After the strongest performance by the FTSE 100 in 16 years, the UK’s more domestically focused shares look set to muddle along for yet another spell as the economic backdrop remains bleak.

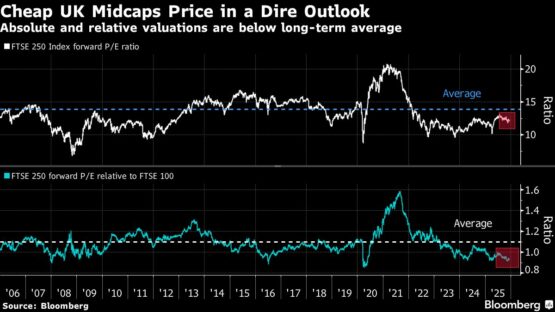

The UK’s blue-chip gauge has defied expectations in 2025, rising 19% and outperforming the S&P 500 and Euro Stoxx 50. But domestic peers have been left behind. The FTSE 250 is up just 6.5% as high interest rates, a downbeat economy and a growing tax burden weigh on sentiment.

“Investors are definitely concerned about growth, taxes and politics in the UK,” said JPMorgan Chase & Co. strategist Mislav Matejka. “There is no compelling angle, there’s no clear growth acceleration.”

The Bank of England meets this week, and a rate cut is nearly priced in, with another one expected by June. Still, that may not be enough to support the market without a clearer improvement in growth. The UK risks its first quarterly contraction since Labour took office, after activity slipped in October ahead of Chancellor Rachel Reeves’ tax-raising budget.

In contrast, euro-area mid-caps have been standout performers, gaining 17% thanks to more dovish monetary policy and government spending commitments. Estimates for earnings growth next year aren’t looking great either for the FTSE 250 at just 7.5%, compared with 27% for the Euro Stoxx Mid-Cap, according to data compiled by Bloomberg. The estimates are also higher for most large cap benchmarks, which are expected to generate close to or above double-digit earnings growth in 2026.

ADVERTISEMENT

CONTINUE READING BELOW

“Given the structural headwinds post Brexit and lack of pro-long-term growth policies from the government, we find it hard to turn constructive on the broader UK equity space, despite a compelling valuation case,” said Barclays Plc strategist Emmanuel Cau, who is underweight UK stocks.

After meeting with more than 100 investors and clients, he said concerns were raised about next spring’s local elections — which could pose a setback for Labour — alongside persistent fiscal and growth worries.

For the FTSE 100, the strategists noted its defensive, value-tilted profile and attractive valuation, making it a useful diversifier. But it could lag next if global growth picks up as expected and investors pour money into markets with a stronger outlook. The benchmark often serves as a haven, given its heavy exposure to health care and staples, and tends to outperform when investors are more risk-averse.

As a result, investors need to be selective. Some sectors should see early signs of recovery once interest rates begin to fall. The Bank of England may find it easier to justify easing policy as the economy shows clear signs of softness. JPMorgan’s Matejka argued there is room for deeper cuts in 2026 than the two currently priced in by money markets, which could lift homebuilders, real estate and consumer-exposed sectors.

ADVERTISEMENT:

CONTINUE READING BELOW

“Pessimism is laying the groundwork for possible improvement,” said Martin Walker, co-head of UK and European equities at Invesco. “Lower rates could certainly help, encouraging reluctant households to start spending again.”

UK households are sitting on savings equivalent to 14% of GDP, which could be deployed as they get more confident, Walker said. He sees opportunities in utilities and internationally focused consumer-staples companies, many of which trade at compelling valuations relative to global peers. He also favors health care and domestic UK banks.

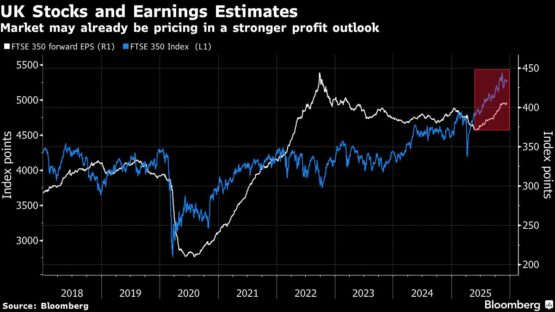

Broader valuations remain relatively low compared to global equities, but the UK has already re-rated this year, reducing some of its previous appeal. The FTSE 350 now trades around 13 times forward earnings, above the long-term average of roughly 12. Large caps have supported performance through strong dividends and buybacks, while earnings estimates have turned higher.

UK stock investors were rewarded with 6.5% total shareholder yield, including dividends, buybacks and M&A, according to Russ Mould, investment director at AJ Bell. That outpaces inflation, gilts and cash, he said.

“The UK has been a bit of a cash machine,” he said, adding that earnings momentum and cash returns are the first “stepping points” for 2026. The UK is “not expensive by historic standards, but it’s no longer cheap,” Mould said.

© 2025 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#FTSE #eyes #year #smaller #names #struggle