Bitcoin extended a four-week slide amid broader market volatility as investors fretted over the impact of artificial intelligence on the economy.

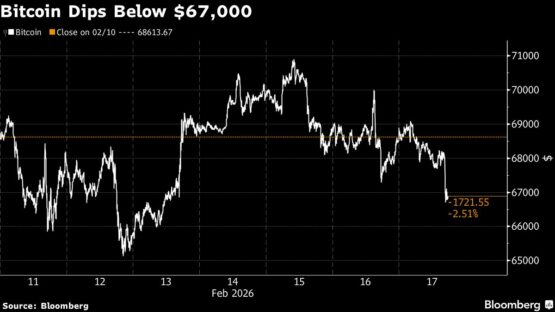

The token dropped as much as 3.2% to $66 604 on Tuesday in New York before paring the decline. Bitcoin, which has tended to move with fluctuations in tech stocks in recent months, mirrored an earlier move lower in US equities but failed to keep pace when they edged higher.

“Sentiment is clearly bleak in crypto markets,” said Noelle Acheson, author of Crypto is Macro Now newsletter. “There is strong progress in adoption by traditional institutions, but this is not reflected in overall prices, which depresses sentiment even more.”

Traders struggling to assess the outlook for AI whipsawed stocks in another volatile session on Wall Street. There’s uncertainty over the technology’s potential to disrupt some segments of the economy and skepticism that big AI spending will pay off soon.

ADVERTISEMENT

CONTINUE READING BELOW

Flows remain a headwind for Bitcoin, with $360 million withdrawn from US-listed exchange-traded funds last week, a fourth straight week of net outflows.

Sentiment is fragile. CryptoQuant’s Fear and Greed Index stood at 10 out of 100 on Monday, deep in “extreme fear” territory.

Paul Howard, senior director at market maker Wincent, expects consolidation as Bitcoin searches for fresh sentiment drivers. A US Supreme Court ruling on tariffs due Friday could prove more consequential than routine Federal Reserve meeting minutes or inflation prints, he said.

Investors are also debating whether Bitcoin has established a durable floor. Many see $60 000 as a key support level, but that may not hold if risk appetite deteriorates further, said Robin Singh, chief executive officer of crypto tax platform Koinly.

ADVERTISEMENT:

CONTINUE READING BELOW

“One macro wobble, another wave of uncertainty, or even just sustained chop in the mid-$60 000s could easily tip this into a sharper flush back into the $50 000s,” Singh said.

In the latest quarter, Harvard University trimmed its Bitcoin exposure, according to a Bloomberg analysis of fourth-quarter filings with the US Securities and Exchange Commission. The Boston-based school sold 1.5 million shares of the iShares Bitcoin Trust ETF (ticker IBIT). The position still ranks among its largest holdings — after Alphabet Inc. and gold — and Harvard also initiated a stake in the iShares Ethereum Trust ETF (ETHA), gaining exposure to the second-largest cryptocurrency for the first time. Dartmouth College’s endowment meanwhile increased its Bitcoin and Ether stakes.

“I expect the recovery from this bear market to be rounded, not v-shaped,” said Matt Hougan, chief investment officer at Bitwise Asset Management. “There is actually a lot of very good news in crypto that is not being recognised by the market. It’ll get there over time.”

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Bitcoin #declines #riskoff #mood #concerns #fore