Coinbase Global Inc. showed how quickly a cooling crypto market can pressure even one of the industry’s most diversified exchanges.

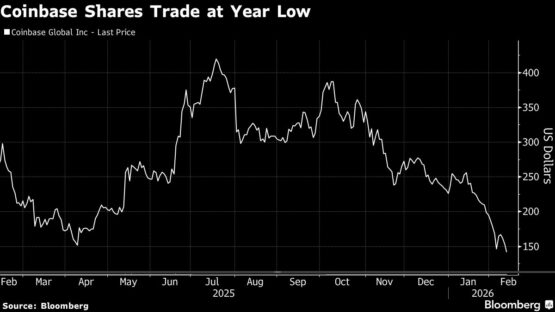

Revenue in the fourth quarter tumbled a more-than-estimated 20% to $1.8 billion as falling token prices drained trading activity across digital assets. After registering an unrealized loss to mark down the value of its crypto holdings and investments, the company posted a net loss of $667 million, compared with a $1.3 billion profit from the same period last year. The stock – down nearly 37% for the year – edged higher in after-hours trading.

The results arrive as Bitcoin has fallen nearly 50% from October’s high, a retreat that has left many retail traders sitting on the sidelines and revived comparisons to earlier crypto downturns. Those cycles have often forced exchanges to retrench quickly, and early signs suggest this one may follow a similar pattern.

Rival exchange Gemini Space Station said last week that it plans to cut up to 25% of its workforce and scale back international operations, underscoring how rapidly weaker markets can translate into operational pressure. Kraken’s chief financial officer departed the exchange, which reported sequentially lower fourth-quarter revenue. Robinhood Markets Inc. said this week its revenue from crypto trading declined 38%.

“Soft revenue with strong institutional and weak consumer,” said Dan Dolev, an analyst at Mizuho Securities, who has a “neutral” rating on the shares. “The 1Q run-rate fell below consensus expectations. Ebitda missed, which needs further investigation.”

ADVERTISEMENT

CONTINUE READING BELOW

Coinbase’s hope is that it is entering this downturn as a different company. Over the past several years, it has worked to reduce its reliance on spot trading, including the acquisition of the crypto options exchange Deribit and the recent launch of stock trading and prediction markets. Analysts are watching those businesses closely for signs they can provide steadier revenue through market cycles.

“We definitely saw softer quarter-over-quarter market conditions,” Chief Financial Officer Alesia Haas said in an interview. “However we outperformed the market on total trading volume.” That was driven by derivatives, she said.

The most consequential shift, however, has been in stablecoins. A sizable portion of Coinbase’s revenue came from revenue-sharing tied to USD Coin, issued by Circle Internet Group Inc., a stream analysts view as higher margin and more predictable than transaction fees tied to trading volumes.

“An overdependence on retail trading is not a future you want to have, especially if the fees associated with trading begin to go in the direction of traditional brokerages, which is to say move towards zero over time,” said Mark Palmer, an analyst at Benchmark Co., who has a “buy” rating on the stock.

ADVERTISEMENT:

CONTINUE READING BELOW

Still, that shift may now be under threat. Draft stablecoin legislation being negotiated in Washington could restrict exchanges from offering rewards tied to users’ stablecoin balances, a change that could directly affect Coinbase’s revenue-sharing arrangement with Circle.

In January, CEO Brian Armstrong pulled his support from the bill, although the company and the banking industry had two meetings at the White House to discuss a compromise.

“We are sitting at the table, and we’ll stay at the table until we get a deal done,” Haas said.

At Clear Street, analyst Owen Lau said recent price action and volumes resemble a mid-cycle drawdown rather than outright collapse.

“Absent renewed euphoria and new volume highs, current conditions appear more consistent with a mid-cycle pullback than a full crypto winter,” he wrote in a recent note. On the other hand, researcher Kaiko calls this the “halfway point of bear market.”

For Coinbase, the distinction matters. A short downturn would support the case that diversification and stablecoins can soften crypto’s volatility. A longer freeze would once again expose how difficult it is to fully separate exchange earnings from the market’s boom-and-bust cycles.

“Retail is buying the dip,” Haas said. “I think what’s important is that retail investors are healthy.”

This quarter offered a measured verdict: Coinbase may be better positioned than it was in past downturns, but still far from insulated from the crypto market’s swings.

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Coinbase #posts #667m #net #loss