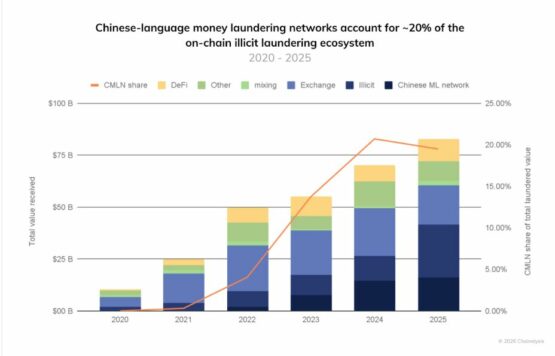

A growing share of global crypto crime is being driven by Chinese-language money laundering networks, which have processed an estimated 20% of illicit digital funds over the past five years, according to blockchain analysis firm Chainalysis.

Illicit cryptocurrency laundering climbed above $82 billion in 2025, according to a Chainalysis report released Tuesday, with Chinese-language money laundering networks accounting for $16.1 billion of that total. Their footprint has widened from a handful of active wallets a few years ago to nearly 1 800 in 2025, marking the emergence of a full-service underground ecosystem.

“These are groups that are growing exponentially,” Andrew Fierman, head of national security intelligence at Chainalysis, said in an interview. “We’re talking about growth of over 7 300 times faster than other illicit flows.”

While China enforces a blanket ban on crypto transactions, illicit activity persists because authorities primarily target actions threatening capital controls or financial stability, tacitly permitting some crypto activity, according to the firm.

ADVERTISEMENT

CONTINUE READING BELOW

The networks “have really embraced cryptocurrencies, notably stablecoins like Tether but also other cryptocurrencies like Bitcoin,” said Kathryn Westmore, a senior associate fellow at the Centre for Finance and Security at RUSI, adding that crypto provides “a way to launder the proceeds of cash-generating criminal activities, like drugs or fraud.”

A Tether spokesperson didn’t immediately return a request for comment.

ADVERTISEMENT:

CONTINUE READING BELOW

In August, the US Treasury issued a warning for banks that Chinese money-laundering networks are assisting Mexican drug cartels in hiding their profits, after the Financial Crimes Enforcement Network identified about $312 billion in such transactions between 2020 and 2024. The laundering groups also help individuals bypass the currency controls imposed by the Chinese government, according to the Congressional Research Service.

“Crypto offers an efficient way to discreetly move funds across borders without having to rely on the complex manual network of informal ledgers in various countries that used to be the norm,” Chris Urben, managing director at Nardello & Co, said in the Chainalysis report.

Broader use of stablecoins in so-called “unhosted wallets,” beyond the reach of financial institutions, could make it easier for criminals to evade detection, a June report by the Financial Action Task Force warned. The intergovernmental body, which develops policies to combat money laundering and terrorist financing, said most illicit activity on cryptocurrency ledgers now involves stablecoins.

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Chineselanguage #money #laundering #networks #driving #crypto #crime