For too long, South Africans have had to endure sky-high fees, manual processes, and slow turnaround times when receiving foreign currency through the banks – a legacy experience that feels increasingly out of step with today’s digital world.

Banks have dominated the forex space for decades, collectively earning billions, while everyday South Africans and SMEs bear the burden of hidden 2-3% costs on every inward transaction.

Combine that with slow processing, endless paperwork, and opaque communication, and what should be a simple electronic transfer quickly turns into a costly headache.

“It’s hard to understand why receiving money from abroad still comes with so much friction and unnecessary costs,” says Harry Scherzer, CEO of Future Forex and a qualified actuary.

“Technology has transformed so many financial transactions, yet international payments have long lagged behind.”

However, multi-award-winning fintech Future Forex has reimagined the entire process, offering South Africans a pioneering solution that makes bringing funds into the country faster, more cost-effective, and far less cumbersome than ever before.

By pairing leading financial technology with white-glove client support, Future Forex ensures its clients’ offshore funds land in South Africa in record time – all without the tedious paperwork and manual processes that have traditionally complicated inward transactions.

This streamlined solution is up to just one-fifth the cost compared to traditional banks and other fintech players, delivering substantial benefits for anyone who is:

- Receiving an overseas salary;

- Repatriating investment returns or selling foreign property;

- Handling an offshore inheritance;

- Running a business and bringing foreign revenue back for their South African cost centre; or

- Relocating on a ‘swallow’ visa and needing swift access to funds for rent or investments.

“We’ve also seen a growing number of South African expats returning home, but the banks’ opaque fees, cumbersome paperwork, and unclear timelines often leave people scrambling to secure property, transfer investment capital, or act on time-sensitive opportunities. Our goal is to remove those barriers,” adds Scherzer.

What makes Future Forex’s solution faster and more affordable?

“In this market, you have to keep innovating, and that’s exactly what we’ve been doing,” says Scherzer.

“We analysed the entire process of bringing funds into the country, mapped out every bottleneck, and designed a solution that overcomes them by combining cutting-edge technology with hands-on expertise.”

Unlike traditional banks, where clients are often left navigating endless call centres, filling out repetitive forms, and receiving little to no guidance on compliance requirements, Future Forex’s approach is radically different.

Its systems are fully digital, highly automated, and built to remove friction at every stage.

This means clients never have to submit the same information twice, and all the unnecessary admin is taken care of behind the scenes.

On top of that, every Future Forex client is supported by a dedicated account manager who oversees the entire inward payment process, providing expert guidance, proactive updates, and comprehensive compliance support – all at no extra cost.

“Our philosophy is simple: we believe clients should have expert support whenever they need it, and intuitive technology taking care of the rest.”

Award-winning tech

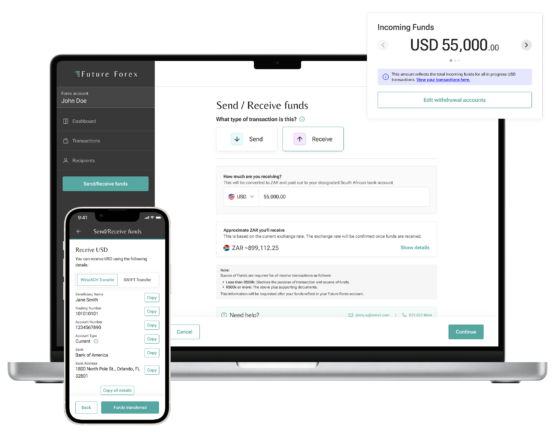

For clients who prefer to manage their transactions themselves, Future Forex offers a highly intuitive web and mobile app that makes every aspect of the payment process seamless.

Clients can access live rates and real-time quotes instantly, initiate transactions, monitor their funds, and manage their account with ease – all from one convenient, easy-to-use platform.

This powerful mix of innovative tech and personalised service has positioned Future Forex as a pioneer in SA’s foreign exchange landscape.

The company has earned multiple accolades, including ‘Company of the Year’ at the 2025 Africa Career Summit and ‘Outstanding Customer Service in Forex & Payments, South Africa’ at the World Business Outlook Awards, adding to a consistent string of recognitions in previous years.

Follow this link to get in touch with a Future Forex expert or request a quote for your transaction. You can also give them a call on 021 518 0558 or send them a message on WhatsApp.

Brought to you by Future Forex.

Moneyweb does not endorse any product or service being advertised in sponsored articles on our platform.

#Bringing #funds #faster #cheaper