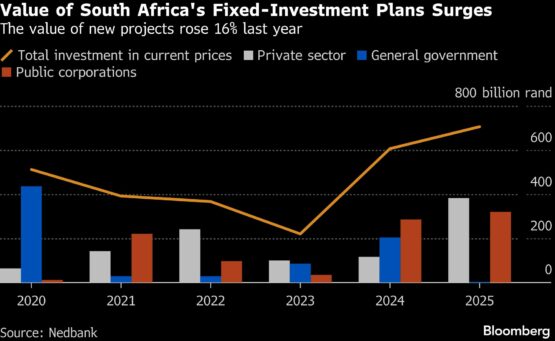

Planned capital investment in South Africa surged last year as private commitments tripled, while government projects excluding state companies declined, according to a report by Nedbank Group Ltd.

The value of newly announced plans climbed 16% to R705.6 billion ($44 billion), the lender said in its Capital Expenditure Project Listing report released Monday.

Read:

Public and private sector’s capex plans could see projects of R790bn [2024]

South Africa infrastructure spend plans soar as energy woes ease [2024]

Private firms committed to investing R382.5 billion, up from R116.2 billion in 2024.

Major initiatives included Vodacom Group Ltd’s R85.2 billion expansion and modernisation of digital infrastructure through network upgrades and an accelerated 5G rollout, as well as NT55 Investments’ planned R50 billion inland port in the central Gauteng province, which is designed to ease freight bottlenecks by creating car and rail terminals with train-to-truck transfers, the lender said.

“The rise in private-sector project announcements is reflective of a better cyclical environment,” Nedbank said.

A 12% increase in the value of planned projects by state companies also fuelled investment activity, driven mainly by Eskom Holdings SOC Ltd’s R320 billion power infrastructure overhaul.

ADVERTISEMENT

CONTINUE READING BELOW

Read: Identifying the bugs in SA’s long-promised infrastructure boom [2025]

By contrast, the value of projects planned by government itself tumbled to R2.9 billion last year, from R204 billion in 2024, when the authorities announced a R43.7 billion housing and community development programme and a R35.8 billion second phase of the Rooiwal wastewater project.

Years of underinvestment and mismanagement have left Africa’s largest economy with a massive infrastructure backlog that’s curbed output.

President Cyril Ramaphosa has previously estimated that the country needs as much as R1.6 trillion in public-sector infrastructure investment and a further R3.2 trillion from the private sector for it to achieve its infrastructure goals by 2030.

Read:

Creecy punts private sector investment for five rail and port corridors

Ramaphosa targets R3trn private sector infrastructure boom

Treasury confirms R27bn World Bank loan to fix infrastructure

The government has sought to crowd in private investment through reforms while shifting spending toward growth-enhancing infrastructure.

Measures under Operation Vulindlela – a task force set up by Ramaphosa to address energy and freight constraints – are progressing, with 47% of reforms on track and most of the remainder advancing despite delays, the National Treasury said Friday.

ADVERTISEMENT:

CONTINUE READING BELOW

South Africa raised R11.8 billion in its first infrastructure bond sale late last year, attracting bids worth more than twice the amount sought.

“There has been a clear improvement in the fundamentals that drive investment,” Nedbank said.

Credit-default swap spreads on South African sovereign debt have narrowed across all maturities to their lowest levels since 2010, signalling a sharp drop in risk premia. Together with falling long-term interest rates, this lowers the hurdle for new investment, according to Nedbank.

Read:

Investors pile into SA’s first infrastructure bond

Operation Vulindlela’s wins are real, but implementation momentum is slowing

More supportive cyclical conditions – including easing inflation and lower borrowing costs – are also lifting domestic demand, which should gradually absorb spare capacity and prompt firms to consider expansion, it added.

“We forecast gross fixed capital formation to increase from -2.3% in 2025 to 2% in 2026 and to grow at a sub-par average of 1.9% over the next three years,” the lender said, while warning that investors are likely to stay cautious as high operating costs, excess capacity in some sectors and higher US tariffs threaten private capital spending.

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#private #investment #plans #triple #reforms #progress