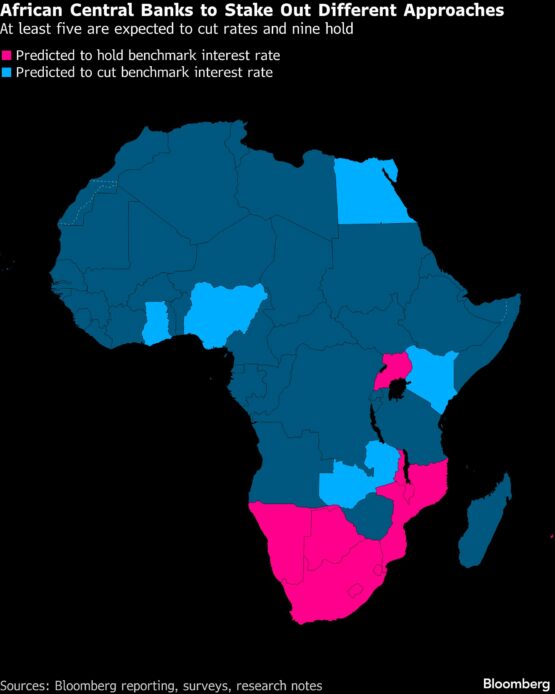

Key African economies — including Egypt, Nigeria and Kenya — are poised to cut interest rates at their first policy meetings of the year as price pressures continue to slow, though central bankers are expected to tread carefully as easing cycles near their end.

Those economies will be joined by at least 11 others over the course of the month in setting interest rates, including South Africa and Mozambique, where policymakers’ next moves are far less certain.

Read: Goldman, Morgan Stanley’s SA inflation call undercuts Sarb

“With global growth expected to ease to around 3.1% this year and monetary stances diverging across advanced markets, African policymakers will need to balance the opportunity for easing with ongoing external vulnerabilities,” according to Angelika Goliger, EY Africa chief economist.

Here’s what African nations may do and why:

A monthlong wave of monetary policy decisions will begin Wednesday, with Ghana and Mozambique.

Ghana, Africa’s largest gold producer, is projected to extend its easing cycle as inflation has cooled sharply and its real policy rate remains elevated at 12.6 percentage points.

ADVERTISEMENT

CONTINUE READING BELOW

Read: Prime interest rate: What is it, and do we need it?

“Based on conditions we are seeing, with the inflation rate below the lower band of the target and a fairly stable currency,” Ghana is expected to cut by a cautious 200 basis points to support faster economic growth, said Patrick Asuming, a senior lecturer at the University of Ghana Business School.

Inflation in the West African nation eased to 5.4% in December, falling below the 6% lower bound of the central bank’s target range for the first time since 2019.

Less clear is what Mozambique will do, where inflation is also softening and the real rate is at 6.3 percentage points. The country “faces persistent FX?reserve pressures, limiting near?term scope to ease until the metical stabilises,” Goliger said.

Attention will turn to South Africa on Thursday, with economists deeply divided over the central bank’s next move.

While the central bank is expected to revise its 2026 inflation forecast down to 3.3% from 3.5% — close to its new 3% target — analysts are split on the policy outcome. Thirteen surveyed by Bloomberg forecast rates will be kept at 6.75%, while 11 expect a 25-basis-point cut.

The divide centers on whether policymakers will wait for clearer signals from the rand and oil prices, or move now, encouraged by the currency’s recent rally.

Africa’s largest economy’s decision will weigh on neighbors Eswatini, Namibia and Lesotho, whose currencies are pegged to the rand and are set to announce their own rate decisions in the days ahead.

ADVERTISEMENT:

CONTINUE READING BELOW

Policymakers in Egypt, Kenya and Nigeria, who will give their decisions next month, are predicted to lower borrowing costs.

“We see scope for a 100-basis-point” cut in Egypt, 25 basis points in Kenya and 200 basis points in Nigeria, said Gergely Urmossy, an emerging-markets strategist at Societe Generale.

Read: Fed to hold rates as political storm intensifies around Powell

“Domestic inflationary developments and inflation outlook allow for rate cuts, but the timing and the size of the cuts are subject to uncertainty, predominantly due to — potential — shifts in global investor sentiment,” Urmossy said. “Throughout 2026, we expect several hundred basis points of rate cuts in Egypt, Ghana and Nigeria, while in Kenya our terminal policy rate forecast is 8.5% — with downside risks.” Its benchmark rate is currently at 9%.

Others due to make decisions over the month — including Mauritius and Uganda — are likely to remain cautious and leave rates unchanged to further assess the inflation trajectory.

Read: Zimbabwe inflation hits single digits for first time since 1997

“Overall, the region is nearing the end of its easing cycle,” said Goliger. “While select markets — notably Angola, and to a lesser extent Kenya and Ghana — may still deliver incremental cuts, the broad phase of monetary loosening is likely to taper by the second half of 2026,” she said. “Uncertain global financial conditions and ongoing FX constraints remain the key limiting factors.”

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Africa #starts #year #rate #cuts