Alphabet plans to sell a very rare 100-year bond as part of its mega debt issue, in the first sale of such long-dated debt by a technology firm since the late 1990s.

The 100-year bond will be denominated in sterling, along with four other tranches in the currency, according to a person familiar with the matter. The deal, which is Alphabet’s debut sterling sale, could be priced as early as tomorrow, the person added, asking not to be identified.

It marks the first sale with such an extreme maturity by a technology firm since Motorola sold this type of debt in 1997, according to data compiled by Bloomberg. The market for 100-year bonds is dominated by governments and institutions like universities. For corporates, potential acquisitions, outdated business models and technological obsolescence make such deals a rarity.

Still, given the sheer volume of debt that tech firms need to raise to stay ahead in the race to build artificial intelligence capabilities, even ultra-rare deals are making a comeback.

“They want to tap every kind of investor possible from the structured finance investor to the super long-dated investor,” said Gordon Kerr, European macro strategist at KBRA. The main buyer of the 100-year bond would be insurance companies and pension funds, and “the guy who underwrites it is probably not going to be the guy who’s there when it gets repaid,” he said.

ADVERTISEMENT

CONTINUE READING BELOW

Strong demand from UK pension funds and insurers has made the sterling market a go-to venue for issuers seeking longer-dated funding.

Still, excluding government issuers, only Electricite de France SA, the University of Oxford and the charitable foundation Wellcome Trust have issued 100-year bonds in the currency before, based on data compiled by Bloomberg.

All those bonds were issued in 2021, a year when sterling high-grade yields hit their lowest level on record, based on Bloomberg indexes. Due to their very high duration, trader parlance for price sensitivity to changes in interest rates, all of them are indicated well below face value.

The lowest-coupon issue of the three, by Wellcome Trust, is indicated at 44.6 pence on the pound, based on data compiled by Bloomberg. Bond prices move inversely to yields.

And not all super-long bonds are destined to survive. Troubled retailer J.C. Penney Co filed for bankruptcy in 2020, just 23 years after issuing a century bond.

Alphabet’s 100-year mandate comes alongside a multi-tranche sale in the US dollar market. The tech giant earlier kicked off marketing for a seven-part transaction, which is expected to be priced later today. It’s also planning to raise debut notes in Swiss francs, according to another person familiar with the matter.

ADVERTISEMENT:

CONTINUE READING BELOW

Alphabet last tapped the US bond market in November, when it raised $17.5 billion in a deal that attracted about $90 billion of orders. As part of that transaction, it sold a 50-year bond — the longest corporate tech bond offering in US dollars last year, according to Bloomberg-compiled data — which has tightened in secondary markets. The company also sold €6.5 billion ($7.7 billion) of notes in Europe at the time.

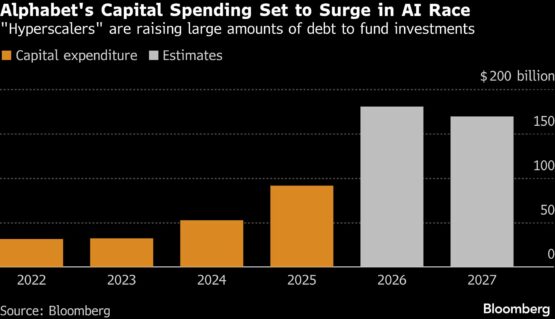

The mega debt deal comes less than a week after Alphabet said its capital expenditures will reach as much as $185 billion this year — double what it spent last year — to finance its ambitions in artificial intelligence.

Other tech firms, including Meta Platforms and Microsoft Corp, have also announced huge spending plans for 2026, while Morgan Stanley expects borrowing by the massive cloud-computing companies known as hyperscalers to reach $400 billion this year, up from $165 billion in 2025.

Still, the 100-year bond issue will likely remain a rarity.

“It’s difficult to say whether or not that’s something that will become commonplace,” said KBRA’s Kerr. “It’s not even really commonplace in the treasury market.”

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Alphabet #plans #techs #100year #bond