South Africa’s $4 billion beauty market is fast becoming a key battleground for retailers grappling with a sluggish economy, weak consumer confidence and intensifying competition.

Once relegated to drugstores and niche outlets, beauty and personal-care products are now front and centre. High-end department stores, value clothing chains and even supermarkets are dedicating more shelf space for makeup, skin and hair care, and fragrances.

The shift reflects a broader push by retailers to launch private labels, expand international brand offerings and capture a category that promises growth when others stall.

Read:

Retail review 2025: ‘It just wasn’t the year for retailers’

Dis-Chem set for stronger full-year performance

Clicks looking to cement itself as the ‘leader in beauty’

Premium retailer Woolworths Holdings has rolled out beauty halls in major stores, pairing luxury brands such as La Mer and Chanel with its own ranges and backing that with local manufacturing. Revenue from the division has more than doubled to over R1 billion in the past two years. The group expects to repeat the performance by 2028, said Julie Maggs, its general manager for beauty.

The Foschini Group, which spans upmarket to value segments, is expanding its in-house product lines and plans to double the number of stores with dedicated beauty departments. Pepkor Holdings, Africa’s largest seller of clothing and mobile phones, launched a new beauty range across 400 stores in November.

For retailers under pressure, the appeal is clear: Beauty products often sell, carry higher margins and are less sensitive to economic cycles.

ADVERTISEMENT

CONTINUE READING BELOW

“Local retailers are seeing beauty as an untapped growth area, where they can ramp-up new sales and capture market share,” said Syd Vianello, an independent retail analyst in Johannesburg. The entry of large companies with the capital to invest in high-quality store layouts is stimulating demand, he said, while in-house brands at groups such as TFG and Woolworths are delivering solid margins.

The so-called “lipstick effect” — consumers treating themselves to small luxuries during hard times — is another tailwind.

South Africa’s beauty and personal care market grew 7% year-on-year to $3.9 billion in 2024, according to market research firm Euromonitor International. Gross domestic product expanded 0.6% over the same period while consumer sentiment has remained depressed for 26 consecutive quarters.

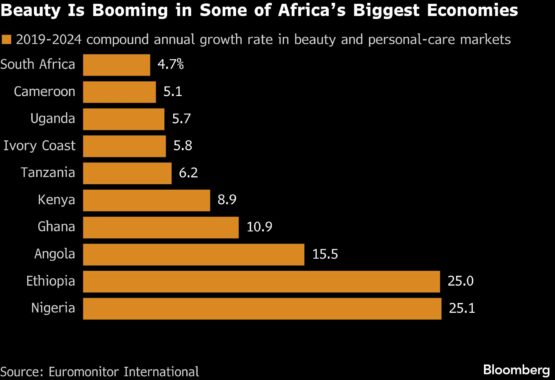

The rise of South Africa’s beauty industry mirrors trends across emerging markets. Growth in Nigeria and Ethiopia, Africa’s most populous countries, is outpacing the rest of the continent, while in India, a beauty and fashion e-commerce boom has minted unicorns and a self-made female billionaire.

“Beauty is very personal and emotive, which helps its resilience,” said Jamie Lane, the CEO of ARC, which stocks global brands and recently converted its flagship Johannesburg branch into Africa’s biggest beauty store. Demand is showing “strong and sustained growth,” he said, with brand, product and beauty trends driving customer behaviour more than price.

ADVERTISEMENT:

CONTINUE READING BELOW

Read:

Two listed retailers where you get a chunk of the business for ‘free’

TFG sinks as earnings warning spooks market

Woolworths expands beauty push to Kenya after demand jumps

Woolworths hasn’t ‘been in better shape’ – Bagattini

Demographics are adding momentum. Growth in the Black middle class since the end of apartheid, combined with a young, social-media-savvy population, has increased awareness of cosmetics, ingredients and self-care routines.

At Clicks Group, the country’s largest pharmacy chain, skin, hair and personal care now outpace pharmaceuticals as the biggest contributors to its R47.8 billion in turnover.

Spending is also driven by the rising availability of local and international brands such as pop star Rihanna’s Fenty Beauty as well popular Korean and Japanese labels and the proliferation of e-commerce, including by Chinese-origin firms Shein and Temu.

Older middle- to high-income earners that are paying closer attention to their health and want to enhance their appearances without undergoing cosmetic procedures are also contributing to the defensive nature of the market, according to Clicks CEO Bertina Engelbrecht. The group is seeing “phenomenal” returns from 44 stores with upgraded beauty halls and plans to extend the concept across more of its nearly 1 000 locations, she said.

Private labels aimed at value-conscious shoppers are also becoming increasingly prominent. Retailers invest heavily to tailor products to local conditions — from climate-specific skin care to inclusive colour palettes and hair products.

The payoff can be significant. “We are not charging silly prices for them and on top of that, the gross margins are significantly better because we’re not paying somebody else for their branding,” said TFG Chief Executive Anthony Thunström. The group is targeting a more than fourfold increase in beauty sales to R5 billion by 2030.

ADVERTISEMENT:

CONTINUE READING BELOW

The strategy carries risks, including inventory missteps. Offering skincare services and premium beauty demonstrations also adds complexity, from training consultants to allocating store space, said Alec Abraham, an analyst at Sasfin Securities in Johannesburg.

Still, the boom is spilling over from products to services, and drawing back seasoned entrepreneurs, including Ian Fuhr, who built and achieved a multimillion-dollar exit from Sorbet, South Africa’s largest beauty-salon chain.

His latest venture, Popsicle Professional Nails, opened two salons in December, ahead of the peak summer-holiday season. Early demand has been strong enough for Fuhr and his partners to accelerate growth plans.

The original target was to start franchising in a year. Now, Fuhr expects to do so in about half that time.

The battle at the checkout counter will be shaped by consumers like Rufaro Chiswo, a 24-year-old graduate student who often buys local and international products recommended by influencers. Before recently resuming her studies, Chiswo worked as a video editor and spent about R1 500 a month — roughly 8% of her income — on makeup and skin care. “I spent a crazy amount of money,” she said. “It’s something that I never compromised on, no matter what I was earning.”

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Lipstick #effect #powers #SAs #beauty #arms #race