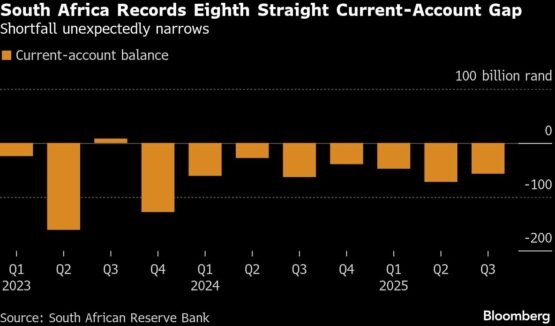

South Africa’s current-account deficit unexpectedly narrowed in the third quarter, reflecting an improvement in the nation’s terms of trade.

The gap on the current account, the broadest measure of trade in goods and services, shrank to 0.7% of gross domestic product — equivalent to R57 billion ($3.3 billion) — in the three months through September, compared with a revised 1% in the prior quarter, data released by the central bank on Thursday showed. The latest reading beat the 1.2% median estimate of four economists in a Bloomberg survey.

South Africa’s terms of trade, including gold, improved slightly in the third quarter, while the terms excluding bullion ameliorated at a faster pace as the rand price of exported goods and services increased more than that of incoming shipments, the bank said.

ADVERTISEMENT

CONTINUE READING BELOW

“The narrowing of the current-account deficit mainly resulted from a smaller shortfall on the services, income and current transfer account,” it said.

South Africa’s trade surplus shrank to R178.3 billion in the third quarter from R187.2 billion in the prior three-month period as the value of imports increased more than exports. The bank cited higher imports of refined petroleum products and crude oil as the main driver in the increase in the value of imported mining products.

The deficit on the services, income and current-transfer account declined to R235.3 billion from R259.4 billion as the country recorded a smaller shortfall on its primary-income account.

As a percentage of GDP, the shortfall on the services, income and current transfer account narrowed to 3% from 3.4% previously.

South Africa has now posted eight successive current-account deficits — the longest stretch since 2019, according to data compiled by Bloomberg.

© 2025 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#South #Africa #posts #smallerthanexpected #currentaccount #deficit