Demand surged at South Africa’s weekly government bond auction as investor optimism grew ahead of next week’s budget.

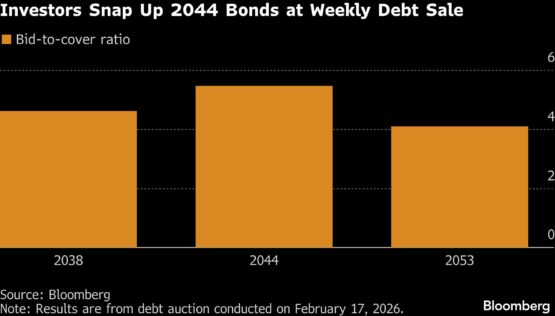

Primary dealers placed orders for R14.2 billion ($883 million) of debt, almost five times the R3 billion of securities offered on Tuesday, according to central bank data. That compares with a bid-to-cover ratio of 3.9 at last week’s sale.

Long-dated bonds attracted the strongest demand, signaling confidence the government will rein in the budget deficit, leading to a reduction in debt issuance. Securities due 2044 drew orders of R5.46 billion, or 5.5 times the amount on sale.

The demand “shows real depth, not just tactical buying,” said Kristof Kruger, a senior fixed-income trader at Prescient Securities. “It reflects improved sentiment toward South Africa’s fiscal trajectory. When investors believe inflation is anchored and fiscal risk is contained, they are willing to extend duration.”

ADVERTISEMENT

CONTINUE READING BELOW

Finance Minister Enoch Godongwana will give details of the country’s fiscal path when he presents his budget to lawmakers on February 25, with soaring commodity prices likely providing a windfall in the form of higher-than-targeted tax revenue.

“It should be quite a market-friendly budget,” said Michelle Wohlberg, a fixed-income analyst at Rand Merchant Bank in Johannesburg. “We could even see a potential cut in issuance if the commodity windfalls provide enough room.”

ADVERTISEMENT:

CONTINUE READING BELOW

Godongwana will also provide an update on measures to boost growth and attract investment, though the key for investors is whether the government is delivering on its pledge to reform the economy, said Kruger.

“Today’s auction suggests investors are not positioning for crisis. They are treating South Africa as investable,” he said. “Strong demand at the long end is a vote of confidence, but it is conditional on execution.”

The yield on the 2044 bonds fell two basis points on Tuesday to 8.54%, the lowest on a closing basis since 2015.

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Investors #pile #South #African #bonds #weekly #debt #sale