Dear reader,

When investing offshore – particularly in US- or UK-listed securities – it is important to understand how foreign estate and inheritance taxes may apply to non-resident investors.

One key concept in this regard is situs, which refers to the legal location of an asset for tax and estate-duty purposes.

For non-US persons, US-listed shares are generally considered US-situs assets. As a result, these assets may be subject to US estate tax on death, with marginal rates of up to 40%, after a relatively low exemption threshold.

Read: How different offshore investments affect your tax obligations

For South African tax residents, this exposure can exist in addition to local estate duty (up to 25%) and potential capital gains tax, which can materially reduce the value ultimately transferred to beneficiaries.

While not all investors will be affected in practice, the risk is often underestimated and should be considered as part of a holistic offshore investment and estate-planning strategy.

Why the investment structure matters

When investing offshore, the legal ownership structure is just as important as the choice of underlying shares or funds.

Holding US-listed securities directly in an individual’s own name may be simple, but it can expose the investor to:

- Foreign estate tax risk;

- Foreign probate and administrative delays; and

- Less flexibility in beneficiary planning.

For South African tax residents, one commonly used solution is investing through an offshore investment wrapper, often referred to as a sinking fund (terminology and features may vary between providers).

How an offshore wrapper typically works

An offshore sinking fund is a regulated investment structure that allows investors to hold offshore assets – such as equities, unit trusts, exchange-traded funds (ETFs), bonds, or cash – within a single legal vehicle. In most cases, the wrapper (and not the individual investor) is the legal owner of the underlying assets.

Read: Offshore investments: Is your structure optimised or overlooked?

Because the investor does not directly own the US-listed shares, this structure can reduce or eliminate US situs estate tax exposure, subject to the specific platform, jurisdiction, and applicable tax rules.

Depending on the structure and underlying investments, potential benefits may include:

- Estate tax risk management

Assets held within the wrapper are generally not treated as US-situs assets in the investor’s personal estate, which may mitigate exposure to US estate tax. - Tax efficiency over time

Where roll-up funds are used, tax on growth is typically deferred and applied at a maximum effective rate of 12% under South African tax rules, which may improve long-term outcomes compared to direct offshore investing. - Beneficiary nomination and estate efficiency

Investors can nominate beneficiaries directly. While the investment remains part of the investor’s estate for South African estate-duty purposes, the proceeds usually do not pass through the estate administratively, which can assist with liquidity and reduce delays. - Avoidance of foreign probate

Using a wrapper may help avoid complex and costly probate processes in foreign jurisdictions, such as the United States.

This approach is not limited to new investments. In appropriate circumstances, existing offshore portfolios can be restructured into a wrapper, although this should be carefully assessed due to potential capital gains tax and transaction costs.

A well-considered restructure may help:

- Reduce future capital gains tax exposure;

- Improve estate-planning outcomes; and

- Manage foreign inheritance or estate tax risk.

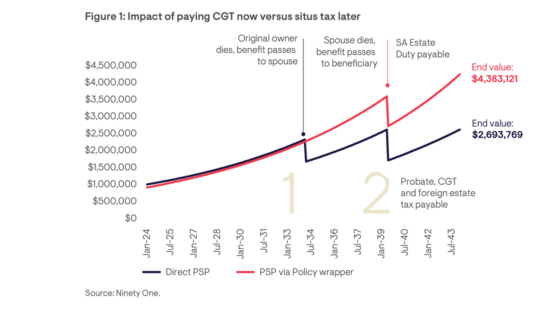

Over longer investment horizons, these benefits can meaningfully improve the value ultimately received by beneficiaries.

The graph below has been formulated by the Ninety One advisor solutions specialist team – it illustrates the potential long-term impact of restructuring an existing offshore portfolio into a more tax-efficient structure.

Source (graph and scenario): Marc Lindley, head of advisor solutions and Albert Coetzee, external consultant to Ninety One.

This type of strategy should be implemented carefully and in the context of a broader financial plan. It is generally advisable to do so with the guidance of a suitably qualified and licensed wealth advisor, together with appropriate tax and fiduciary specialists.

#invest #shares #minimise #estate #tax #exposure