Chinese automakers built nearly one in 10 passenger cars sold in Europe last month, a record share that caps a year of rapid growth led by brisk sales of hybrid and battery-powered vehicles.

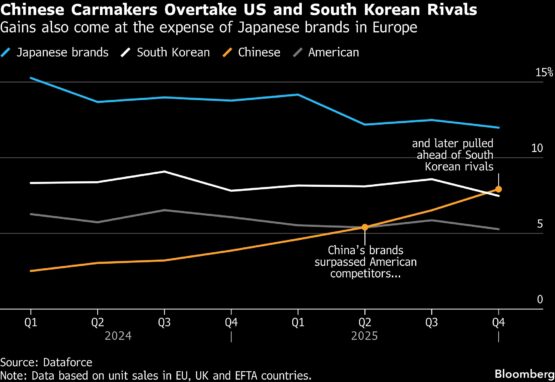

With December’s 9.5% share of the European car market, Chinese brands outsold South Korean rivals including Kia on a quarterly basis for the first time, based on figures from researcher Dataforce. BYD and its peers are poised to make further inroads as trade barriers fall and a Chinese export push accelerates.

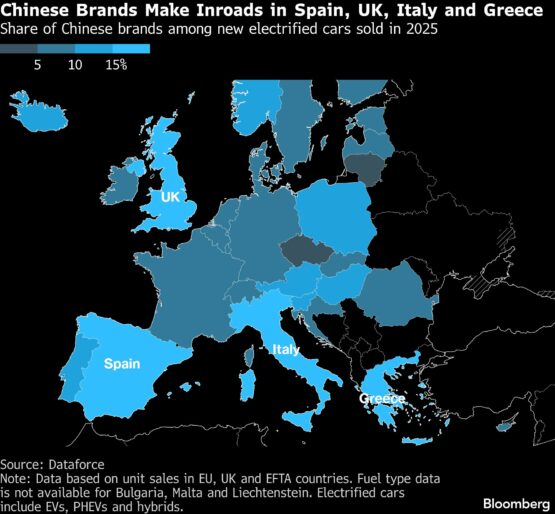

The advance was strongest for the electrified cars that account for the bulk of Europe’s growth. Chinese automakers used their competitive edge in battery technology to win customers for EVs and hybrid-electric vehicles from Spain to Greece, Italy and the UK.

“We were stunned by the rapid uptake of Chinese cars in southern Europe,” said Julian Litzinger, an analyst with Dataforce. “We knew that people in those countries are more flexible in their choice of brand, but for EVs that was not foreseeable.”

Read:

SA weighs steep tariffs on vehicles from China, India

SA new vehicle sales hit decade high as affordability drives demand

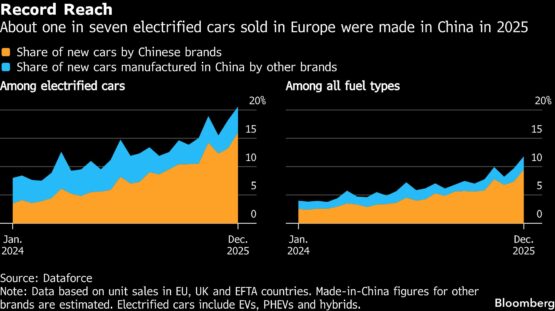

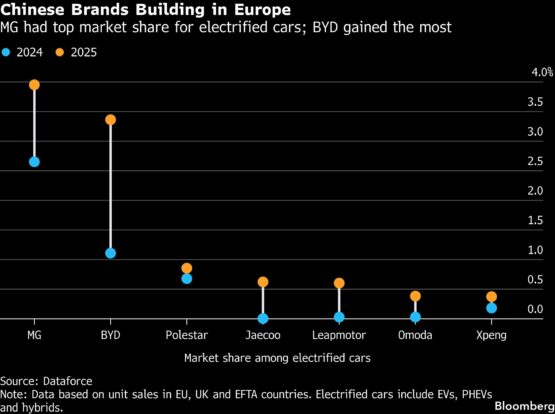

Chinese brands accounted for 16% of Europe’s electrified car market in December, and 11% for all of 2025, a Bloomberg analysis of the data shows — more than doubling from 2024. Zhejiang Leapmotor Technology Co. and Chery Automobile Co. put up significant volumes, joining incumbents BYD and MG maker SAIC Motor Corp.

The mainland’s reach extends further when counting cars imported by non-Chinese brands like Tesla Inc., Volkswagen AG, BMW AG and Renault SA. On that basis, about one in seven electrified cars sold across the whole of Europe in 2025 were made in China.

ADVERTISEMENT

CONTINUE READING BELOW

China’s growing foothold spotlights the immense strains facing Europe’s carmaking sector, a bedrock industry that provides more than 13 million jobs and underpins economic stability. European brands, squeezed by tariffs in the US and dwindling share in China, face a growing challenge at home to produce the cars people will drive in the future.

“The progression of Chinese cars in Europe is massive,” said Roberto Vavassori, a Brembo NV executive who heads Italy’s Anfia trade group. Without urgent measures, the industry won’t replace the more than 110,000 jobs lost across Europe over the past 18 months, he said. “It’s a matter of survival for our industry.”

There’s no sign of any let-up. Chinese carmakers, contending with overproduction at home and shut out of the US, have redoubled expansion efforts in Europe. BYD said on Jan. 24 it aims to increase deliveries to markets outside of China by nearly 25% this year.

European manufacturers have gained some breathing room from three straight years of market growth. They’ve got competitive EVs entering the market, including Stellantis NV’s Citroën ë-C3 and Renault’s coming Twingo. With the exception of the UK, the region’s carmakers have defended key countries like Germany and France.

Non-European brands that have built factories in the region and nurtured dealer networks for decades face being squeezed out by China’s momentum. Chinese brands overtook US carmakers in the region during the second quarter of 2025, and surpassed South Korean companies in the fourth quarter, according to Dataforce.

“We believe that the rise of the Chinese in Europe will lead to the withdrawal of some other brands,” Litzinger said. With unit sales still below pre-Covid levels, “they take over significant volume, which will make it hard for others to breathe.”

As one of the world’s biggest automotive markets, Europe presents a massive opportunity. Its size also underscores the risk for an automaking sector that provides more than 7% of the EU’s GDP and 6.1% of jobs, according to McKinsey & Co.

ADVERTISEMENT:

CONTINUE READING BELOW

Chinese firms previously acquired brands like Volvo Car, MG and Lotus, expanding more recently with joint ventures in the region. Some, like BYD, are also building local factories and design centres, and have pledged to use European suppliers.

“The intention is very clear, we want BYD to become a European manufacturer,” Alfredo Altavilla, special adviser to BYD in Europe, said in an interview. “We are not here to take European jobs away but to create them, and hopefully we will succeed in partially making up for the shortfall in automotive jobs caused by other manufacturers.”

Stellantis, the owner of Fiat and Peugeot, plans to start producing Leapmotor cars in Zaragoza, Spain, this year. Chery is looking to make EVs in Barcelona with a local partner. In the meantime, the companies have geared up imports.

Stellantis’s partnership with Leapmotor has commercial potential and can help the carmaker “get in touch with technology and with experience” originating outside of Europe, Emanuele Cappellano, the carmaker’s European chief, said on 9 January. “It’s a way to learn.”

Suppliers say they see potential positives. “This means additional business opportunities – in Europe, China, and worldwide,” said Thomas Stierle, CEO of e-mobility at Germany’s Schaeffler AG.

Tariff pivot

European auto executives have also called for levelling the playing field, given Beijing’s massive subsidies to China’s battery industry, but the policy response to date has had little effect. The EU in late 2024 imposed tariffs on Chinese-made EVs after probing state aid. Chinese brands ratcheted up sales of plug-in hybrids, while still pressing ahead with EVs.

Volkswagen Tiguan eHybrid and BYD Seal U DM-i.

ADVERTISEMENT:

CONTINUE READING BELOW

Now the EU is considering a switch to minimum import price agreements, while moving to loosen the 2035 phase-out of combustion-engine cars. Germany plans to open €3 billion ($3.5 billion) in EV subsidies to Chinese manufacturers — leading to criticism.

The German subsidy “could give Chinese manufacturers an additional boost” against manufacturers like Volkswagen, said Metzler analyst Pal Skirta.

“We really want tax money to be used in a way that secures jobs in Germany and Europe,” IG Metall union Chair Christiane Benner said this week.

Stretched consumers are less swayed by national pride, giving Chinese brands an opening to court the aspirational middle class with lower-priced models.

BYD sells its Seal U DM-i plug-in hybrid in the UK starting at £33 340 ($45 935), compared with £42 840 for VW’s Tiguan eHybrid Match. Both sport-utility vehicles seat five and can go over 75 miles in all-electric mode.

Chery’s £35 000 Jaecoo 7 plug-in SUV, nicknamed “the Temu Range Rover” in reference to the Chinese discount marketplace and its resemblance to the classic British SUV, is gaining popularity across the UK.

And the company’s Chery badge ran a recent spot for its Tiggo 9 starring former England footballer Peter Crouch running errands for his wife, TV personality Abbey Clancy. “Don’t judge me,” he says, after forgetting to buy milk.

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#cars #sold #Europe #Chinese #brand