When it comes to the world’s richest billionaires, tech founders litter the top of the list. AI has been heralded as a multi-trillion-dollar industry, catapulting many founders to extreme wealth; but now AI bubble fears and doubts over valuations have led to billions erased from CEOs’ net worths overnight. For Larry Ellison, whose net worth has been hardest hit, that looks like a $59.2 billion loss since the year started—and we’re only in February.

After months of eyebrow-raising over software stocks and AI’s impact on the sector, a selloff on Tuesday triggered billions to be wiped from the wealthiest’s net worths. In the few days since then, Ellison has watched his wealth slide by $19 billion, according to current data from the Bloomberg Billionaires Index.

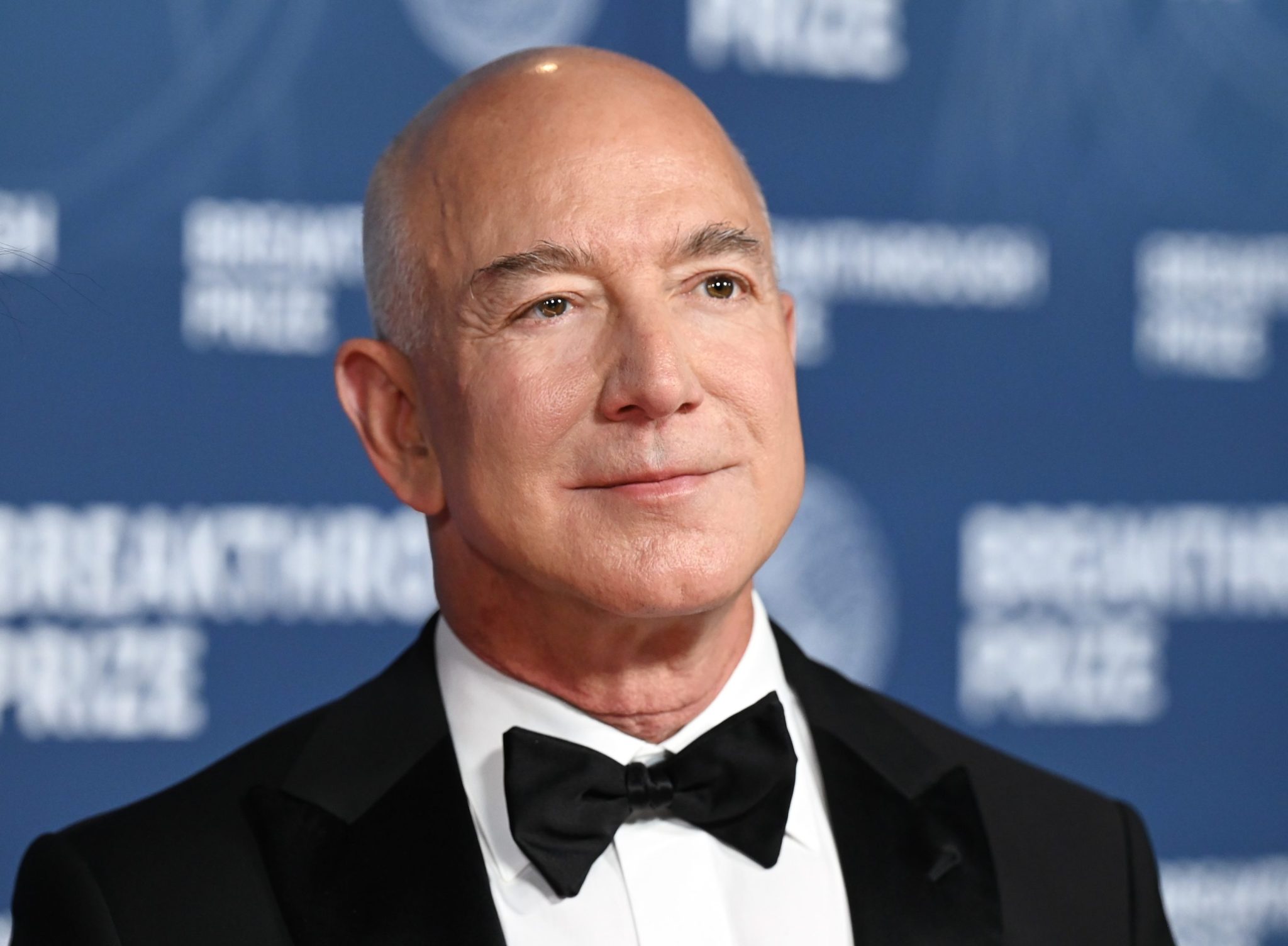

Amazon founder Jeff Bezos’ fortune has also dropped $14 billion since Tuesday, contributing to his $6.82 billion loss for the year so far.

The Tuesday sell-off, turbocharged by Anthropic’s new legal AI tool, also sent the already-dwindling fortunes of other software billionaires to tumble even harder. Following the broad selloff that saw the S&P 500 software and services index fall by nearly 4%, at least $62 billion was wiped from the net worths of the industry’s wealthiest entrepreneurs so far this year, according to a Bloomberg analysis of its Billionaires Index.

But the three founders of advertising platform AppLovin had the biggest relative decline in wealth in the aftermath in the selloff; CEO Adam Foroughi had lost 31% of his net worth since the start of the year, around $7.8 billion, while former CTO John Krystynak’s fortune was shaved down 30% after a $2.4 billion blow. Fellow AppLovin cofounder Andrew Karam also emerged from the selloff 29% less rich than at the start of 2026.

Despite building the world’s most valuable company thanks to AI advancements, Nvidia CEO Jensen Huang has also faced a decline; he’s lost $7 billion since the selloff earlier this week, and is down nearly $12 billion this year. And the net worth of Steve Ballmer, the former CEO of Microsoft, has gone through the ringer this week. Relative to his peers, he’s only lost a modest $5 billion after Tuesday—but since the start of 2026, almost $29 billion has been wiped from Ballmer’s name.

Tech CEOs have scored big on the AI boom—but also taken huge hits

Technology has become a goldrush, with the industry minting new entrepreneurial millionaires and billionaires yearly. Take a look at the top 10 richest U.S. billionaires, who added a whopping $698 billion to their net worths between 2024 and 2025 according to a 2025 Oxfam report, and the sector’s financial power comes to light.

Most of the top 10 wealthiest Americans are the posterchildren of the tech industry: including Oracle cofounder Larry Ellison, Amazon founder Jeff Bezos, Google cofounders Larry Page and Sergey Brin, Meta CEO Mark Zuckerberg, Nvidia CEO Jensen Huang, ex-Microsoft CEO Steve Ballmer, and Dell founder Michael Dell. Each of them gained nearly $70 billion last year—833,631 times more than what the typical American household takes home.

The world’s wealthiest have managed to tap into tech as the industry is still rapidly growing—but fast-evolving promises also leaves the door open for AI bubble concerns. “Second thoughts” can lead to rapid multibillion-dollar losses.

No one knows this better than Oracle cofounder Ellison himself.

Briefly last year, the 81-year-old entrepreneur dethroned Tesla CEO Elon Musk as the richest person in the world. Ellison, who owns 40% of Oracle, had experienced an eye-watering $101 billion wealth surge overnight following his business’ breakout earnings report that sent shares soaring by 36%.

But the high was short-lived; Ellison’s estimated net worth fell by $34 billion just two days following Oracle’s stock surge, while Musk enjoyed a $35 billion gain, putting him back on top. Ellison’s loss was triggered by “second thoughts” around the company’s cloud deal with OpenAI, J. Bradford DeLong, a U.C. Berkeley economist, told Fortune last year.

A rapidly expanding AI market also means new, fierce competitors who can throw vast fortunes into disarray.

In January of last year, billionaires saw their wealth surge by $10 billion every day. But just one month later, the honeymoon period was over; during February 2025, Musk’s net worth dropped from $433 billion to $349 billion. Meta CEO Zuckerberg slipped from $243 billion to $232 billion in the same time period, and Larry Ellison lost about $9 billion. The reason why? Chinese tech underdog DeepSeek rocked the market with its low-cost R1 model, wiping billions off the stock market, with $600 billion vanishing from Nvidia’s market value alone.

#Arrow #Button #Icon