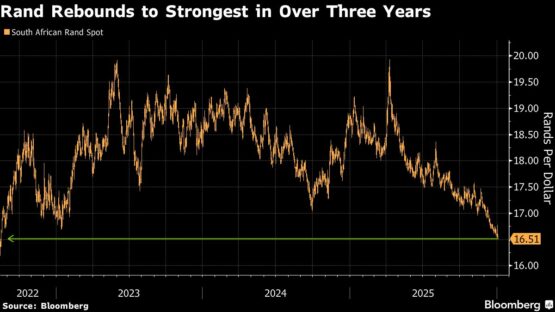

South Africa’s rand kicked off the new year by climbing to the strongest level since 2022, backed by upbeat South African trends, including continuing economic reforms and rising metals prices.

The rand rose as much as 0.6% to R16.50 against the dollar on Friday, outperforming most emerging-market peers. The currency appreciated 14% in 2025, its best year since 2009.

Read:

The government is pursuing economic reforms to lift growth in the continent’s biggest economy from a decade-long average of less than 1%, while metals prices extended gains on Friday.

Meanwhile, the South African Reserve Bank’s 3% inflation target has helped lower inflation expectations with investors increasingly upbeat on policymakers’ ability to deliver price stability.

“The environment is very positive for the rand and I don’t see a reason for the rand to weaken from here,” said Anders Faergemann, a portfolio manager at PineBridge Investments Europe Ltd.

ADVERTISEMENT

CONTINUE READING BELOW

The bullish outlook contrasts with more bearish forecasts of analysts from BNP Paribas SA to Mizuho Bank Ltd, who expect a median of R17 per dollar in the first quarter of 2026.

The rand has been “very resilient in recent months, bolstered by consolidation of the institutional framework and newfound confidence in price stability, which should bolster economic growth”, said Faergemann.

South Africa’s benchmark equity index rose as much as 0.9% before paring gains, led by advances in precious metals and mining stocks.

ADVERTISEMENT:

CONTINUE READING BELOW

Michael Grobler, a strategist at Ashburton Fund Managers Ltd, sees the rand as “short-term overbought” and likely to consolidate around R16.50-16.70 per dollar after strong end-of-year performance.

Risks to the currency include a resurgent dollar, profit-taking in precious metals as well as renewed geopolitical tensions which could end up lifting oil prices.

“In the short and medium term the performance of [the] rand will be dictated by a continuing bull market in metals,” Grobler said.

© 2026 Bloomberg L.P.

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Rand #jumps #threeyear #high