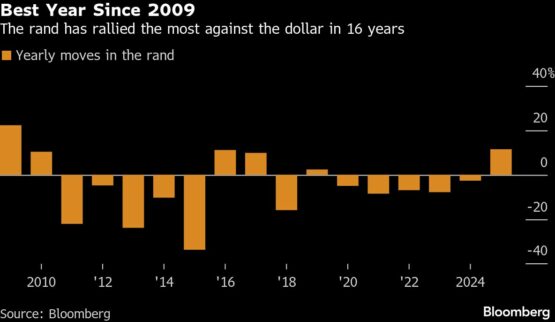

South Africa’s rand is poised to end the year with the biggest jump since 2009, as the dollar’s weakness combined with political stability at home, bolstered the nation’s allure for investors.

The currency has jumped 13% against the dollar this year. Overseas investors bought a net R72.4 billion ($4.3 billion) of local-currency bonds this year. That compares with net purchases of R15.6 billion in 2024.

Meanwhile, the dollar is headed for its worst decline in eight years.

Slower inflation and faster growth in Africa’s biggest economy and expectations that the US Federal Reserve will lower borrowing costs further is likely to boost the currency next year.

Read: Consumer confidence rises in Q4

Investors will also monitor progress in fixing state-run power utility Eskom Holdings SOC Ltd., which has managed to keep the lights on for most of 2025 after years of rotational blackouts, as well as improvements at the country’s rail and port operator.

ADVERTISEMENT

CONTINUE READING BELOW

“A catalyst for further gains could be continued inflows into South Africa by offshore investors”, or investors reducing their protection against foreign-exchange moves, said Lauren van Biljon, senior portfolio manager at Allspring Global Investments.

“Further easing from the US Federal Reserve should keep interest in higher-yielding emerging markets alive and well, at least through the first half of 2026.”

Read:

Rand is losing its reputation for wild swings

SA banks rally as JPMorgan upgrades on strong macro outlook

Fed cuts rates with three dissents, projects just one cut in 2026

President Cyril Ramaphosa has managed to keep his coalition government together and introduced policy measures that are expected to help the economy expand 1.3% this year, compared with less than 1% on average in the prior decade.

South African ports and logistics firm Transnet SOC Ltd. earlier this month signed an agreement with Filipino billionaire Enrique Razon’s company to expand the main terminal at the continent’s top container hub in Durban.

Read:

Transnet signs 25-year port agreement with billionaire Razon’s ICTSI

Saudi-backed port developer weighs Durban harbour deal

The deal marked the biggest attempt yet to bring in private expertise to revive state-owned ports, which rank among the least efficient globally, according to the World Bank.

“Political stability under the new government has also lifted a degree of political risk off the rand and also supported the currency in 2025,” said Brendan McKenna, an emerging markets economist and FX strategist at Wells Fargo Securities.

ADVERTISEMENT:

CONTINUE READING BELOW

The rand’s gains this year would mark its first since 2019. It has also been the best-performing emerging-market currency in the past six months after the Colombian peso.

South Africa’s new lower inflation target is also giving the unit fresh momentum. The nation last month formally adopted a 3% inflation target long championed by central bank Governor Lesetja Kganyago, aligning the goal more closely with trading partners.

Read:

Inflation expectations fall toward 3% target

Inflation dip strengthens case for January rate cut

Lower inflation target set to reshape rand’s long-term path

The shift – replacing the 3% to 6% target band in place since the turn of the century – spurred demand for government bonds that helped push 10-year yields to the lowest level since 2017. The rally in gold to a record, and in platinum group metals also aided the currency.

Meanwhile, the currency’s measure of implied volatility over the next year fell to its lowest level since 2001, signalling that investors anticipate fewer price swings in the months ahead.

© 2025 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Rand #set #biggest #gain #years #stability