Aluminium rose to the highest level in almost four years — and other base metals rallied — after US President Donald Trump appeared unperturbed by a steep decline in the dollar.

Asked what he thought about recent weakness in the currency, Trump told reporters it was “doing great,” adding to increasing bearish sentiment on the greenback. A gauge of the dollar tumbled almost 3% in the four sessions through Tuesday, making commodities priced in the currency cheaper for many buyers.

Base metals have made a strong start to 2026. As well as the dollar weakness, driven by Trump’s erratic policymaking and attacks on the Federal Reserve, they’ve benefited from a rotation into harder assets. That’s been spurred by the debasement trade, where investors move away from currencies and sovereign bonds on concerns over fiscal deficits, while supply constraints have also aided some metals.

ADVERTISEMENT

CONTINUE READING BELOW

That’s the case with aluminum: China has a cap on smelter capacity, and it’s not yet clear how quickly producers in the rest of the world can ramp up to feed growing demand from the energy transition.

ADVERTISEMENT:

CONTINUE READING BELOW

Goldman Sachs Group Inc. raised its forecasts for aluminum “following the strong price performance and continued bullish sentiment from investors,’ it said in a note. The bank, one of the more bearish commentators on the metal in recent months, sees it averaging $3,150 a ton in the first half, up from $2 575, but still below current prices.

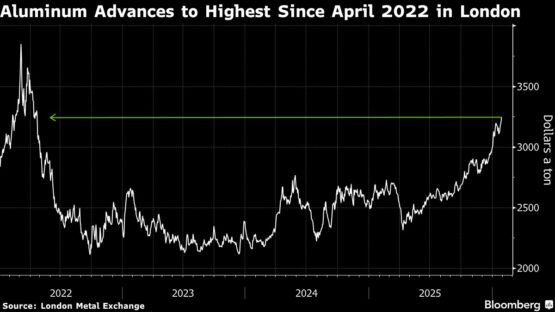

Aluminium rose 1.2% to $3 246.50 a ton on the London Metal Exchange as of 10:54 a.m. in Shanghai. It touched $3,252 earlier, the highest since April 2022 in the aftermath of Russia’s invasion of Ukraine. Copper climbed 0.9% and zinc was up 1.7%.

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Aluminum #hits #2022high #Trump #comfortable #weak #dollar