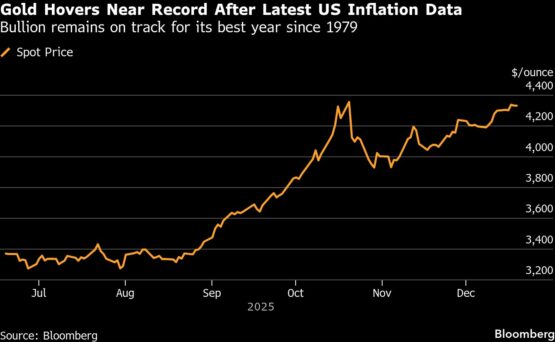

Gold and silver hovered near record highs, after slower-than-expected inflation in the US supported bets for more interest-rate cuts.

Spot gold was near $4 330 an ounce by mid-morning in London on Friday, and on track for a second weekly gain. The core US consumer price index rose at the slowest pace since early 2021, according to data released on Thursday, bolstering the case for lower borrowing costs – a tailwind for non-yielding precious metals.

However, the latest inflation report was muddled by a record six-week government shutdown that ended last month. Since delivering its third straight rate cut last week, the Federal Reserve has been ambiguous about the future pace of monetary easing. Traders are assigning a roughly 25% chance of a reduction in January, while US President Donald Trump has advocated aggressively for lowering rates next year.

ADVERTISEMENT

CONTINUE READING BELOW

In Asia, the yen dropped against the dollar after the Bank of Japan raised its interest rate to the highest level since 1995 but offered no clear guidance on future monetary tightening.

Geopolitical tensions, including in Venezuela, have also enhanced gold’s haven appeal. Trump has ordered a blockade of all sanctioned oil tankers off the country’s coast as he ratchets up pressure on Caracas amid a buildup of America’s military presence in the region.

Precious metals have been on a scorching rally this year, with both gold and silver set for their best annual performances since 1979. Silver has more than doubled and gold has jumped about two-thirds on a run underpinned by elevated central-bank buying and inflows into bullion-backed exchange-traded funds.

Falling US interest rates have led ETF investors “to start competing for limited bullion with central banks,” Goldman Sachs Group Inc. analysts including Daan Struyven said in a note. “We expect the same two drivers — structurally high central-bank demand and cyclical support from Fed cuts — to lift the gold price further.”

ADVERTISEMENT:

CONTINUE READING BELOW

Platinum has also more than doubled this year. The metal’s surge to above $1,980 an ounce — the highest since 2008 — has come as the London market shows signs of tightening, with banks parking supplies in the US to insure against the risk of tariffs. Exports to China have also been robust this year, with demand bolstered by the start of futures trading in Guangzhou.

Gold was little changed at $4 327.33 an ounce as of 10:46 a.m. in London, up about 0.7% for the week. It hit an all-time high above $4,381 in October. Silver rose 0.9% to $66.08, trading near a record of $66.89 set on Wednesday. Platinum edged lower, while palladium rose 0.6%. The Bloomberg Dollar Spot Index was up 0.2%.

© 2025 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Gold #silver #record #highs #data #support #ratecut #bets