Gold advanced back above $4 900 an ounce as dip-buyers snapped up the metal after a two-day drop, with traders looking ahead to the release of minutes from the Federal Reserve’s recent meeting.

Bullion rose as much as 1.3% in thin trading on Wednesday, with much of Asia offline due to the Lunar New Year holiday. The metal had lost more than 3% over the previous two sessions, when the US dollar strengthened. A key gauge of the US currency rose as much as 0.4% on Tuesday before paring gains.

ADVERTISEMENT

CONTINUE READING BELOW

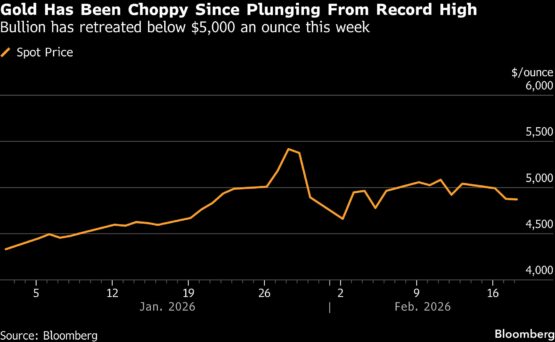

A powerful rally carried gold to an all-time high above $5 595 an ounce in late January, but the market overheated after a surge in speculative buying and snapped back almost to $4,400 in just two sessions. Though the metal has regained nearly half of these losses, trading has been unusually choppy since the rout.

Many banks, including BNP Paribas SA, Deutsche Bank AG and Goldman Sachs Group, forecast that prices will resume their upward trend, with the factors that underpinned gold’s earlier, steady ascent still intact. These include heightened geopolitical tensions and a move away from sovereign bonds and currencies, as well as concerns over the Federal Reserve’s independence.

In the near term, investors will be looking to comments from Fed officials for clues on US monetary policy, as well as the minutes — due later Wednesday — from the bank’s January meeting, when policymakers opted to hold interest rates steady. An appetite for cutting rates would be a tailwind for non-yielding precious metals – gold rallied briefly on Friday when modest inflation data boosted the case for lowering borrowing costs.

ADVERTISEMENT:

CONTINUE READING BELOW

Fed Governor Michael Barr said on Tuesday rates should remain steady “for some time,” until officials see more evidence that inflation is heading toward the central bank’s 2% goal. Fed Bank of Chicago President Austan Goolsbee, meanwhile, said there was potential for more cuts this year if inflation continued on its path toward that target.

Spot gold rose 1% to $4 926.47 an ounce at 2:14 p.m. in Singapore. Silver climbed 2.6% to $75.45 an ounce. Platinum rose 2% and palladium was up 2.2%. The Bloomberg Dollar Spot Index was 0.1% higher.

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Gold #regains #ground #twoday #drop #thin #holiday #trading