The salespeople on the front line of a private-markets push to win over the world’s wealthy are quite adept at fielding questions on opacity, liquidity and valuation. Their list of tricky talking points just got a new addition — the so-called SaaSpocalypse.

At the IPEM Wealth conference that kicked off in Cannes this week, a market meltdown linked to fears over artificial intelligence’s impact was an uncomfortable backdrop as a selloff ripped through a raft of software stocks. It also spilled over to private-credit and alternative asset managers, many of whom were out in force at the event. However, evangelists of private markets pitching their products to Europe’s affluent had a different message: Nothing to see here.

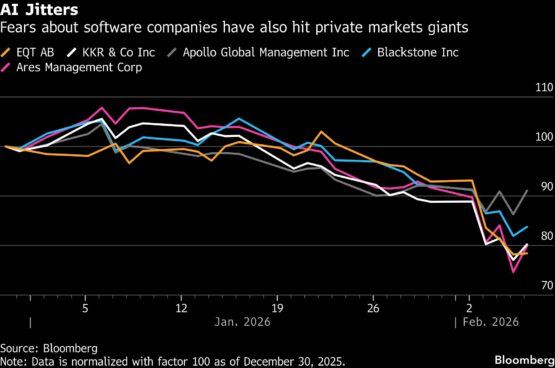

Meanwhile, investors fretted about the money managers’ exposure to those software companies. KKR & Co. ended the week almost 10% lower, while Ares Management Corp. dropped 12.8% even after the firms reported solid results. Both companies, together with peers Blackstone Inc., and EQT AB, are sitting on double-digit declines since the start of January.

The jitters back home in London and New York pose a new challenge for private-market players who are already under scrutiny from regulators around the world. Policymakers in the US, European Union and Australia have been pushing for more transparency in private markets as they assess financial stability and contagion risks.

While the stock plunge tests the ability of private-market advocates to pitch their funds to wealth clients and exposes their need to sharpen their marketing scripts, the tone at the IPEM conference — and outside — was broadly optimistic.

Panelists including Ares’ head of investment strategy, Brendan McCurdy, discussed how to make alternatives a more central part of portfolios at the IPEM event on Feb. 5. At the same time, McCurdy’s boss and Ares Chief Executive Officer Michael Arougheti faced the task of addressing the company’s plunging share price as he unveiled results in New York.

ADVERTISEMENT

CONTINUE READING BELOW

Markets are “missing the point” that loans are safe, Arougheti said in a Bloomberg Television interview Thursday. “That’s why I work in private markets, the markets trade on momentum, there’s a lot of forces in the public markets that are not tethered to fundamentals.”

The AI turbulence was front and center for KKR too, with the first analyst question on the company’s earnings call on 5 February immediately addressing the “elephant in the room.”

Co-CEO Scott Nuttall sought to assuage concerns, noting that only about 7% of its $744 billion of assets under management is exposed to software, a concentration well below industry levels.

“We tell people here that they’ve got to focus on things they can control, short-term trading of our stock is not one of them,” KKR CFO Robert Lewin said in a Bloomberg Television interview. “We feel really good about our exposure. This isn’t something that has become front of mind in the past couple of days, this is something we have been thinking about for a number of years.”

Won’t end well

Those reassurances aren’t likely to silence long-time critics who have been flagging the risks of opening private-market products to a broader and less sophisticated audience.

The rush of money from everyday investors is “not going to end well,” 26north Partners founder and former Apollo co-founder Josh Harris said at a separate event this week.

“People don’t understand the duration,” Harris said Tuesday at a Wall Street Journal conference. “They don’t understand that some of these structures may not be liquid when things go wrong — and that’s exactly when they need the money.”

Such warnings and the latest market gyrations threaten to compound the pressure that’s gradually been building on the amped-up scores of private fund sales teams sipping champagne in the hotel bars along Cannes’ boulevard de la Croissette.

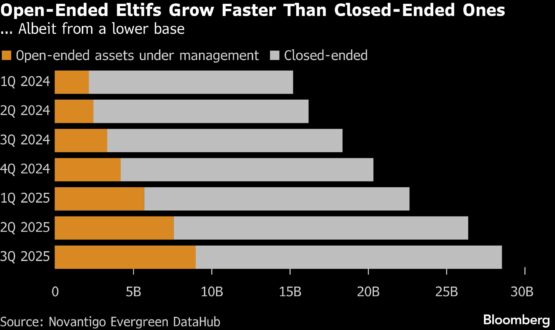

More than 130 private market funds were launched over the past two years, after the European Commission overhauled rules for so-called Eltifs, short for European Long-Term Investment Fund. But asset managers have so far largely refrained from disclosing how much the vehicles have raised while they continue to work on building out their distribution channels.

Growing pains are also being felt at relatively new private-markets players such as BlackRock Inc., which last year halted a plan to launch an infrastructure Eltif.

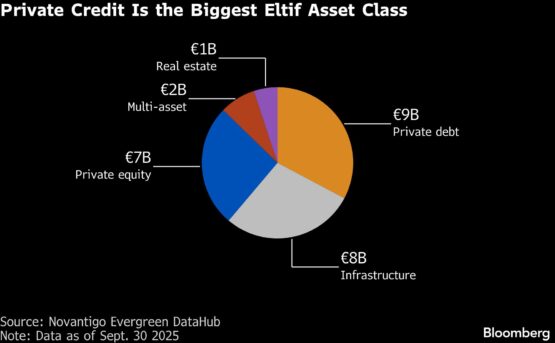

Assets in open-ended vehicles, which offer investors the chance to withdraw some of their money — unless there’s a stampede for the exit — nearly quadrupled to €9 billion ($10.6 billion) in Europe from the beginning of 2024 through the end of September last year, according to Novantigo. The research and consulting firm estimates that Eltifs’ overall assets could reach more than €180 billion by the end of the decade, up from €29 billion currently.

ADVERTISEMENT:

CONTINUE READING BELOW

Europe’s fragmented regulatory landscape is a factor and has forced private fund giants including Blackstone, Apollo and KKR to go on a drive to educate intermediaries as they seek partners that can help sell their products to wealthy investors in countries across the continent.

“Education is crucial to what we do,” said Farhad Karim, chief operating officer of Blackstone Private Wealth, speaking broadly of private markets. “When headlines move faster than fundamentals, the most important thing we can offer is transparency. When you do that, the picture often looks quite different from the narrative. Facts matter.”

Private-market products haven’t yet taken off in Europe in marked contrast to the US, where adoption has been more widespread.

For example, an Eltif doesn’t require a minimum investment, making it more accessible to retail investors. But many managers typically still ask fund buyers to stump up at least €10 000. Fees also tend to be far higher than what publicly traded funds charge, given the work involved in sourcing and executing deals.

“This is a bit of a chicken and egg situation,” said Mara Dobrescu, a senior principal at research firm Morningstar Inc.

Investment platforms have been slow in onboarding retail-oriented evergreen funds in Europe, citing operational complexity because these vehicles involve different notice periods, fee structures, redemption terms, and gating mechanisms, she said. At the same time, retail investors “haven’t exactly been clamoring” for these products either, she added.

Structures like Eltifs are “fairly new and unfamiliar, and the lack of a track-record makes it difficult to know what to expect,” Dobrescu said.

Race for exit

Market observers regularly warn that evergreen funds will have to restrict withdrawals when markets get choppy. That’s in part because individual investors can be more prone to a race for the exit at times of turbulence.

The Blackstone Real Estate Income Trust is among the industry’s most recent and prominent examples. After a rapid rise in interest rates three years ago spooked investors who feared property values would fall, Blackstone was forced to limit withdrawals.

Analysts and traders, meanwhile, are assessing the durability of private credit, a cornerstone of the products that private markets firms are racing to sell to wealth clients.

ADVERTISEMENT:

CONTINUE READING BELOW

A BlackRock private debt fund said last month that it expects to mark down the net value of its assets in part because of its exposure to e-commerce aggregators. Investors from one of Blue Owl Capital Inc.’s tech-focused funds pulled about 15.4% of net assets.

IPEM’s organisers, for what it’s worth, seem acutely aware of the risks their industry faces.

In the event’s main brochure, the hosts liken private capital managers’ push into retail to a “gold rush” where “excitement is high” and competition is fierce. “As the tide rises, we have a collective responsibility to remain disciplined and aligned to determine whether the industry stays on top — or is pulled under.”

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Private #markets #push #worlds #wealthy #runs #meltdown