Netflix shares tumbled in early trading Wednesday after giving a disappointing forecast for earnings in the months ahead as it spends more on programming and works to close its $82.7 billion deal with Warner Bros Discovery.

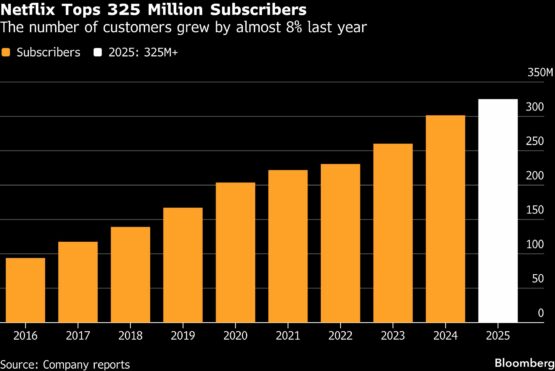

The streaming leader said Tuesday it plans to increase spending on films and TV shows by 10% this year while forging ahead with plans to buy the studio and streaming business of Warner Bros, a deal that would unite two of the world’s largest entertainment companies. Netflix spent about $18 billion on programming last year, with subscribers growing almost 8% to top 325 million.

On a call with investors to discuss quarterly results, Netflix executives said they are increasing spending to take advantage of “attractive investment opportunities.” The company has secured the streaming rights to movies from Universal and Sony, is expanding its portfolio of live events and video games and will introduce a new mobile user interface for the service later this year.

Closing the Warner Bros deal will add $275 million in costs for this year, on top of the $60 million spent through the end of 2025. Netflix will pause share buybacks to accumulate cash for the acquisition, according to its quarterly letter to shareholders.

All that spending will weigh on the company’s profit in the short term. For the current quarter, Netflix forecasts earnings of 76 cents a share, below Wall Street estimates of 82 cents. Sales will be $12.2 billion, in line with estimates.

ADVERTISEMENT

CONTINUE READING BELOW

Shares of Netflix fell 7.7% in premarket trading in New York to $80.56.

Netflix is in a hotly contested pursuit of Warner Bros.’ streaming and studio businesses. On Tuesday, it announced an amended agreement to buy those divisions for $27.75 a share in cash after previously offering a mix of cash and stock. Warner Bros. plans to spin off its cable networks in a separate transaction. Paramount Skydance Corp, led by technology scion David Ellison, is offering $30 a share in cash for all of Warner Bros.

Netflix executives projected confidence that they would get their deal approved by regulators.

“We’ve already made progress towards securing necessary regulatory approval,” co-Chief Executive Officer Ted Sarandos said on the call. Sarandos described the deal as pro-consumer and pro-innovation.

Netflix is buying Warner Bros to obtain one of the richest film and TV libraries in the world, content it can mine for new material and help the company expand newer businesses like consumer products, experiences and video games. Last year’s programming budget delivered a marginal increase in viewership for Netflix, with overall engagement growing about 2% in the second half.

ADVERTISEMENT:

CONTINUE READING BELOW

The company had a particularly strong programming lineup to close the year, including the final episodes of Stranger Things, a documentary series about hip-hop mogul Sean Combs and a new Frankenstein film.

Even as growth in new users and viewing has slowed, Netflix has sustained double-digit sales growth by raising prices and introducing advertising. The company expects to increase prices in 2026 and predicts ad sales will double this year from $1.5 billion in 2025.

The streaming giant reported sales of $12.1 billion in the fourth quarter and earnings of 56 cents a share, both ahead of analysts’ expectations. Netflix reported sales of $45.2 billion for all of 2025, up 16% from the year before.

Netflix gave soft operating margin guidance that included more Warner Bros.-related expenses than expected, analysts at Vital Knowledge said in a note to investors. Looking past that deal, “the underlying business fundamentals seem relatively healthy, with subscribers, pricing, and advertising revenue all moving higher,” they wrote.

Netflix has stopped providing quarterly updates on its subscriber total, directing investors to focus on more traditional financial metrics. For all of 2026, Netflix forecasts sales to grow as much as 14% to $51.7 billion, with an operating margin of 31.5%.

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Netflix #shares #slide #spending #mounts #Warner #deal