February is a busy month in Cape Town. The summer tourist season might be winding down, but three big annual events shine the spotlight on South African economic policymaking: the Mining Indaba, the State of The Nation Address (Sona), and the Budget Speech.

This year, there is something of a golden thread running through these events (excuse the pun) as they occur against the backdrop of record global precious metals prices.

Read:

Seven charts that show how SA may finally be turning the corner

SA’s economy in best shape in decade – Standard Bank

As dust settles from Sona, the manufacturing crisis requires action

There is also renewed international interest in metals and minerals that are critical for the electrification of the global economy, a process that is urgent not only to combat climate change but also to enable artificial intelligence (AI).

Digging deep

Delegates at the Investing in African Mining Indaba, to give it its full name, therefore have reason to feel bullish about the prospects for their industry, which has not been the case for much of the past decade.

However, South Africa remains a difficult country in which to run a mine. It has a long history of mining, which means there is a deep body of knowledge, but there are also memories of racial discrimination, worker exploitation and lax environmental management.

This complicates the current environment, leading to sometimes frosty relations between government, labour and the mining houses.

It also contributes to unsettled debates on empowerment and other matters, which is problematic in an industry that craves regulatory certainty given that a mine is a multi-decade investment.

Infrastructure is arguably an even bigger bottleneck for mining than for other sectors. Mines are electricity-intensive and cannot afford power outages when workers are kilometres underground.

By far the most economical way of transporting ore is by rail, but the Saldanha iron ore and Richards Bay coal corridors both operate below capacity.

Crime is a growing problem for the industry, with cable theft contributing to rail and power disruptions, while illegal miners (‘zama zamas’) often violently disturb legitimate activities.

Read:

Jeremy’s weekly wrap: Mining hurdles and the infrastructure cliff

Ramaphosa targets crime syndicates and water crisis

Mining sector sounds alarm over soaring electricity costs

Despite the country’s resource endowment, very little exploration activity is being done. This does not bode well for the development of future mines.

Mzila Mthenjane, CEO of Minerals Council SA, told the Indaba that exploration spending was only R781 million in 2024, a fraction of the 2006 peak of R6.2 billion.

There are things that can reverse the decline. A functioning cadastre – a fully online system where all mining rights applicable to a particular piece of land can be viewed – is necessary.

It will also allow a move away from paper-based processes that will reduce the risk of corruption around the awarding of mining rights.

A distinct regulatory and tax regime for junior miners is also necessary, given that exploration work is risky. Similarly, South African investors will have to think differently about how to fund such companies.

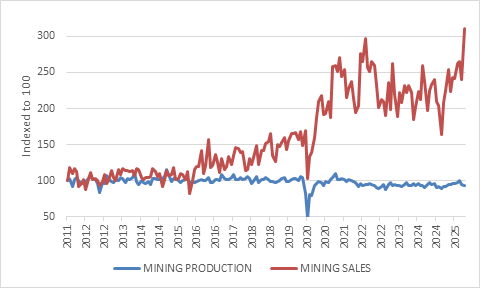

SA mining production and sales

Source: Stats SA

Stats SA’s mining data tells a mixed story.

The December 2025 production numbers point to a negative final quarter, but longer-term there is no trend. Production levels have not grown over the past 15 years.

On the other hand, mining sales have jumped thanks to elevated precious metals prices. This is good for the trade balance, the fiscal balance and domestic financial markets.

ADVERTISEMENT

CONTINUE READING BELOW

But for the country to truly benefit from higher prices, volumes should also rise.

There are signs that the mining environment is improving. The government is implementing a new cadastre, though it is well behind schedule.

Electricity supply has improved substantially, but affordability is an obstacle, particularly for smelters. Transnet’s turnaround strategy is also bearing fruit, with volumes rising from a 2022 low of 149 million tonnes to a projected 181 million tonnes for the current financial year.

Listen/read: Transnet signals turnaround as private operators enter rail and ports

This is still well below the 220 million tonnes it moved in 2015, and the 250 million tonnes target for 2030. As Michelle Philips, CEO of Transnet, noted, that goal can only be achieved with private investment.

Last year, 11 private rail operators were granted access to Transnet’s tracks, though it will take time for wheels to hit the steel.

State of cautious optimism

These encouraging developments also featured in President Cyril Ramaphosa’s seventh Sona last Thursday.

Whereas previous versions of Sona were mostly a list of promises of things to be done, this year the president could report on real progress, including the removal from the Financial Action Task Force grey list, the S&P credit rating upgrade, and the strong performance of local financial markets over the past year.

It is also an achievement, partly due to his own leadership, that the governing coalition survives.

It has hardly been smooth sailing for the multi-party government of national unity (GNU), but it will take time for politicians and citizens alike to get used to coalition politics.

Read: Steenhuisen warns DA about exiting GNU

In the meantime, the country has enjoyed political stability and probably a more energetic cabinet than it has had in years. Therefore, Sona rightfully touched on where things are going right in the country.

It is also worth noting that most of the progress is due to better cooperation between government and businesses, and more specifically government opening space for private sector involvement in areas it previously controlled tightly – a very important shift in approach.

To-do list

Nonetheless, the bulk of the speech focused on a long to-do list of interventions, most of which are important from an economic point of view.

There isn’t space to cover them all, but water is top of mind given the crisis in Johannesburg and other municipalities.

It is a specific problem but also a symptom of broader dysfunction in local government.

The president announced a National Water Crisis Committee to urgently address the issue. This copies the successes of similar bodies to tackle the energy and logistics crises by bringing government, the private sector and industry experts together.

Listen/read: Business backs Ramaphosa reforms but urges implementation

A broader restructuring of local government is underway but this will be a difficult and time-consuming affair.

The increasing reach and boldness of criminal syndicates is another area that requires not just an intervention by the police, but a restructuring of the broader criminal justice system.

Being a ‘mafia state’ is a negative for economic growth. Sona devoted considerable time to this topic too, and rightly so. As the president said, organised crime is “the most immediate threat to our democracy, our society and our economic development”.

Budget expectations

ADVERTISEMENT:

CONTINUE READING BELOW

The Budget is where such policy ideals and financial realities meet and often clash. Spending needs are great, but every additional rand for the police, for instance, must come from somewhere.

Taxpayers can cough up, but given a narrow tax base, higher tax rates can end up being counterproductive and discourage economic activity. However, the South African Revenue Service (Sars) has made progress in raising tax collection and recovering tax debt.

The money can be reallocated from other departments, and indeed National Treasury has introduced a Targeted and Responsible Savings (Tars) initiative, which aims to reduce, merge, or close low-priority and underperforming programmes, tighten social grant eligibility, and identify ghost workers.

Read: Tars to root out government ghost workers

This will generate some savings, but not enough to fund all the additional spending demands.

Treasury has also been trying to shift the composition of spending away from consumption towards investment (from opex to capex).

The third option, to increase borrowing, should be ruled out given elevated debt levels. The government already spends 21 cents of every rand Sars collects on interest payments.

Treasury has instead focused on stabilising debt levels in a balanced way, since a drastic cut in spending can reduce borrowing requirements but will harm service delivery. Therefore, it is neither practical or politically feasible.

As with the other policy reforms, ‘fiscal consolidation’ can only work if there is political legitimacy. The sooner a reform bears fruit, the more legitimacy it has.

Crucially, then, when the finance minister delivers the 2026 Budget Speech next Wedneday (25 February), he will still face difficult trade-offs but can point to two successes that will build legitimacy for his ongoing fiscal consolidation efforts.

Firstly, the debt curve has finally been flattened.

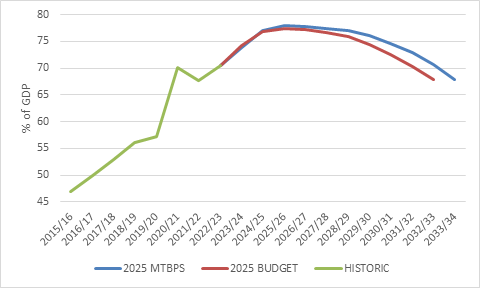

Gross government debt to GDP ratio

Source: National Treasury

The 2025 Medium Term Budget Policy Statement (MTBPS) projected that gross government debt would stabilise at 77.9% of GDP in the 2025/26 financial year. The Budget is likely to confirm that this indeed happened, which would make it the first time since 2009 that the ratio did not increase.

It is too soon to declare victory, of course, but on current trends the debt ratio should continue to gradually decline in the years ahead.

The mining tax windfall from the precious metals boom will support this decline, though Treasury is likely to be conservative in how it includes this in its projections.

After all, no one really knows where the gold and platinum price is headed. But it does imply that no near-term tax increases are likely.

The main reason debt is stabilising is because the government has run a primary surplus over the past two years, meaning that tax revenues exceeded non-interest spending.

The MTBPS projects a growing primary surplus rising to 2.5% of GDP by 2028. The Budget is likely to affirm this path, despite it being an election year.

Not everyone agrees that this is feasible.

The International Monetary Fund’s recent Article IV review of South Africa’s economy forecasts a continued rise in the debt ratio on the basis that government will not be able to stick to the primary surplus targets given the massive spending demands.

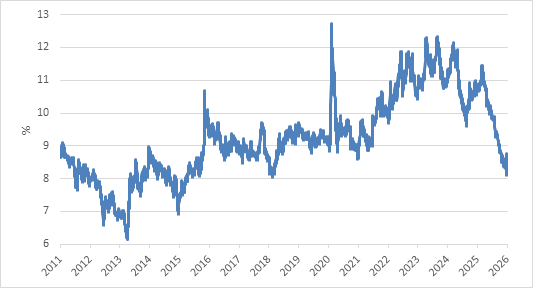

10-year government bond yield

Source: LSEG Datastream

ADVERTISEMENT:

CONTINUE READING BELOW

Despite this scepticism, the minister will be able to point to the other big win: the rapid decline in South African bond yields.

This is partly in response to the new 3% inflation target and also comes against the backdrop of a global narrowing of spreads – the gap between the yields of riskier emerging market and corporate bonds relative to those of ‘safer’ developed market government bonds.

Nonetheless, the improved fiscal picture alongside a better economic growth outlook is a big driver.

Usually, faster economic growth would result in higher bond yields (and lower prices) as investors price in rising inflation. But in South Africa, the more the economy performs, the better the bonds are going to do, as it implies organic tax revenue growth that reduces the need to borrow.

Read: Morgan Stanley sees SA’s 2026 budget extending bond surge

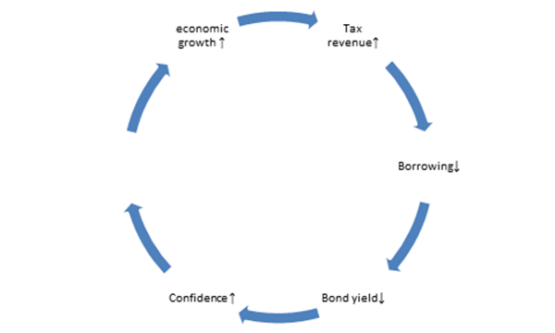

South African government bond yields are high because investors demand additional compensation for the risk of lending to an indebted government. However, elevated government bond yields raise borrowing costs for the private sector too, depressing economic growth – a vicious cycle.

Therefore, achieving taster economic growth remains key to putting government finances on a sound footing over the longer term and turning the vicious cycle into a virtuous cycle of falling borrowing costs and faster growth as shown in the following chart.

Fiscal feedback loop

Source: Author’s illustration

This picture is also crucial for credit rating agencies.

While S&P Global upgraded the government’s rating, the other two major agencies, Fitch and Moody’s, want to see further evidence of fiscal discipline and structural economic improvement despite expressing cautious optimism.

Introducing a so-called fiscal anchor, a legislated rule to bind the government to budget sustainability, could help.

Many countries have such anchors, which are often either specific numeric targets or parameters for budget variables, though Treasury prefers a principles-based approach.

The Budget Speech is expected to communicate progress towards introducing a fiscal anchor, which could help convince investors and rating agencies that the progress won’t be undone.

In conclusion, South Africa is good at making policies but struggles to implement them. More specifically, it is good at macroeconomic policies – led by National Treasury and the South African Reserve Bank – but is often let down by microeconomic or sector-level policies, and massively by local government performance.

Macroeconomic stability goes some way towards enabling a growth-friendly environment, but for the economy to truly perform requires that micro-obstacles be removed and sensible sector-specific support supplied.

Read/listen:

SA ‘on the right path to investment-grade rerating’ – Redefine’s Ntobeko Nyawo

Do Trump’s signed deals count for nothing?

Why SA’s long-awaited green shoots are finally starting to surface

Nonetheless, there is reason to believe that the country is turning the corner.

Since fiscal space and state capacity are limited, the private sector is increasingly roped in to drive job creation and economic growth – creating new investment opportunities in the process.

Progress is never in a straight line, and there are domestic and international risks to the outlook – as always – but an improved economy and confidence should provide support for local bond and equity valuations over the medium term.

It wasn’t that long ago that some commentators wrote the country off as a failed state. Now, however, the president correctly closed his speech by noting that it is turning the corner.

Izak Odendaal is an investment strategist at Old Mutual Wealth.

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Slowly #surely #South #Africa #turning #corner