Thank you for your question! It’s an excellent one because it affects many people who are retired or approaching retirement.

In summary, based on the calculations and methodology used, the tax of roughly R51 000 on the R142 000 lump sum is correct, and your wife did make use of the R500 000 tax-free portion available to her.

Before diving in, I’ve made an assumption that the R142 000 annuity you mentioned is the one-third lump sum from another retirement fund your wife was invested in.

Based on that, here’s an outline of how the tax works.

Understanding aggregated lump sum benefits

What you’re dealing with is called aggregation of lump sum benefits.

This happens when someone who is retiring (or accessing a lump sum benefit now) has already taken a lump sum benefit in the past.

Read: What many investors don’t know about their retirement funds – but should

Sars combines these amounts to calculate the correct tax liability on the current lump sum.

In simple terms: tax on lump sum benefits is cumulative. It considers all previous lump sums received under the current tax rules.

What Sars looks at

Sars only includes lump sums taken after certain key dates – these dates correspond to major changes in how lump sums are taxed:

- Retirement benefits from 1 October 2007 onward

- Withdrawal benefits from 1 March 2009 onward

- Severance benefits from 1 March 2011 onward

These dates matter because they mark changes in the Income Tax Act that affect how benefits are taxed. Anything before these dates falls under older rules and isn’t included in the current calculation.

How the tax was calculated in your wife’s case

To show how Sars arrived at the R51 120 tax, here’s a step-by-step breakdown:

Step 1: Add all relevant lump sums together

- Latest retirement lump sum (2024): R142 000

- Resignation benefit taken (2022): R4 500 000

- Total taxable amount:R142 000 + R4 500 000 = R4 642 000

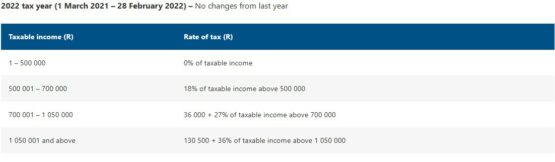

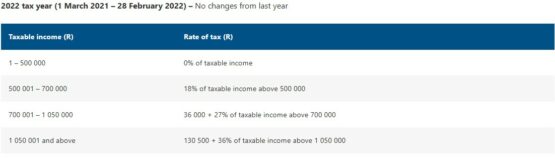

Step 2: Calculate tax on this total using the retirement lump-sum tax table

Because the total exceeds R1 050 000, the highest tax bracket applies:

Tax = R130 500 + [36% × (R4 642 000 – R1 050 000)]

= R130 500 + (36% × R3 592 000)

= R130 500 + R1 293 120

= R1 423 620

Step 3: Calculate tax on the previous lump sum only

Previous lump sum (resignation 2022): R4 500 000

Step 4: Apply the same tax table to that amount

Tax = R130 500 + [36% × (R4 500 000 – R1 050 000)]

= R130 500 + (36% × R3 450 000)

= R130 500 + R1 242 000

= R1 372 500

Step 5: Subtract Step 4 from Step 2

This gives the tax payable on the current lump sum:

R1 423 620 – R1 372 500 = R51 120

So, Sars deducts R51 120 from the R142 000 lump sum your wife withdrew at age 55, which aligns with the tax figure provided in your question.

Read:

Deciding on the optimal lump sum at retirement

The ‘perfect’ retirement lump sum: A costly mistake?

Although it may not be obvious at first glance, the calculation does include the R500 000 tax-free portion your wife qualified for in 2022. It’s just that once the lumps sums are aggregated, the tax-free portion is absorbed into the cumulative calculation rather than appearing as a separate line item.

I hope this provides the clarity you are looking for. For further information on this, we recommend consulting with a Certified Financial Planner ® who can assist in providing you with appropriate advice around the tax consequences when exiting retirement and investment vehicles.

#wife #qualify #R500k #tax #exemption #retirement