An early departure by Christine Lagarde could narrow the field of candidates vying to succeed her as European Central Bank president.

Lagarde will step down before her term ends in October 2027, the Financial Times reported Wednesday, allowing President Emmanuel Macron to help find a replacement ahead of French elections that could usher in the far right.

While the ECB insisted Lagarde is “totally focused on her mission,” in saying that she “has not taken any decision regarding the end of her term,” it suggested she is indeed considering cutting short her mandate.

A premature exit could give an edge to the established frontrunners for her job — namely former Dutch central bank chief Klaas Knot and Spain’s Pablo Hernandez de Cos, who currently leads the Bank for International Settlements.

The pair, who analysts polled by Bloomberg see as the favorites, already have a head start on others — including Bundesbank President Joachim Nagel and ECB Executive Board member Isabel Schnabel — in terms of campaigning and lobbying.

For Nick Kounis, an economist at ABN Amro, Knot may now be best positioned.

“Timing-wise, Knot has not taken a new big job yet, while de Cos has,” he said. “So an early appointment may favor Knot on the margin.”

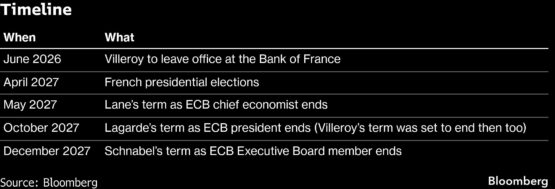

The starting gun on Lagarde’s succession was effectively fired when a replacement was found last month for her No. 2, Luis de Guindos. A quicker departure for her would likely see other upcoming openings at the ECB also filled as part of a package deal between member states.

One such vacancy is Schnabel’s, though she told Bloomberg on Wednesday that she sees no need to leave before the end of her term.

ADVERTISEMENT

CONTINUE READING BELOW

The ECB presidency is subject to intense horse-trading as European Union governments haggle over potential candidates. As head of the euro zone’s second-largest economy, Macron would play a key role in the process.

Lagarde herself was appointed in 2019 as part of a mammoth batch of EU jobs that included naming Ursula von der Leyen as head of the European Commission.

The latter’s presence could now disadvantage a German candidate, should Lagarde step aside early, as it would leave Germany in control of two of the continent’s most powerful institutions for a prolonged period. Von der Leyen’s term doesn’t run down until 2029.

“It is very unlikely that both the European Commission and the ECB will be run by two Germans,” ING economist Carsten Brzeski said. “The earlier the ECB decision is taken, the less likely a German ECB presidency will be.”

There are signs, however, that Germany may yet propose someone.

“Of course it’s conceivable that Germany could always propose a suitable candidate for this position,” government spokesman Stefan Kornelius said Wednesday in Berlin. “That this candidate also shares our ideas on stability for the ECB, these are basic assessments that the government always shares with partners.”

Spain is much more certain of its stance. Its Economy Ministry said Wednesday that the country will work actively to ensure it holds an “influential and meaningful position” on the ECB’s Executive Board.

“The forthcoming renewal cycle at the ECB represents a key opportunity for Spain to assume a leadership role within Europe’s main economic institutions,” it said.

There’s also some skepticism as to the veracity of the report on Lagarde, which cited an unidentified person familiar with her thoughts. Bank of France Governor Francois Villeroy de Galhau viewed it as speculation.

ADVERTISEMENT:

CONTINUE READING BELOW

“I’ve read a rumour concerning Madame Lagarde,” he told lawmakers in Paris. “It doesn’t seem to be information to me and I’ll let the ECB comment. It seems like a rumour to me.”

There was no knee-jerk reaction in markets, with the euro down only a touch as the dollar edged higher against most major peers. Market participants said it’s too soon to draw conclusions about the potential effect on the single currency.

Andrzej Szczepaniak, an economist at Nomura, said there’d be a “very limited” impact on ECB decision-making if Lagarde was replaced early, since inflation is expected to hover around 2% and the economy is recording stable growth.

“Whether it is Lagarde or someone else at the helm, the ECB will leave rates unchanged this year,” he said. “Ultimately, the ECB takes monetary-policy decisions by building consensus, and whomever replaces Lagarde is unlikely to radically shift or change the way the ECB works.”

The nature of Lagarde’s arrival at the ECB offers hope to any late entrants to the race for her position. She only emerged in the final stages of negotiations over a broader set of EU jobs, with other candidates deemed to have better prospects.

Lagarde has been linked with an early departure from the ECB before but sought last June to quash talk that she’s planning to head the World Economic Forum, saying she’s “fully determined to deliver my mission and I’m determined to complete my term.”

She told Bloomberg Television more recently that she’s “not a quitter,” while saying that she was surprised to learn on accepting the ECB role that the job carried a term of eight years rather than five.

Speculation ramped up again, however, following the announcement that Villeroy will leave his post prematurely. He reiterated Wednesday that his exit isn’t connected to France’s elections.

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Early #Lagarde #exit #set #narrow #field #race #lead #ECB