Gold and silver sold off heavily on Friday, cooling a record-breaking rally, as a report the Trump administration is preparing to nominate Kevin Warsh for Federal Reserve chair boosted the dollar.

Silver plunged more than 16% toward $96 an ounce, while gold fell more than 7% below $5 000, intensifying the wild swings that interrupted record-breaking rallies that had stretched technical indicators.

A gauge of the dollar rose as much as 0.5%, making precious metals more expensive for most buyers. Silver and platinum tumbled more than 10%.

Read: Trump administration prepares to back Warsh for Fed chair

President Donald Trump is expected to name Warsh as his nomination for Fed chair, Bloomberg News reported. The former Fed governor has a longstanding reputation as an inflation hawk, but has aligned himself with the president in recent months by arguing publicly for lower interest rates. Trump said he would announce his nominee on Friday morning US time.

Read: JSE plunges over 3.5% amid precious metals volatility

Gold’s move “validates the cautionary tale of fast-up, fast-down,” said Christopher Wong, a strategist at Oversea-Chinese Banking Corp. While reports of Warsh’s nomination were a trigger, a correction was overdue, he said. “It’s like one of those excuses markets are waiting for to unwind those parabolic moves.”

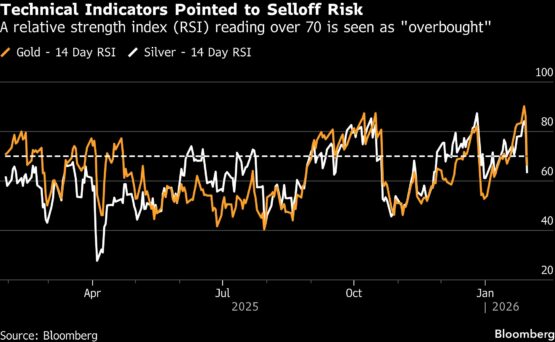

With gold and silver jumping so much already this year, some technical indicators flashed warning signs. One is the relative-strength index, which in recent weeks signaled that both metals may have become overbought and due a correction. Gold’s RSI recently hit 90, the highest it has been for the precious metal in decades.

ADVERTISEMENT

CONTINUE READING BELOW

ADVERTISEMENT:

CONTINUE READING BELOW

Even after the pullback, gold is still up around 17% in January, closing in on its sharpest monthly gain since 1980. The jump in silver has been eye-watering, with the white metal up 43% so far this year.

Read:

What’s driving record gold demand in a $5 000 market?

Simon’s weekly wrap: Gold, tech and regulation under scrutiny

Big swings, big risks: Commodities are volatile

The Trump administration’s upending of the global order — including the seizure of Venezuela’s leader, along with threats to annexe Greenland and impose tariffs against allies — has been a major driver. Most recently, Trump has been warning of a possible strike on Iran and saying he will put levies on any countries that provide oil to Cuba.

Meanwhile, the risk of another US government shutdown was avoided after Trump and Senate Democrats reached a tentative deal. The White House is continuing to negotiate with Democrats on placing new limits on immigration raids that have provoked a national outcry.

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Gold #silver #plunge #reports #Fed #nominee #boost #dollar