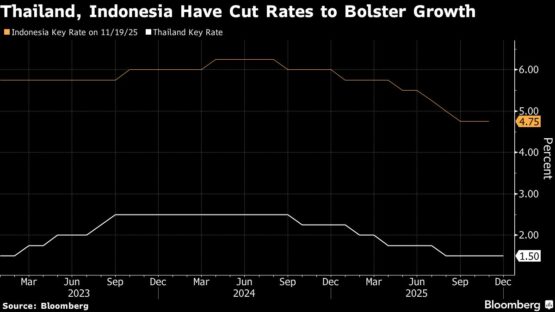

Central banks in Thailand and Indonesia will make their last interest rate decisions of 2025 under a cloud of economic challenges from politics to weather.

Bank of Thailand will likely use its thin policy space to lower rates on Wednesday, seeking to cushion the economy from fresh political turmoil. Meanwhile, it’s a close call for Bank Indonesia as policymakers grapple with a struggling currency and the aftermath of the deadliest cyclone in a half century.

Here’s what to watch out for in the double-header, starting 2 p.m. in Bangkok and Jakarta:

Thailand

The Monetary Policy Committee will lower the one-day repurchase rate by a quarter point to 1.25%, according to 23 of 24 economists in a Bloomberg survey. One analyst sees another hold after an unexpected pause in October.

The Southeast Asian nation has been hit by a series of shocks, from US reciprocal tariffs, severe flooding in the southern region, and a deadly border clash with Cambodia.

Prime Minister Anutin Charnvirakul last week triggered the dissolution of parliament, paving the way for elections Feb 8. The move effectively shelves fiscal stimulus until a new government forms, potentially in five months.

“With the political situation in flux, it is more important than ever for the central bank to be an anchor of stability,” said Erica Tay, an economist at Maybank Securities.

ADVERTISEMENT

CONTINUE READING BELOW

BOT will also update its economic projections, which earlier pegged growth slowing to 2.2% this year and 1.6% in the next — lagging regional peers.

“The key risk now is whether elections can proceed as scheduled if the border conflicts persist,” said Burin Adulwattana, managing director and chief economist of Kasikorn Research Center Co.

A cut could temper the baht’s strength, which has weighed on exports and tourism. The currency climbed to its highest in more than four years Monday and has appreciated more than 8% this year, Asia’s second-best performer, according to Bloomberg data.

Newly appointed Governor Vitai Ratanakorn said last month the baht should be weaker to reflect economic fundamentals, adding the central bank will step in to smooth excessive volatility. Vitai on Tuesday ordered stricter checks on foreign-exchange transactions involving dollar sales, especially those related to gold, to curb inflows after the baht’s rapid gains this month.

Falling consumer prices since April also gives policymakers freedom to ease. The BOT has cut by 100 basis points since October last year, and the benchmark already sits at its pre-pandemic level of 1.5%.

But Vitai himself has acknowledged that the economy is held back by structural issues — ageing population and mounting household debt — that may be beyond the reach of monetary policy.

Indonesia

Bank Indonesia will likely keep its BI-Rate at 4.75%, according to 22 of 34 economists in a Bloomberg survey. The rest see a 25-basis point cut.

ADVERTISEMENT:

CONTINUE READING BELOW

BI Governor Perry Warjiyo said at the policy rate meeting last month that his short-term focus was on rupiah stability and attracting capital. He also said in late November that BI would continue to strike a balance next year between supporting growth and stabilising the currency.

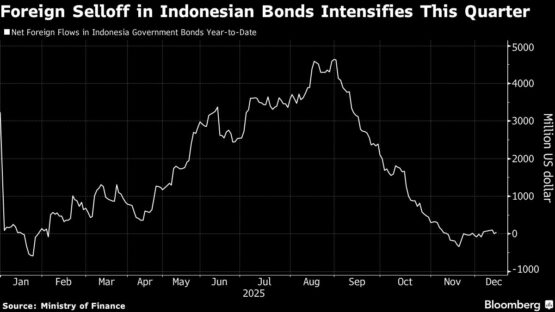

Southeast Asia’s largest economy is facing an exodus of foreign investors, concerned about slowing growth and costly government programs like free lunches and low-income houses.

The nation’s bond market this year risks seeing net outflows for the first time in three years, with overseas funds reversing purchases of $4.6 billion last month. Foreign investor selling of Indonesian debt hit a one-month high last week.

The rupiah losses this year have deepened to 3.5%, the second-worst performing Asian currency.

Global risk-off sentiment, Jakarta’s widening fiscal deficit and uncertainty over restrictions on exporters’ foreign-exchange earnings has driven bond outflows and complicates BI’s policy steps, said Josua Pardede, economist at PT Bank Permata in Jakarta.

The nation is also recovering from a cyclone that tore across Sumatra late last month, killing over 1,000, displacing more than a million, and washing away entire communities. The damage could disrupt agricultural production and dampen short-term economic growth, bolstering BI to retain its easing bias.

© 2025 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Politics #disasters #challenge #Thai #Indonesian #central #banks