For years, South Africans moving funds into or out of the country have faced steep charges, outdated manual processes, and lengthy delays via traditional banks. It’s an outdated system that is indefensible in this fast-paced, tech-driven era.

It’s no question that SA’s major banks have long controlled the foreign exchange market, raking in massive profits while individuals and small businesses shoulder hidden fees of 2-3% on every transaction – costs that are hidden within opaque and complex pricing structures.

These high costs, coupled with sluggish processing, mountains of documentation and indifferent service, have earned the banks a well-deserved reputation for taking advantage of their customers.

“While technology has revolutionised countless areas of finance, cross-border payments have remained stuck in the past for far too long,” says Harry Scherzer, CEO of Future Forex and a qualified actuary.

Along with exorbitant costs, banks’ service levels leave much to be desired.

If you have query or want to follow up on a transaction, you’re left to deal with a call centre, a chatbot, or multiple different bank representatives who don’t understand you or your business.

However, Future Forex – an award-winning fintech innovator – has completely transformed how South Africans move funds internationally, making both inbound and outbound transactions quicker, more affordable and far simpler than traditional banking options.

Through its economies of scale, advanced fintech tools and personalised, white-glove service, the company reduces transaction costs by up to 50% for individuals and up to 30% for SMEs.

The real cost of forex through the banks?

“Most people have little or no idea how their forex charges are calculated,” explains Scherzer.

There are the more visible fees, such as SWIFT fees (typically R500-R1?000 per transaction) and ‘commission’ charges. But the real damage is in the hidden spread, the difference between a currency’s buy and sell rate.

Let’s take an example: assume you are an SME purchasing R1 million in goods from the US. If the Google spot rate is R16 to the USD, you might be quoted R16.33 to the USD by the bank – a hidden spread of around 2% that amounts to over R20 000 on a single transaction.

The more you transact, the more profit is quietly drained from your business.

The same applies to individuals sending money abroad for emigration, investment or offshore property. Once you lose 2-3% of your investment capital, you have to spend so much more time in the market to recoup this.

“We’ve also noticed more South African expats coming back home, yet they often struggle with banks’ unclear charges, heavy paperwork, and unpredictable wait times,” says Scherzer.

“This makes it tough to buy a home, move investment funds, or seize urgent opportunities. Our mission is to eliminate those obstacles entirely.”

What sets Future Forex apart?

“You can’t stand still in this market. You have to keep innovating – which is exactly what we’ve been doing,” says Scherzer.

“We thoroughly examined the full remittance journey, identified every pain point and inefficiency, then built a modern system that eliminates them through smart technology and expert oversight.”

In contrast to banks – where customers chase endless phone support, repeat the same details over and over, and get minimal help with regulations – Future Forex takes a completely different path.

Its platform is 100% digital and highly automated, cutting out unnecessary steps at every turn. But that’s not to say it relies entirely on technology.

“Customers moving funds abroad want those funds to move as fast as possible and with minimal obstacles. That’s where the tech comes in,” says Scherzer.

“But when they need help on regulatory issues, or want to track the movement of their funds, they want to speak to a human, someone who knows the regulations and can answer their questions. They don’t want to be hanging on the line only to be bumped from one agent to another.”

That’s why Future Forex allocates a dedicated account manager to each client who guides them through the process, delivers timely updates, and offers expert compliance support.

These foreign exchange specialists assist with everything from South African Revenue Service (Sars) Approval of International Transfer (AIT) applications and South African Reserve Bank approvals, to ensuring that the correct Balance of Payments (BoP) codes are submitted – all at no additional cost.

For South Africans moving or living abroad, the company also assists with the entire tax emigration process.

“Our approach is straightforward: deliver top-tier expert help when it’s needed, backed by user-friendly technology that handles everything else,” says Scherzer.

Top-rated technology

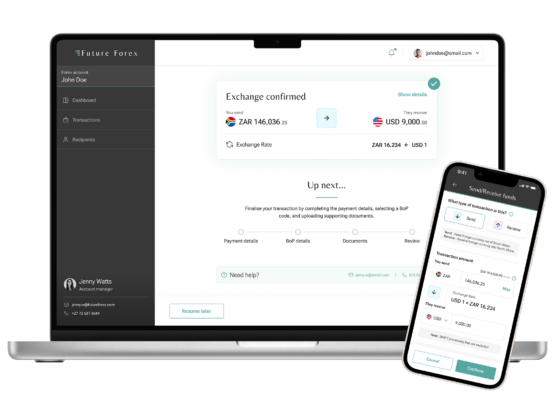

For clients who like to manage their own transactions, Future Forex’s intuitive web and mobile app offers live exchange rates, real-time payment tracking, easy document uploads and more – making forex payments simpler, faster, and more convenient than ever.

This powerful mix of innovative tech and personalised service has positioned Future Forex as a pioneer in SA’s foreign exchange landscape.

The company has earned multiple accolades, including ‘Company of the Year’ at the 2025 Africa Career Summit and ‘Outstanding Customer Service in Forex & Payments, South Africa’ at the World Business Outlook Awards, adding to a consistent string of recognitions in previous years.

Follow this link to get in touch with a Future Forex expert or request a quote for your transaction. You can also give them a call on 021 518 0558 or send them a message on WhatsApp.

Brought to you by Future Forex.

Moneyweb does not endorse any product or services being advertised in sponsored article on our platform.

#International #Transfers #Reimagined #Future #Forex