Receiving funds from abroad through South African banks remains one of the most challenging and costly aspects of the country’s financial industry. Painfully slow timelines, high fees, and excessive bureaucracy have created a system that’s long overdue for competition.

And it’s no secret that traditional banks make billions annually from the forex market, mostly through hidden spreads, which is the gap between a currency’s buy and sell rates.

For most inward remittances, these spreads typically range as high as 2% to 3% per transaction, a significant expense for what is essentially a simple electronic process.

“In an era where technology has made countless financial transactions faster and more affordable, the banks’ high fees and sluggish processing times are increasingly difficult to defend. For decades, South Africans have simply accepted this as the standard because viable alternatives were scarce,” says Harry Scherzer, CEO of Future Forex and a qualified actuary.

However, that much-needed competition has arrived in the form of multi-award-winning fintech Future Forex.

The company has pioneered a game-changing solution that makes bringing funds into the country faster, simpler, and far more cost-effective for both individuals and businesses – all while delivering a level of transparency that the banks have long promised but always failed to match.

By combining cutting-edge financial technology with white-glove client service, Future Forex ensures its clients’ offshore funds arrive in South Africa at lightning speed, while eliminating the cumbersome paperwork and slow manual steps that have long complicated inward transactions.

This innovative solution reduces transfer costs to as little as one-fifth of what banks and other fintech players charge.

Whether you’re a remote worker receiving foreign earnings, repatriating investment returns, selling overseas property, receiving an inheritance, or a business channelling international revenue back to your South African cost centre, Future Forex transforms the traditionally slow and expensive ordeal into a swift, seamless, and cost-effective experience.

“We’ve also been assisting a growing number of expats who are returning to South Africa, many of whom have found that slow bank processes aren’t just frustrating – they can delay rent payments and even lead to missed investment opportunities with real financial consequences.”

Why is Future Forex so much quicker and more affordable?

Traditional systems are riddled with bottlenecks, but Future Forex has re-engineered the entire process. Through highly automated systems, advanced technology, and expert human oversight, they’ve dramatically reduced both costs and payment processing times.

With a fully digital process, clients never have to resubmit documents or complete redundant forms. A dedicated team of forex and compliance specialists manages everything for you behind the scenes, ensuring swift and seamless access to your funds.

Why service matters

“Banks tend to treat customers as just another number in the system,” says Scherzer. “You’re kept waiting, transferred from one person to the next, and rarely speak to anyone who actually understands your needs or your business.”

Unlike banks, where inquiries disappear into endless call-centre queues or impersonal chatbots, Future Forex prioritises genuine human support. Every client is assigned a dedicated account manager – a forex expert with in-depth industry knowledge who oversees your transaction from start to finish, provides real-time updates, and resolves issues immediately on your behalf.

“When clients reach out, they need someone who understands their unique circumstances and responds promptly,” says Scherzer. “Having a single, knowledgeable point of contact who’s just a phone call away makes a world of difference, and that level of client-centric service is rare in this industry.”

Award-winning technology

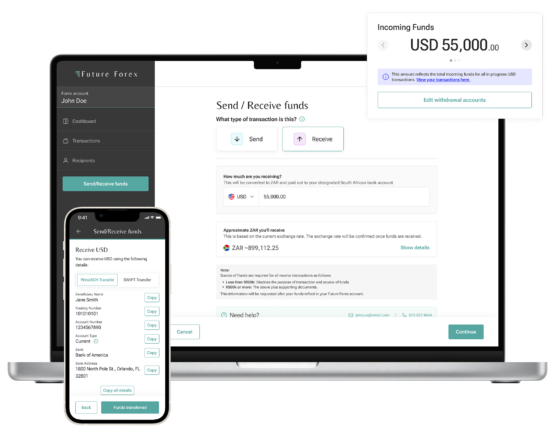

For those who prefer self-service, Future Forex provides an intuitive web and mobile app that simplifies every inward transfer. Clients can access live rates, receive real-time quotes, book transactions, track funds, and manage their accounts with ease – all from a single, user-friendly platform:

This innovative combination of cutting-edge tech and personalised client experience has positioned Future Forex as a trailblazer in South Africa’s foreign exchange landscape.

The company has earned numerous prestigious recognitions, including ‘Company of the Year’ at the 2025 Africa Career Summit & Gala Awards and ‘Outstanding Customer Service in Forex & Payments, South Africa’ at the World Business Outlook Awards, adding to its impressive track record of accolades.

Follow this link to get in touch with a Future Forex expert or request a quote for your transaction. You can also give them a call on 021 518 0558 or send them a message on WhatsApp.

Brought to you by Future Forex.

Moneyweb does not endorse any product or service being advertised in sponsored articles on our platform.

#Forex #Transfers #Face #Disruption