Gold rose, holding above $5 000 an ounce for a second day, as a weak US dollar helped to extend a blistering rally fuelled by geopolitical risks and investor flight from sovereign bonds and currencies.

Bullion jumped as much as 1.4% on Tuesday, its seventh straight day of gains. President Donald Trump threatened to hike tariffs on South Korean goods, and a key measure of the dollar sank on Monday on mounting speculation the US may help Japan to support the yen, making precious metals cheaper for most buyers. Silver climbed more than 7%.

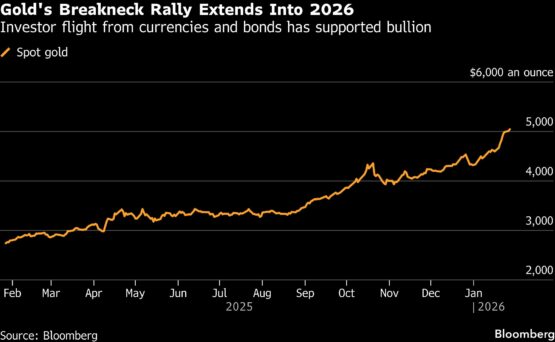

Gold’s dramatic rally – the metal has more than doubled over the last two years – drives home bullion’s historic role as a gauge of fear in markets. Fresh from its best annual performance since 1979, it’s gained a further 17% so far this year due largely to the so-called debasement trade, whereby investors retreat from currencies and Treasuries. A massive selloff in the Japanese bond market is the latest example of investors rejecting heavy fiscal spending.

ADVERTISEMENT

CONTINUE READING BELOW

In recent weeks, the Trump administration’s actions — threats to annex Greenland and military intervention in Venezuela, as well as renewed attacks on the Federal Reserve’s independence — have also shaken markets. The US leader’s warning to South Korea follows a threat to Canada over the weekend to impose 100% tariffs if Ottawa makes a trade deal with China.

America’s increasing isolation from other nations is convincing many investors to cut holdings of dollar assets and switch to gold, according to Europe’s largest money manager, Amundi SA. “Gold in the long term is a very good protection against debasement and a good way to maintain some purchasing power,” Vincent Mortier, Amundi’s chief investment officer, said in a Bloomberg Television interview.

Gold’s appeal is showing up in speculator positioning data, and options traders are bracing for more upside in a red-hot market where few wish to stand against the wave. Implied volatility of Comex futures climbed to the highest since the peak of the Covid-19 pandemic in March 2020, while volatility on State Street’s SPDR Gold Shares — the world’s largest bullion-backed exchange-traded fund — has also broken out higher.

“Traders are buying pullbacks rather than fading rallies,” said Fawad Razaqzada, an analyst at City Index. “As long as that mindset persists, it is difficult to argue against higher prices in the near term, even if there is a short-term disconnect between fundamentals and reality.”

ADVERTISEMENT:

CONTINUE READING BELOW

Looking ahead, investors are awaiting Trump’s pick for the next Fed chair after the US president said he has finished interviewing candidates and reiterated he has someone in mind for the job. A more dovish chair would increase bets on further interest rate cuts this year — a positive for non-yielding bullion — after three successive reductions.

In the near term, however, the US central bank is widely expected to halt its rate-cutting cycle on Wednesday as a steadier jobs market restores a degree of consensus after months of growing division.

Gold rose 1.2% to $5 067.84 an ounce as of 1:00 p.m. in Singapore. Silver advanced 4.3% to $108.25 an ounce, having hit an all-time high above $117.71 in the previous session before retreating. Platinum and palladium climbed, while the Bloomberg Dollar Spot Index edged up 0.1% having fallen 0.4% in the previous session.

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Gold #extends #gains #debasement #trade #gathers #pace