Emerging-market stocks, currencies and precious metals are extending a storming start to 2026 as tensions between the US and Europe weigh on the dollar and re-energize diversification flows around the world.

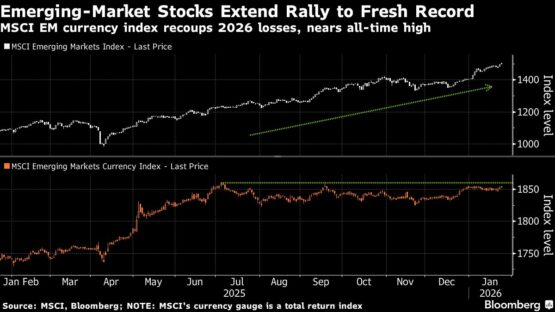

The rally gathered pace Friday, with the MSCI Emerging Markets Index heading for a fifth successive week of gains, its longest winning streak since May. The gauge has totted up a 7% advance this year, compared with a 1% gain for the S&P 500. Asian tech shares have underpinned the EM rally.

Risk sentiment got a boost after China’s central bank set the yuan’s daily reference rate stronger than the 7-per-dollar level for the first time in over two years, signaling its tolerance of the currency’s rally. South Africa’s equity benchmark eyed its third successive weekly rally as gold traded just under $5,000 an ounce.

Investors are pouring cash into emerging-market funds at a record pace as momentum builds for a rotation out of US holdings. It’s sent the EM stocks gauge to a record high.

ADVERTISEMENT

CONTINUE READING BELOW

While Asian technology shares drive the rally, other regions are also catching up. The benchmark for Emerging Europe, Middle East and Africa has risen on all five days of this week and is on course for its best month since 2020. The MSCI EM Latin America Index of equities on Thursday closed its highest since April 2018.

The Greenland tussle — even if it has been mitigated for now — has revived questions about US exceptionalism and the role of the dollar, spurring funds from Europe to India to diversify away from Treasuries. The flow has added an impetus to an EM rally fueled by robust global growth, the AI spending boom and political shifts in Latin America, as well as fiscal and monetary policy orthodoxy in much of the developing world.

People “are looking to diversify away from US assets, and I would kind of describe it as quiet-quitting of US bonds,” TCW Group Inc. Chief Executive Officer Katie Koch said in a Bloomberg Television interview. “I don’t think there’s going to be a massive announcement, I just think they’re going to look for opportunities to diversify away.”

Currencies like the Brazilian real and Colombian and Chilean pesos have gained more than 3% this year. Meantime, the world’s biggest reported gold buyer, the National Bank of Poland, on Tuesday approved plans to purchase another 150 tons of the precious metal.

The $135 billion iShares Core MSCI Emerging Markets ETF, which invests in EM stocks, has lured more than $6.5 billion in January. That puts it on track for the biggest monthly inflow since its inception in 2012.

ADVERTISEMENT:

CONTINUE READING BELOW

“EM assets are one of the key beneficiaries from stronger global growth,” Oliver Harvey, a strategist at Deutsche Bank in London, wrote in a note. “And when opportunities to express a positive growth view have been constrained in developed markets, the outlook is even more bullish for EM.”

To be sure, the pace of flows into emerging markets can ebb with geopolitical tensions as the pool of developing-nation assets isn’t as deep as the US. With a combined value of almost $36 trillion, emerging markets are roughly half of the US market at $73 trillion.

The US market may remain the top priority for some investors as focus returns to growth divergence with Europe following the “peak of stress,” Citigroup Inc. strategists including Rohit Garg and Gordon Goh wrote in a note.

“That said, the de-dollarization and fiscal profligacy themes are back,” they wrote. “De-dollarization has the potential to impact EM risk premia in a positive way, as was the case in 2025.”

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Quietquitting #assets #fuels #boom #bets #gold