Last week, our local currency strengthened to below R16 to the US dollar. Just have a look at all the forecasts suddenly being published calling for the rand to get even stronger – nothing breeds bullish rand forecasts quite like being three years into a rand bull market.

How much stronger can the rand go?

Read:

Everybody suddenly loves the rand

What’s moving the rand: A comeback against the greenback

Stronger rand delivers cheapest petrol in 4 years

Interestingly, gold and platinum also hit all-time highs last week.

And although they have (violently) reversed since then, they remain well up on a year ago.

So perhaps we should ask how much stronger are gold and platinum likely to get?

And are these things related?

Or, cynically, how much rand strength is really just dollar weakness? Is this less of a case of ‘SA Inc’ working and more a case of markets pricing risk into the dollar?

Well, firstly, gold and platinum have both kept hitting highs.

Listen/read:

What’s driving record gold demand in a $5 000 market?

Gold, silver plunge as reports on Fed nominee boost dollar

Coronation called it: Why the fund manager isn’t buying gold stocks

Commodity volatility ain’t over yet

Gold plunge deepens as traders unwind ‘crowded’ bets on rally

Painful Monday as JSE rout continues

ADVERTISEMENT

CONTINUE READING BELOW

Even after the recent sell-off, the charts are eye-watering …

Gold (USD/oz)

Source: Koyfin, 2 February 2026

Platinum (USD/oz)

Source: Koyfin, 2 February 2026

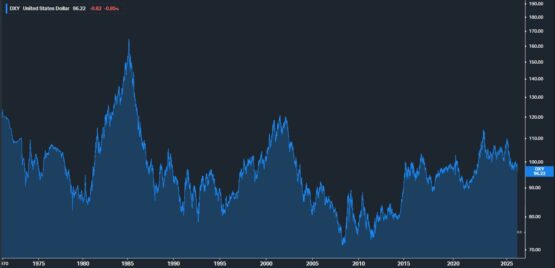

Also, the US Dollar Index (tracking the USD versus the EUR, JPY, GBP, CAD, SEK and CHF) does keep grinding lower with every tweet and tariff threat to come from US President Donald Trump – as the following chart shows.

US dollar Index (DXY)

Source: Koyfin, 28 January 2026

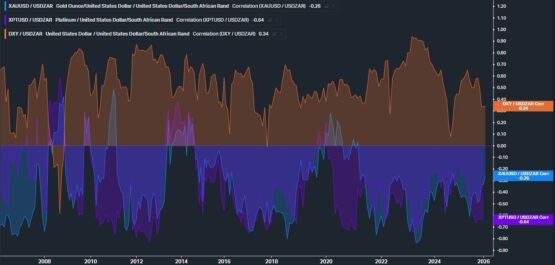

But how correlated are these to the local currency?

In the following chart, we show the rolling 12-month correlation of each of these variables versus the monthly rolling rand exchange rate (versus the dollar).

ADVERTISEMENT:

CONTINUE READING BELOW

Source: Koyfin, 28 January 2026

Correlation is not causation – as in, just because we all breath air and die one day, it does not mean that breathing air is the thing that kills us.

But it is quite clear that:

- Gold and platinum both have mostly negative correlations with our exchange rate (when their prices go up, the rand strengthens); while

- The dollar has a mostly positive correlation (when the dollar weakens against most currencies, the rand tends to be included).

This is an entirely useless conclusion unless we take it a little further with logic.

Because gold is a larger, global, more efficient market than our local exchange rate, it is logical that our exchange rate does not change the gold price, but rather it responds to the changes in the global gold price.

Equally, because the US dollar is a larger, more liquid and more efficient market than our local exchange rate, it is logical that our exchange rate does not change the price of US dollars, but rather it responds to changes in the US dollar.

Thus, I don’t think many would argue when I say that our rand strength here is really a reflection of gold’s rally and the US dollar’s fall.

Listen:

The key forces driving PGM prices

Big swings, big risks: Commodities are volatile

More nuanced, platinum – and indeed all platinum group metals (PGMs) – are both a global market and have SA-dominated supply, thus I struggle to make the same logical assertion here.

What I can say is that the world requires our PGMs … thus the higher the price of PGMs, the greater the foreign exchange earned by our local PGM miners’ exports, which then mechanically buys more ZAR.

ADVERTISEMENT:

CONTINUE READING BELOW

The higher the PGM basket price, the more ZAR they have to buy. Again and again and again …

(The PGM argument is also applicable to gold.)

Read:

Resources rally takes JSE to new high

Gold shares storm to all-time highs on surging metal price

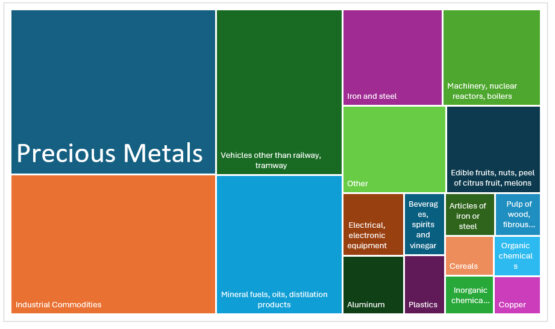

And if you look at our export data, these two commodity sets (gold and PGMs) are very material to our trade balance.

Heat map of South Africa’s exports in 2024

Source: Trading Economics (analyst simplification of titles has taken place)

See the original of the above here.

Thus, instead of a piece bullish about the rand, I thought to rather highlight that in order to be bullish on further rand strength, you have to be comfortable with our local macroeconomic trajectory (no upsets from the government of national unity please) and believe that:

- Gold will keep rallying;

- Platinum (and the PGM basket) will keep rallying; and

- The US dollar will keep weakening.

While the recent violent sell-off in precious metals may give everyone a moment to pause their bullishness, the reality is that these metals’ prices are much higher than they were a year ago and the US dollar remains much weaker than it was a year ago.

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Gold #platinum #mighty #rand