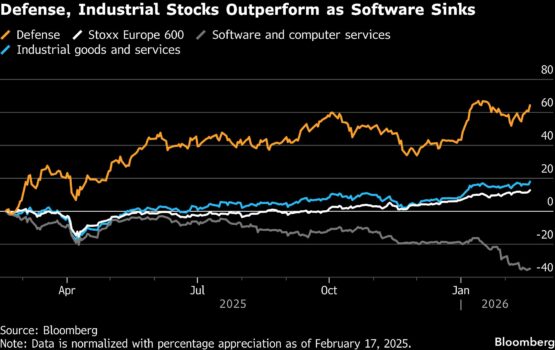

A long-awaited recovery in European initial public offerings appears set to hinge on traditional sectors like defence and industrials for now, as investors rush to cut their exposure to anything in the crosshairs of artificial intelligence.

Norwegian software group Visma AS could push its planned London IPO into the second half of the year as publicly traded peers come under pressure, Bloomberg News reported last month. The pain for software stocks has deepened since, with AI-disruption concerns spreading to industries like travel technology and financial intermediaries as traders scramble to assess the impact of the fast-evolving tools.

While the market swings come outside of the usual calendar windows for major European IPOs, they risk derailing new listings if they don’t subside. Brick-and-mortar sectors are emerging as potential havens, particularly those supported by long-term investment themes — such as the need to overhaul Europe’s energy infrastructure and rearm its militaries.

“If this volatility continues, you will have to think carefully about what companies you want to bring in a pre-summer window,” said Tom Snowball, head of UK equity capital markets at BNP Paribas SA. “Defence IPOs will be able to come to market if they choose, and names within the industrials sector and value chain.”

Recent debuts point to this. Czech munitions maker CSG NV raised €3.8 billion ($4.5 billion) in an IPO last month that was Europe’s largest in more than three years. While the stock has since lost some steam, it remains up about 20% from the IPO price. Copper-based products maker Asta Energy Solutions AG has rallied 48% since its Frankfurt listing last month, signalling appetite for energy transmission plays.

ADVERTISEMENT

CONTINUE READING BELOW

Others are poised to follow suit. Gabler Group, a maker of submarine technology components, has announced plans to list in Frankfurt by early March. Vincorion, also a supplier to the defence industry, has been gearing up for a potential IPO as soon as this quarter, as is Danish fish feed provider BioMar Group, Bloomberg News has reported.

There are also multi-billion-dollar listings in this year’s pipeline. Franco-German tankmaker KNDS NV is eying a possible dual listing before the summer lull, while lift maker TK Elevator is preparing to go public in Frankfurt in the second half of the year, people familiar with the matter have said.

Despite the volatile environment, Capital Group investment director John Lamb intends to continue looking at IPOs, though he acknowledges that committing cash into certain sectors can be hard to justify in this environment.

“It’s less about the region and more about the sector these days,” he said. “I’d use software as an example, where it’s a particularly treacherous area to be thinking about participating in IPOs.”

To be sure, market jitters can still upend IPOs in sectors that are perceived to be more shielded, if broader investor sentiment becomes too skittish.

ADVERTISEMENT:

CONTINUE READING BELOW

Both CSG and Asta, for example, opted to limit formal order-taking for their IPOs to just a few days in an attempt to reduce the exposure to stock swings as geopolitical uncertainty prompted by President Donald Trump’s comments over Greenland kept markets on edge.

Dutch mobile operator Odido is among the companies expected to list this year that had been considering launching its IPO as soon as January, Bloomberg News had reported, though it missed that initial window amid the market volatility. European telecommunications stocks have risen since, with investors seeking refuge in sectors seen as less exposed to AI disruption.

“It’s been very difficult to run a diversified portfolio because the dispersion of returns has been so great,” said Kirsty Desson, a senior investment director at Aberdeen Group Plc who oversees the money manager’s Global Smaller Companies fund.

In Europe, she sees structural growth in defence and infrastructure spending, two areas where she anticipates further issuance in the form of new listings or follow-on offerings — particularly in areas such as “power, utilities and construction and engineering.”

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#rout #Europe #economy #IPOs #revival