With January almost behind us, many South Africans are settling into their financial plans for 2026 – and for a growing number, that involves moving money abroad to achieve their goals.

“Whether you’re planning to send funds offshore or bring them back to SA, it’s worth pausing to understand the true cost of your international money transfers before making any moves,” says Harry Scherzer, CEO of Future Forex and a qualified actuary.

Even with the rand trading at its strongest levels since 2022, its inherent volatility means timing is only part of the equation when it comes to moving funds internationally. The other, often overlooked factor is the cost of the transaction itself – and who you choose to move your money with.

For years, SA’s traditional banks have effectively controlled the foreign exchange market, setting opaque pricing and processes that typically hide costs of 2-3% per transaction – leaving customers with little room to manoeuvre, says Scherzer.

“High fees and inefficiencies became the norm simply because there were no credible alternatives.”

However, multi-award-winning Future Forex is taking on the banks directly, reducing transaction costs by up to 50% for individuals and 30% for businesses – all while introducing a level of service and transparency long absent from the industry.

“By leveraging cutting-edge tech and our economies of scale, we’re able to pass substantial savings directly to our clients, with full pricing disclosure and no hidden fees,” explains Scherzer.

“Beyond the numbers, our personalised, white-glove service ensures that every client – whether an individual or a business – receives expert guidance at every step.”

Why the banks are so expensive

One reason the banks have been getting away with exorbitant costs for decades is that few of their customers understand the real cost of transacting internationally.

While some of the bank’s costs are visible, others are deliberately obscured. For example, the more visible charges are the SWIFT (typically R500 to R1?000 per transaction), and ‘commission’ fees. But the largest cost is buried away in the hidden spread, which is the difference between a currency’s buy and sell rate.

Let’s say you’re planning to send R1 million to the US.

You might do an internet search and find the rate at R16.50 to the dollar. However, the bank will likely quote around R16.83 per dollar instead.

That seemingly small 33c difference equates to 2% of the transaction amount. That’s R20 000 lost to hidden fees before your transaction is even processed.

“We spend a lot of time educating our new customers on how the banks pile their costs up,” says Scherzer.

“Once they understand the pricing structure and realise they can outsource their forex without having to change banks, or pay extra fees, they don’t think twice about making the switch.”

For individuals investing offshore, purchasing property abroad, or emigrating, a 50% saving makes a tangible impact on financial goals.

The same is true for SMEs: a 30% fee reduction on a R500 000 import consignment can unlock significant capital for growth.

In South Africa’s volatile economy, these savings are vital.

Combining tech with a human touch

Beyond cost savings, Future Forex’s edge lies in its combination of leading financial technology with a level of personalised service rarely seen in the industry.

Unlike banks, which often rely on chatbots or understaffed call centres, Future Forex assigns each client a dedicated account manager available via WhatsApp, phone call, or email.

These experts provide end-to-end guidance, track transactions and address any queries or hurdles, delivering a white-glove service typically reserved for private banking or large corporates.

“When transferring funds internationally, you should be able to call and speak with an expert who understands you or your business and the latest regulatory shifts, which is not something you’re going to get from the banks,” says Scherzer.

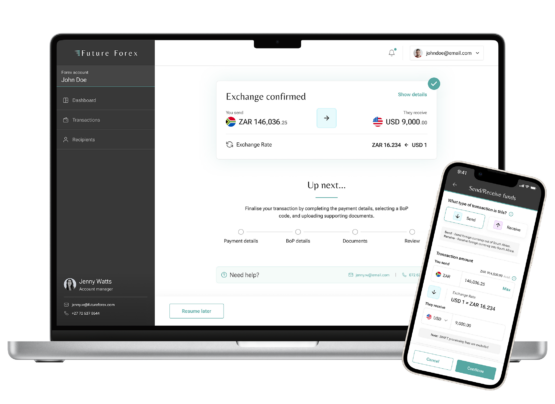

For those who prefer to manage their international payments autonomously, Future Forex’s cutting-edge platform offers live exchange rates, real-time payment tracking, and easy document uploads through a user-friendly mobile app or desktop interface – making forex payments simpler, faster, and more convenient than ever before.

Image: Future Forex

Taking care of regulatory requirements

South Africa’s strict exchange controls add another layer of complexity to international money transfers. However, Future Forex eliminates the red tape by handling the required paperwork at no extra cost.

“For individuals, our experts provide full support through the transfer process and necessary documentation. Whether it’s tax-related guidance or helping with a South African Revenue Service Approval for International Transfer (AIT), we manage it all for you,” says Scherzer.

“For our business clients, our team effectively becomes your dedicated forex department. “We assist with everything from SA Reserve Bank approvals to Balance of Payments codes (BoP) and Advance Payment Notification (APN) applications – all included in our service at no extra cost.”

You also get complimentary access to premium tools like forward contracts and foreign currency accounts, which the banks usually charge extra for.

This unique mix of full transparency, modern tech, and reliable human support sets Future Forex apart in South Africa. It’s why they’ve earned accolades like ‘Company of the Year’ at the 2025 Africa Career Summit and ‘Outstanding Customer Service in Forex & Payments, South Africa’ from the World Business Outlook Awards.

Follow this link to get in touch with a Future Forex expert or request a quote for your transaction. You can also give them a call on 021 518 0558 or send them a message on WhatsApp.

Brought to you by Future Forex.

Moneyweb does not endorse any product or service being advertised in sponsored articles on our platform.

#Moving #Money #Internationally #Cheaper #Alternative