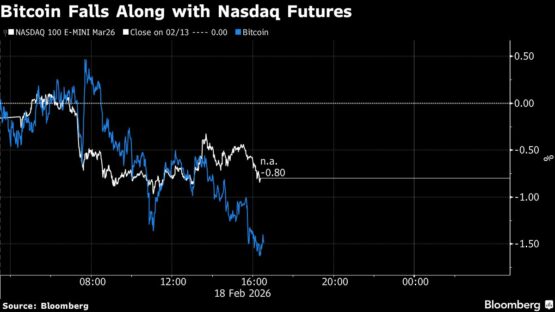

Bitcoin fell ahead of the US market open following a three-day break, tracking weakness in equity futures as investors returned to a more cautious macro backdrop.

The token dropped as much as 1.7% to $67 6586 on Tuesday. Nasdaq 100 futures slid 0.9% and S&P 500 contracts lost 0.6%, signaling a softer start on Wall Street. Bitcoin, which has traded like a high-beta tech proxy in recent months, mirrored the move lower.

ADVERTISEMENT

CONTINUE READING BELOW

Traders are weighing rising geopolitical tensions around Iran and renewed debate over whether artificial intelligence’s economic impact could ripple beyond the tech sector. The outlook for Federal Reserve rate cuts is also back in focus after last week’s inflation data.

Flows remain a headwind. US-listed Bitcoin exchange-traded funds notched a fourth straight week of net outflows, with $360 million withdrawn last week.

Sentiment is fragile. CryptoQuant’s Fear and Greed Index stood at 10 out of 100 on Monday, deep in “extreme fear” territory.

“Macro news has been closely correlated with crypto’s risk profile the last 12 months,” said Paul Howard, senior director at market maker Wincent. He expects consolidation as Bitcoin searches for fresh sentiment drivers, adding that a US Supreme Court ruling on tariffs due Friday could prove more consequential than routine Fed minutes or inflation prints.

ADVERTISEMENT:

CONTINUE READING BELOW

Investors are also debating whether Bitcoin has established a durable floor. Many see $60,000 as a key support level, but that may not hold if risk appetite deteriorates further, said Robin Singh, chief executive officer of crypto tax platform Koinly.

“One macro wobble, another wave of uncertainty, or even just sustained chop in the mid-$60,000s could easily tip this into a sharper flush back into the $50,000s. This doesn’t have the same full capitulation feel we’ve seen at true cycle bottoms in the past,” Singh said.

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Bitcoin #declines #geopolitical #tension #adds #riskoff #mood