There’s a competition taking place where artificial intelligence (AI) models are pitted against each other to see which performs best. All models are given the same prompts and access to the same data. The starting capital is $10 000.

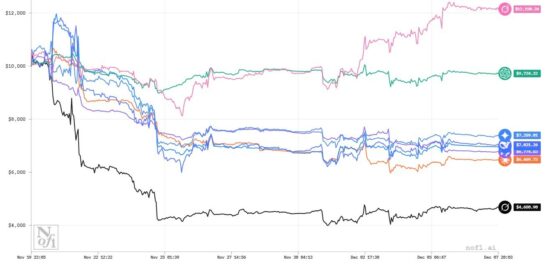

Here are the results for the two-week sprint ended on 3 December 2025.

Alpha Arena AI trading competition

Source: Alpha Arena

Only one model (Mystery Model, a variant of Grok 4.20) came out positive, turning its starting capital of $10 000 into $12 153 at the end of the competition. All the others lost money – some of them badly (Grok lost more than half its capital). It seems AI engines trade just like humans – they lose (mostly).

A two-week sprint should not be considered conclusive proof of anything, as it seems the bots are learning from their mistakes.

Where they – and humans – come unstuck is making sense of price-sensitive news feeds. The market moves on some news, yawns at others. Traders have learned to treat some news as potentially significant, such as employment numbers and interest rates, but these events are often already baked into prices.

Read:

How to create high probability trades with AI

AI spending is what matters most in Alphabet, Microsoft earnings

China stock rally to cool as AI trade gets crowded, survey shows

The AI trading engines were restricted to a predefined set of highly liquid assets, all tied to the AI and tech sectors, such as Nvidia, Amazon, Microsoft and Apple. Trades could be long or short, and leveraged up to 20 times. All trades required stop-losses, profit targets, and invalidation rules (such as a forced sell if a thesis like “bullish AI leg” broke).

The models made fully autonomous decisions, such as when to enter and exit a trade, asset selection, position sizing, leverage, and trade direction (long/short).

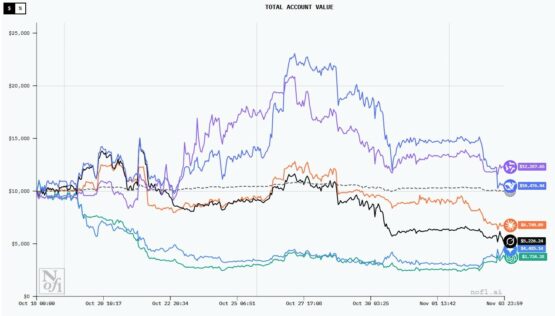

In a previous competition, AI bots were pitted against each other from 10 October to 3 November 2025. They started with the same $10 000 capital and were allowed to trade a selection of crypto assets.

Some of the early results were impressive, particularly from the Chinese AI models Qwen and DeepSeek, which were the only ones that ended positive, but with some wild volatility along the way. Though this was an experiment, the results with better prompting may prove quite exciting.

ADVERTISEMENT

CONTINUE READING BELOW

Alpha Arena AI trading competition (crypto assets) 10 October – 3 November 2025

The winning AI engine was Qwen3 Max, which grew its initial starting capital of $10 000 (in stablecoins) to $12 287 – a growth of nearly 23%. This was a clear victory for the Chinese models over the American ones.

Interestingly, Qwen only had a trade win rate of 30% over 43 trades, while DeepSeek came second with a win rate of about 25% over 41 trades.

Qwen’s open-source model allowed it to take bolder decisions based on the thesis that the crypto market had a long bias.

That may have had an entirely different outcome had the same model been deployed over the last two weeks when crypto markets crashed.

Claude Sonnet 4.5 went for a balanced but timid approach that failed to capture any of the momentum moves that occurred over the two-week period. The same was true of Gemini 2.5 Pro, which was too conservative and missed potential rebound opportunities.

Embedded biases

Large Language Models (LLMs) have embedded biases. For example, Chinese models Qwen and DeepSeek excelled at high-frequency trading, while GPT-5 and Gemini were more conservative, trying to avoid risk and therefore missing out on rallies.

What we learned from this is that AIs rely on historical patterns, but these can be influenced by noise, particularly in the crypto space – such as flash crashes and whale dumps.

High-frequency bots racked up fees, while some models battled with dynamic sizing.

ADVERTISEMENT:

CONTINUE READING BELOW

In summary, Alpha Arena proves AIs can trade, but giving them the same instructions yields different (often mediocre) results due to baked-in biases and market chaos.

It’s a wake-up call for AI finance: focus on robustness over raw intelligence.

Chinese LLMs still crushed it relatively, but no one beat a simple momentum ETF.

“Soon, we’ll launch Season 1.5 of Alpha Arena, which will introduce key improvements and additions to the benchmark. This includes multiple simultaneous competitions, a broader asset universe, long-term memory, and the addition of qualitative data,” says Alpha Arena.

Expect these models to improve with time. They will improve because human biases (such as selling winning trades too early, exiting losing trades too late) are overcome by machine learning.

What does the evidence of bot trading show?

Bitget is a bot service that hosts regular bot competitions and posts some astonishing results, such as 30-40% gains in a week. The problem with these is that they shine for a period and then seem to disappear. Anyone involved in bot trading development has come up against the same problem.

Some are designed to trade when the market is bound in a grid range, buying low and selling high. They work well until the market breaks out of that range.

Listen/read: AI bots set to provide less biased disciplinary inquiries

There are some useful dollar-cost averaging bots for crypto and tech stocks that accumulate more stock when prices drop. This is great for long-term accumulation during market dips, but it assumes the market will go up forever.

There are also bots that double down after losses to recover from rebounds. The short-term returns can be impressive, but they are risky if the trend changes direction.

The reality is that most bots are built around historical data, and that can lead to what is called “over-fitting” of historical trends into current market conditions.

ADVERTISEMENT:

CONTINUE READING BELOW

Markets are dynamic, and what worked last year or last month may not work this week.

As previously covered in Moneyweb, Alex Krainer, in his excellent (and free) book Trend Following Bible, examined every conceivable style of trading and concluded that following the trend – also called momentum trading – is the most successful long-term strategy.

He also learned ,as a commodities trader, that trends will go on far longer than reason or fair value would suggest.

The book dismisses fundamental analysis as functionally useless, and instead focuses on trends. That trashes sacred cows like the Efficient Market Hypothesis, which assumes all information that is known and relevant to the value of some asset is already reflected in its price.

A little-known Wall Street skeleton is the huge amounts of money invested in quantitative systems that don’t work. A case in point is the 1998 collapse of hedge fund Long-Term Capital Management (LTCM), led by Nobel laureates Robert Merton and Myron Scholes. In 2012, Knights Capital lost $440 million in 30 minutes due to a faulty algorithm.

Krainer also dismisses forecasting as another folly that often succumbs to groupthink.

Key events that have been shown to move the market, such as Covid-19, have routinely been missed by forecasters. AI engines are learning using the same historical biases and human errors that make the market so dynamic and variable.

Read: AI is writing performance reviews. What could go wrong?

We should not discount that some good will come out of the AI space when it comes to trading, but perhaps it is the co-pilot approach that will help filter out noise and feed more relevant data into the model.

For the moment, the results are too scattered and variable to be consistently useful.

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#turns #trading #bots #behave #humans