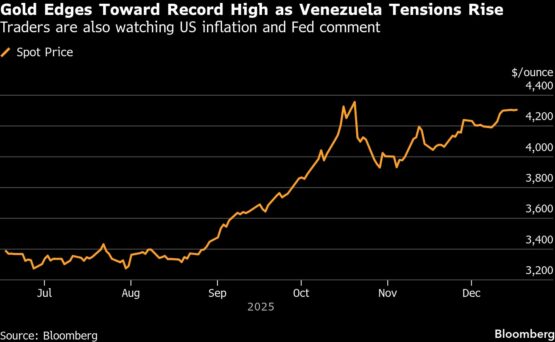

Gold climbed toward a record high as investors looked ahead to US inflation data and monitored escalating tensions in Venezuela. Silver climbed to a fresh peak, extending a powerful rally.

Bullion traded near $4 330 an ounce, recovering from a modest decline in the previous session that snapped a five-day winning streak and about $50 short of its all-time high. Inflation numbers due Thursday will be watched closely for clues on how the Federal Reserve’s appetite for further rate cuts might be impacted. Ahead of the release, several key Fed officials are due to speak publicly.

Gold was also boosted by events in Venezuela, with President Donald Trump ordering a blockade of all sanctioned oil tankers. The US leader is also pressuring his Venezuelan counterpart Nicolas Maduro amid a military buildup in the region and the threat of land strikes.

“The tensions seem to be gradually ratcheting up,” said David Wilson, senior commodities strategist at BNP Paribas. Every factor supporting gold — from inflationary pressures to U.S. equities and a global growth slowdown — appears to be occurring simultaneously, he added, predicting that bullion could reach $5 000 sometime next year.

ADVERTISEMENT

CONTINUE READING BELOW

Gold is not far off the record above $4 381 an ounce set in October. The precious metal has jumped about two-thirds this year and is on track for its best annual performance since 1979. The scorching rally has been driven by elevated central-bank buying, as well as a broader pullback by investors from government debt and key currencies. Geopolitical tensions have also enhanced its haven appeal.

Investors are watching closely for any sign of further monetary easing after the US central bank last week delivered its third consecutive rate cut — a tailwind for precious metals, which don’t pay interest. For now, traders are assigning a near-25% chance of a reduction in January.

Non-farm payroll data released Tuesday showed a continued cooling of the American jobs market, but didn’t move the needle on rate cuts. The Fed is seen giving less weight than usual to economic data due to lingering disruptions caused by the government shutdown.

The appointment of a new Fed chair will provide a further signal on monetary policy next year. Trump — who has called for lowering rates aggressively — is slated to interview Fed Governor Chris Waller on Wednesday for the job, the Wall Street Journal reported on Tuesday, citing unnamed sources. One or two more interviews are expected this week and an announcement is expected sometime in early January, Treasury Secretary Scott Bessent said.

Bullion is expected to average $4,500 an ounce in 2026, according to Nicky Shiels, head of research at precious metals refiner MKS Pamp SA, joining a chorus of predictions that it will push higher. Gold will likely consolidate in the near term “before establishing a milder, more sustainable bullish trajectory” after this year’s “parabolic surge,” Shiels said in a note on Tuesday.

ADVERTISEMENT:

CONTINUE READING BELOW

Meanwhile, platinum surged more than 3% to levels last seen in 2011, after the European Union’s plan to consider easing emissions rules for new cars, and scrapping an effective ban on combustion engines.

There’s been some buying interest from auto companies over the last week or so, Wilson said, adding that rolling back those bans is a positive story for platinum as well as palladium. The two metals are used in catalytic converters to reduce pollution from conventional engines.

Gold advanced 0.7% to $4 322.45 at 1:16 p.m. in Singapore on Wednesday. Silver climbed as much as 4% to a record $66.274. Platinum was up almost 3%, while palladium also rose. The Bloomberg Dollar Spot Index gained 0.2%.

© 2025 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Gold #rises #record #traders #watch #data #Venezuela