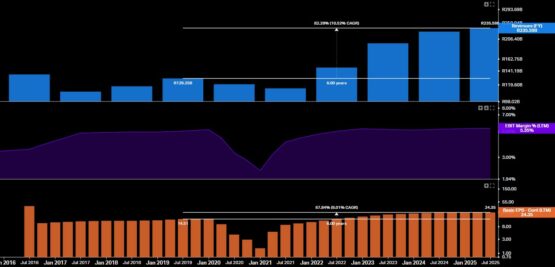

To emphasise what I said above, this weak share price and falling valuation are not because of poor performance from the group. You can see in the charts below that revenue, operating margin, and earnings per share (EPS) have held up and, indeed, continued to grow.

If we ignore Covid’s initial dip and go back and compare revenue and EPS to six years ago (to just before Covid):

- Revenue has grown remarkably at 10.52% compound annual growth rate (CAGR) over the period;

- EPS has kept up, and grown at 9% over this same period; and

- Operating margins (Ebit margin) have held up remarkably despite low-then-high-then-flat volumes and low-then-high-then-flat food inflation (in other words, the environment’s operational volatility is not being reflected in the group’s own operating performance, showing the quality of the management team).

Source: Koyfin, 3 December 2025

No, Bidcorp has and continues to perform well and disagreeing with the market’s current valuation here does not feel like catching a falling knife but rather grabbing an opportunity presented by a distracted market.

Read: Bumper dividends for Bidcorp [Aug 2024]

* Keith McLachlan is CEO of Element Investment Managers.

* Portfolios managed by McLachlan may hold Bidcorp shares.

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Bidcorp #contrarian #call #Moneyweb