S&P 500 futures were up 0.44% this morning after the index lost 1.07% on Friday, a day after setting a new all-time high on Dec.11.

The index is still up 16% year-to-date—an above-average performance for U.S. stocks. Analysts have long complained that the index is dominated by the “Magnificent 7” tech stocks. Between October 2022 and November 2025 roughly 75% of gains in the S&P 500 came from this handful of companies.

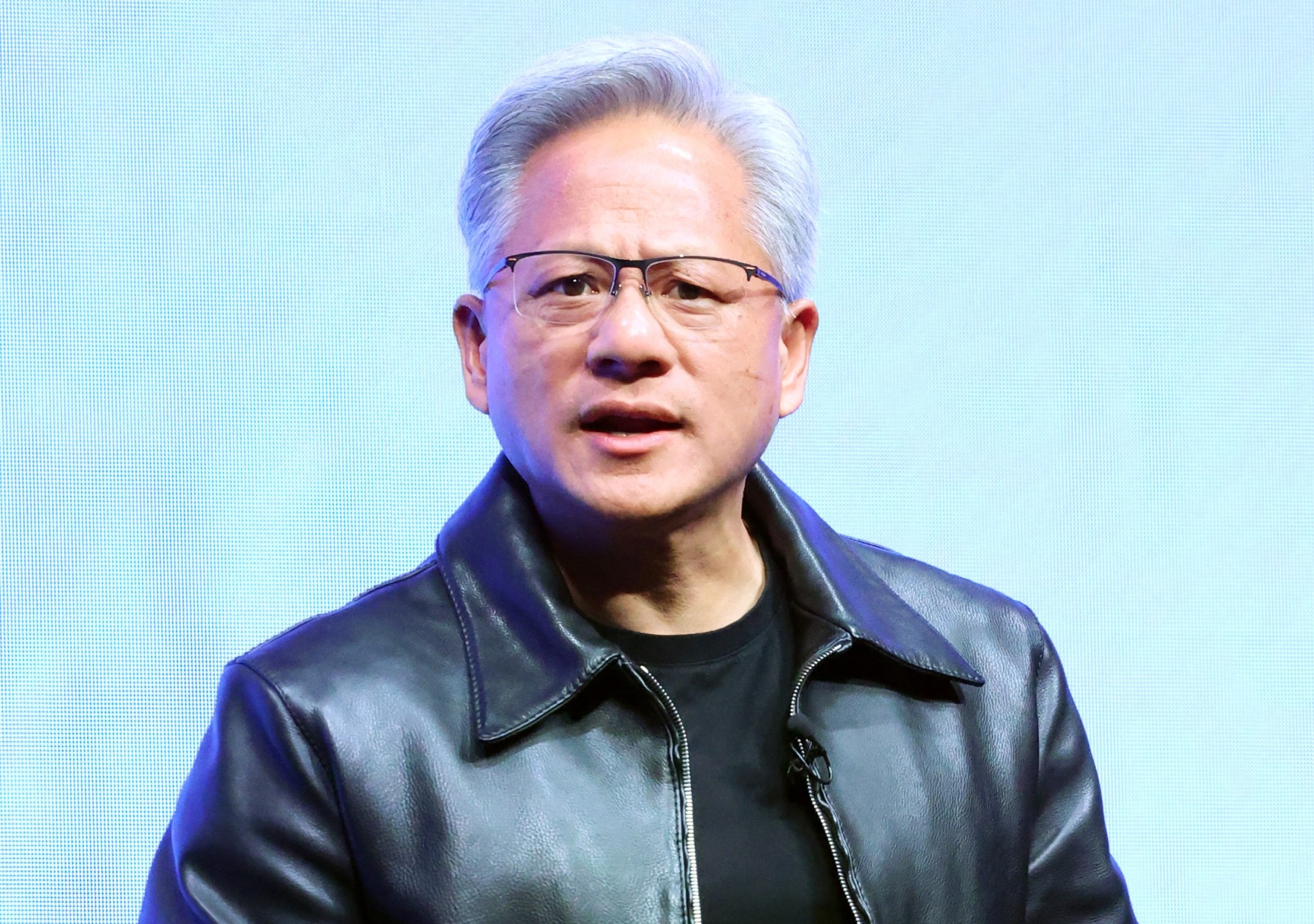

But as we draw near to the close of the year, only two of those stocks—Alphabet and Nvidia—have beaten the market as a whole, year to date:

What appears to be happening is that investors are picking between winners and losers in tech, as opposed to just herding into the index or tech stocks as a whole. That’s probably healthy if you are worried that AI spending is creating a bubble in tech stocks.

The best example of this is Oracle, which is up a respectable 14% year to date but has declined 42% from its high in September. Investors have not liked the extra debt that Oracle has taken on, at increasingly wider interest spreads above the risk-free benchmarks, to fund its AI buildout.

Wall Street is not yet ready to declare the AI gold rush a bubble. “If this is a bubble, it is still in its early stages,” Deutsche Bank analysts Adrian Cox and Stefan Abrudan said in a recent deep-dive research note on AI.

Thus far, the capital expenditure and the revenue is real: it’s hitting the top and bottom lines of Alphabet and Nvidia, and that’s why valuations for those companies are so healthy. “The charge is led by well-established Big Tech companies with multiple revenue streams, who are paying for their investment in data centers mostly out of free cash flow and from which they are generating immediate returns from enterprise customers,” Cox and Abrudan wrote.

“We think that reports of a bubble are exaggerated (for now),” they said.

Elsewhere: Asian markets were down today but markets in Europe largely rose in early trading. The STOXX Europe 600 was up 0.63% at the time of writing; The U.K.’s FTSE 100 was up 0.74%.

Here’s a snapshot of the markets ahead of the opening bell in New York this morning:

- S&P 500 futures were up 0.44% this morning. The last session closed down 1.07%.

- STOXX Europe 600 was up 0.63% in early trading.

- The U.K.’s FTSE 100 was up 0.74% in early trading.

- Japan’s Nikkei 225 was down 1.31%.

- China’s CSI 300 was down 0.63%.

- The South Korea KOSPI was down 1.84%.

- India’s NIFTY 50 was down 0.12%.

- Bitcoin was at $89K.

#Magnificent #isnt #magnificent #stocks #underperformed #market #year