The world’s largest hedge funds are accumulating “substantially higher” leverage in the bond market than smaller rivals thanks to their close relationships with dealers, according to the Bank for International Settlements.

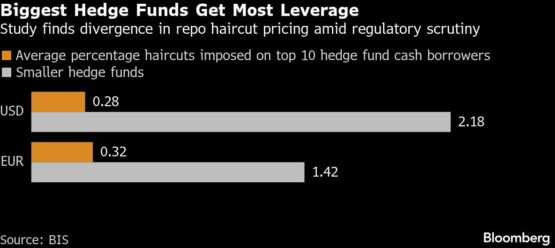

The average haircut — a reduction on the value of collateral in a repurchase agreement transaction — applied by banks to the 10 largest hedge funds was close to zero, according to BIS research published Tuesday. Such minimal haircuts allow these funds to obtain “very high levels of leverage relative to their smaller peers,” it said.

The BIS finding is the latest scrutiny into highly profitable fixed-income strategies such as the basis trade, as regulators seek to tame the risks from such leverage being unwound in a selloff. Earlier Tuesday, the Bank of England called on participants to manage their risk-taking to avoid market disruption.

“These large hedge funds are key clients of major dealers, giving rise to strong trading relationships that dealers appear to reward with more attractive haircut terms,” Felix Hermes, Maik Schmeling and Andreas Schrimpf wrote in the BIS paper.

ADVERTISEMENT

CONTINUE READING BELOW

Hedge fund activity in global repo markets has risen up the regulatory agenda as officials examine the risks from non-bank financial institutions. The BOE’s Financial Stability Report said Tuesday that hedge fund net gilt repo borrowing — where they borrow cash by pledging gilts as collateral — rose to a fresh record near £100 billion ($132 billion) in November, with a “small number” of unnamed funds accounting for 90% of the leverage.

Repo markets are a key source of financing for a variety of hedge fund strategies, including the basis trade. That typically involves a hedge fund using leverage from the repo market to purchase a bond in order to profit from the small price difference between the security and its corresponding futures contract.

Haircuts are pivotal in determining the leverage they and other investors can achieve via repo markets. In theory, a small haircut of 0.5% enables a borrower to hold assets worth 200 times their equity, while a zero haircut could even lead to “infinite leverage,” the BIS report said.

“Understanding the factors influencing haircut settings and their implications for leverage is therefore critical for evaluating vulnerabilities in the financial system,” the researchers said.

The scrutiny has sparked tension between regulators and the industry. A BOE proposal to impose minimum haircuts on repo transactions was opposed by lobby groups, who warned it would harm liquidity.

ADVERTISEMENT:

CONTINUE READING BELOW

While minimum haircuts “could limit leverage build-up, they risk favouring cash lenders at the expense of collateral lenders’ ability to secure the return of their collateral assets,” the BIS paper said. “Thus, a careful design of such tools that takes into account market practices across different segments seems warranted.”

The BIS’s analysis is based on the euro area’s Securities Financing Transactions Data Store. The database captures the entirety of the euro repo market as well as a “substantial volume of repo activity in US dollars, owing to the significant presence of European banks in dollar repo markets,” the report said.

The researchers also pushed back against one defence of zero haircuts: that they reflect what’s known in the industry as portfolio margining. That’s where a bank makes decisions on collateral levels based on a counterparty’s entire trading exposure rather than individual repo transactions.

“Accounting for haircuts set at the portfolio level rather than for individual repo transactions does not alter conclusions on the prevalence of zero repo haircuts,” the BIS researchers said.

© 2025 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Biggest #hedge #funds #repo #leverage #terms #BIS #finds