Gold fell after a two-day gain, as investors took profits in a choppy market that’s still trying to find clear direction following a historic rout. Silver also dropped.

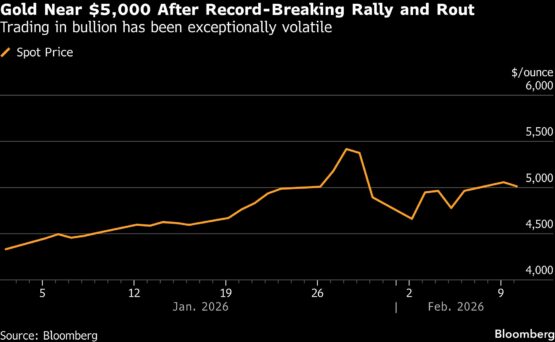

Spot gold lost as much as 1.4%, before paring losses to trade slightly above $5 000 an ounce. Traders are looking to US data due this week for clues on the Federal Reserve’s policy direction. While bullion has declined about 10% since hitting an all-time peak on January 29, it’s still firmly higher this year.

The move “points to profit-taking and position trimming, rather than a renewed rush for the exit,” said Hebe Chen, an analyst at Vantage Markets in Melbourne. “Crucially, gold is holding above the $5 000-an-ounce level despite the recent rout — a psychological zone poised to serve as a key technical hurdle for sellers, even as buyers remain cautious after the volatility.”

ADVERTISEMENT

CONTINUE READING BELOW

Precious metals plummeted at the end of January, when a record-setting surge fuelled by speculative trading caused markets to overheat. However, many of the factors that had underpinned a multiyear rally – heightened geopolitical risks, elevated central-bank buying, and investor flight from sovereign bonds and currencies – remain in play.

Many banks and asset managers, including Deutsche Bank AG and Goldman Sachs Group, have backed bullion to recover due to these long-term demand drivers. Underscoring resilient official demand, the Chinese central bank extended its gold buying to a 15th month in January.

“The flush-out was a much-needed reset for gold prices to resume their gradual trend higher,” said Christopher Wong, a strategist at Oversea-Chinese Banking Corp. “The structural drivers underpinning gold remain intact. Downside momentum has moderated, and gold has begun to find slightly firmer footing at lower — but still historically elevated — levels,” he said.

ADVERTISEMENT:

CONTINUE READING BELOW

Looking ahead, the data due later this week will offer clues on Fed policy after President Donald Trump nominated Kevin Warsh to become the next head of the US central bank. The January jobs report on Wednesday is expected to show signs of the labour market stabilising, and inflation data is scheduled for Friday.

Spot gold declined 0.7% to $5 024.74 an ounce at 11:47 a.m. in Singapore. Silver fell 2.4% to $81.43. Platinum and palladium also traded lower. The Bloomberg Dollar Spot Index, a gauge of the US currency, was down 0.1% after ending the previous session 0.6% lower.

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Gold #retreats #traders #profits #twoday #bounce