BHP Group posted earnings at the upper end of analyst expectations, as a years-long effort to shore up copper production combined with a historic metals rally to offset a lackluster period for its giant iron ore business.

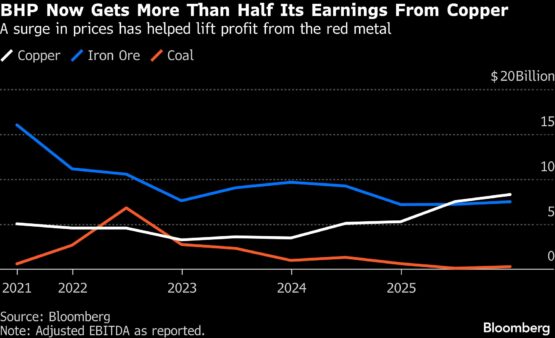

Copper, a metal favoured for its vital role in a more electrified world, accounted for more than half of the group’s profit for the first time — a significant win for Chief Executive Officer Mike Henry, who has sought to diversify the world’s largest miner away from operations focused on serving China’s steel mills. Acquisitions began to bear fruit, as did the improvements at Escondida, the world’s largest mine — all helped by a record surge in prices.

“This is the result of our deliberate actions to grow our copper business,” Henry said in a meeting with analysts. “Now, BHP is, by design, a diversified miner – rather than focused on a single commodity.”

The combination pushed BHP’s underlying attributable profit 22% higher to $6.2 billion for the six months to the end of December. Shares climbed as much as 7.6% in Sydney to a record, their biggest gain in more than 10 months.

“In the last five years, Mike has set the business up with options,” said Glyn Lawcock, head of metals and mining research at Barrenjoey Markets Pty in Sydney. “Clearly, growth to 2030 is really potash and iron ore, but you hit the start of the new decade, it’s pretty much all copper.”

The copper division saw underlying earnings before interest, tax, depreciation, and amortisation climb 59% to $8 billion, thanks to steady output and prices that climbed by almost a third over the period.

ADVERTISEMENT

CONTINUE READING BELOW

Earnings from its iron ore business, which still accounts for almost half of the group’s total, edged 4% higher, as “tough” negotiations with China’s state-owned iron ore buyer continue. Henry said the company’s wider relationship with steel mills was “deep and strategic” and added the miner was confident a resolution would be reached with China Mineral Resources Group Co.

“We are working constructively with CMRG to find a solution acceptable to both sides,” Henry said.

BHP’s Jansen potash project in Canada, another vital leg of Henry’s diversification plan, remains on track for first production in the middle of next year. The miner announced last month that the operation had again blown past cost estimates, with investment in the first phase now seen at $8.4 billion.

Along with peers, BHP has returned to the M&A fray over the past few years as the sector pushes for growth, particularly in copper. But despite some wins — including the 2023 purchase of miner OZ Minerals, and the Vicuna joint venture with Lundin Mining, focused on projects along the Chile-Argentina border — large-scale success has proved elusive.

The company’s approaches for rival Anglo American Plc — most recently an effort to gatecrash the miner’s tie-up with Teck Resources — have been repeatedly thwarted.

“If there was an opportunity that we thought we could create material value for BHP shareholders through acquiring other assets, we would be willing to have a go at it — but that’s such a small opportunity set,” Henry told reporters.

ADVERTISEMENT:

CONTINUE READING BELOW

“Hence the real focus is on running our existing business ever better and unlocking organic growth that we have in the portfolio.”

The company has instead highlighted a plan to raise as much as $10 billion of capital with asset sales and other deals to unlock capital, investing the cash in priority areas or returning it to shareholders.

On Tuesday, BHP announced a $4.3 billion long-term silver streaming agreement with Wheaton Precious Metals, just two months after selling a $2 billion stake in the power network that supplies its vast iron ore operations in the Pilbara region of Western Australia.

The silver deal, an effort to benefit from near-record prices, relates to metal produced as a by-product at the Antamina copper mine in Peru, in which the Australian miner has a 33.75% share.

“Over his term, Henry bought Oz Minerals, built out the company’s copper footprint in Australia, sold off petroleum, collapsed the dual-listed company structure and did the Vicuna joint venture,” Barrenjoey’s Lawcock said. “When he does step down, and he’s just come to his sixth year today, he’s created a different BHP to what it was before.”

BHP said it would pay an interim dividend of 73 cents, equivalent to a 60% payout ratio.

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#BHPs #bumper #copper #profits #accelerate #shift #iron #ore