Barrick Mining Corp plans to spin off its top North American gold assets in an initial public offering later this year as part of a strategic reset by the Canadian metals producer.

The company said Thursday it will sell a minority stake in the new North American unit and expects the IPO to be completed by late 2026. It also appointed interim boss Mark Hill as chief executive officer.

The world’s No. 2 gold producer is pursuing an IPO — which could be worth more than $60 billion — as Barrick seeks to reset following a string of setbacks and a management shakeup. It follows years of declining output and the abrupt departure in September of CEO Mark Bristow, whose term was marred by the seizure of key mine in Mali by the West African nation’s military junta.

The turmoil at Barrick means that the company has struggled to fully capture a record-breaking rally in the price of gold. Pressure has also grown after activist investor Elliott Investment Management LP bought a sizable stake in Barrick.

The company will retain a “significant” majority holding in the new North American business, Barrick said, without providing details of where the unit will be listed.

The spinoff will include the miner’s joint-venture interests in Nevada — where it also owns the Fourmile discovery — as well as a mine in the Dominican Republic. Assets in higher-risk jurisdictions such as Africa and Pakistan, will remain with the parent, it added.

ADVERTISEMENT

CONTINUE READING BELOW

“Following rigorous analysis, the board has decided to move forward with preparations for an initial public offering of Barrick’s North American gold assets in order to maximize shareholder value,” the company said in the statement.

The company’s North American assets could be worth almost $62 billion in value if investors assign the spinoff a premium similar to that of North American rival Agnico Eagle Mines, according to Bloomberg Intelligence analyst Grant Sporre. Still, breaking up the company could also make the new unit more vulnerable to takeover interest.

Bloomberg News reported in October that Newmont Corp was examining a potential deal to gain control of Barrick’s prized Nevada assets. It already holds a minority stake in a Nevada joint venture with Barrick.

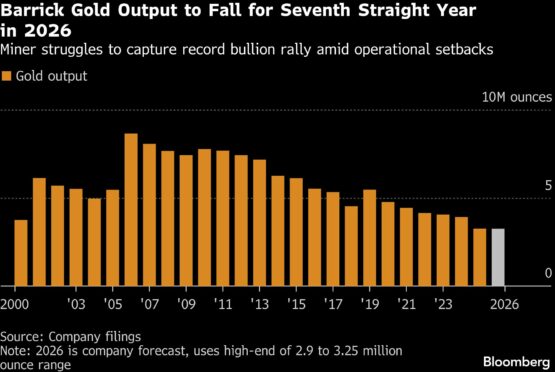

Since being appointed in the wake of Bristow’s exit, Hill has ushered in sweeping changes, including restructuring regional operations and shaking up the senior management team. Barrick has seen successive years of declining output at a time when gold prices have soared, leading to it trade at a lower valuation relative to peers.

ADVERTISEMENT:

CONTINUE READING BELOW

Barrick’s board — led by John Thornton — has also overseen efforts to woo investors with higher payouts and share buybacks. On Thursday, the company more than doubled its fourth-quarter dividend to $0.42 per share from the previous three months and said it had bought back $500 million of stock in the final quarter of 2025.

The miner posted a sixth straight year of declining output, with production falling 17% to 3.26 million ounces — the lowest in at least 25 years. Barrick expects to churn out even lower volumes in 2026, despite taking back control of the Loulo-Gounkoto complex in Mali.

The dramatic slump underscores long-running challenges at Barrick that have tested investor patience as the Canadian miner fails to keep pace with a record-breaking rally in bullion. Geopolitical instability at key mines in Africa, Pakistan and Papua New Guinea have led to significant operational disruptions, weighing on production.

What Bloomberg Intelligence Says

“North American output looks set to fall vs. 2025, underscoring ongoing issues at the Nevada Gold Mines JV, the core asset in the planned NewCo, which may limit scope for a valuation premium at listing.”

—Grant Sporre, Global Head of Metals & Mining

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Barrick #spin #North #American #gold #assets #IPO