2025 was nothing short of explosive for both OVEX and the broader cryptocurrency industry.

As global finance continued its gradual convergence with digital assets, OVEX solidified its position at the intersection of traditional finance and crypto – a place where infrastructure, regulation and real-world utility meet.

This positioning has become especially important against the backdrop of major global regulatory developments, including the growing clarity around stablecoins in key jurisdictions. As stablecoins increasingly emerge as the preferred settlement layer for cross-border value transfer, OVEX has established itself as a critical conduit for stablecoins into and out of Africa.

Building Africa’s stablecoin infrastructure

A core focus for OVEX in 2025 was infrastructure – specifically the development of robust, compliant and scalable fiat-to-fiat, fiat-to-crypto and crypto-to-fiat rails across key African markets.

This focus reflects a long-held conviction that Africa’s integration into the global financial system will be driven not by speculation, but by dependable settlement, deep liquidity and consistent access to global currencies.

Today, OVEX offers fully operational local currency rails in:

- ZAR (South African rand)

- GHS (Ghanaian cedi)

- XOF (West African CFA franc)

- XAF (Central African CFA franc)

- NGN (Nigerian naira)

- TZS (Tanzanian shilling)

- KES (Kenyan shilling)

- UGX (Ugandan shilling)

Beyond these live corridors, OVEX continues to build new rails in markets that are actively pioneering regulated access to crypto.

This expansion is undertaken in close collaboration with local regulators, banking partners and payment institutions to ensure long-term resilience and compliance.

In parallel, OVEX significantly expanded its G7 and global market connectivity. By leveraging its licensing and operational presence in France, the exchange launched fully functional EUR rails, materially strengthening its European corridor.

Additional key international rails include:

- USD (United States dollar)

- AED (United Arab Emirates dirham)

- GBP (British pound sterling)

The result has been a meaningful expansion of OVEX’s addressable market, alongside a sharp increase in demand from institutions and businesses seeking efficient, compliant and scalable access to stablecoins.

Growth driven by real demand

These infrastructure investments translated directly into impressive growth. In 2025, OVEX recorded a year-on-year trading volume increase in the triple digits, driven largely by stablecoin demand in newly supported African markets.

This growth was not fuelled by short-term trading mania, but by structural demand:

- Businesses seeking reliable access to hard currency;

- Institutions managing treasury risk in volatile currency environments;

- Cross-border traders and importers requiring faster settlement; and

- Payment providers and fintechs building crypto-native rails.

In other words, stablecoins moved from the margins into the core of financial operations – and OVEX was positioned to support that shift.

Stablecoins as Africa’s financial backbone

Across the continent, stablecoin adoption continued to accelerate throughout 2025.

Currency volatility, persistent inflationary pressure and limited access to stable foreign currency through traditional banking channels have pushed both individuals and businesses toward US dollar-denominated stablecoins for savings, hedging and everyday payments.

Unlike conventional banking rails, stablecoins can be moved across borders faster, at lower cost, and with far fewer intermediaries.

In markets such as South Africa – where regulatory clarity and financial infrastructure are relatively mature – institutional confidence has grown rapidly. As a result, stablecoin usage has expanded well beyond retail activity into business payments, remittances and large-scale B2B settlement.

OVEX is now extending this proven infrastructure into additional African markets, building both intra-continental and inter-continental corridors that are demonstrably more efficient than existing alternatives.

OVEX’s role throughout this transition has been clear: to ensure that stablecoin adoption occurs in a way that is safe, compliant and scalable – meeting the reliability standards demanded by institutions.

Building out key products to support stablecoin adoption

As stablecoins become core financial infrastructure, access alone is not enough. Institutions require products that remove friction, provide cost certainty and deliver speed at scale.

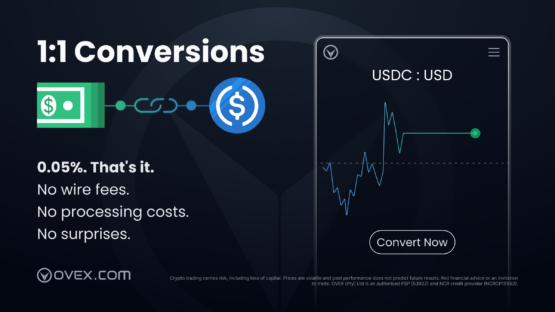

In 2025, OVEX launched a suite of new capabilities designed to complement its existing ramping infrastructure – most notably a direct USD to USDC conversion facility.

This facility allows individuals and businesses to convert USD into USDC quickly, transparently and at a guaranteed 1:1 rate. Rather than relying on traditional exchange trades or opaque minting processes, OVEX offers a direct conversion flow with a flat fee of just 0.05% (five basis points).

How the USDC conversion facility works

The process is deliberately simple:

- Deposit: The client wires USD to OVEX’s secure offshore facility.

- Settlement: Once the funds land and settle with OVEX …

- Instant conversion: … the client’s OVEX account is automatically credited with the equivalent amount of USDC.

A fixed 0.05% fee is applied – and that is the only deduction.

Because the fee is flat, clients immediately receive 99.95% of the capital they send. For example, a $100 000 USD deposit results in $99 950 USDC credited as soon as the funds settle.

Why this matters for institutions

The value of this product lies in its predictability and efficiency:

- Absolute cost certainty: Clients know the exact outcome of every conversion. There are no hidden fees, tiered pricing or unexpected charges.

- Zero slippage: This is a conversion, not a market trade. Clients are insulated from volatility, liquidity constraints and price movement.

- Immediate liquidity: As soon as USD settles, USDC becomes available for trading, payments or treasury use – eliminating the delays common in traditional minting workflows.

By focusing on conversion rather than complexity, OVEX removes a critical point of friction in stablecoin adoption. The result is a product that aligns with institutional expectations: transparent, efficient and built for scale.

Thought leadership on a global stage

2025 was also a year of visibility and advocacy for OVEX.

CEO Jonathan Ovadia represented the exchange at several major global conferences, including Bitcoin MENA – the Middle East’s premier annual conference dedicated to advancing Bitcoin understanding, adoption, and innovation – where he spoke extensively about the role of Bitcoin and stablecoins in emerging markets.

His message has been consistent:

- Financial inclusion and empowerment: Crypto, particularly stablecoins, allows Africans to store value digitally in stable units, reducing dependence on volatile local currencies and opening access to global finance.

- Lower remittance costs: Crypto dramatically reduces the high fees, often ranging from 12% to over 30%, associated with traditional remittance channels.

- A neo-banking future: OVEX envisions a crypto-powered neo-bank for Africa, enabling instant, low-cost international transfers and global currency access, comparable to holding foreign bank accounts.

- Solving systemic constraints: Currency illiquidity and cross-border payment friction remain major barriers to African trade. Crypto offers a credible alternative settlement layer.

- Empowering choice: Just as mobile phones transformed access to information, crypto gives people and businesses choice over how and where they hold value.

Expansion with purpose

Throughout 2025, OVEX continued its measured expansion into key African markets, including Nigeria, Kenya and Zambia.

This growth has been guided by a clear philosophy: focus on institutions, high-net-worth individuals and sophisticated market participants who require deep liquidity, compliance and bespoke service – while still enabling broader ecosystem growth.

Behind the scenes, the bulk of the year was spent finishing what matters most – the plumbing.

Payments, custody, liquidity, compliance and settlement infrastructure have been refined to support scale.

OVEX also launched a completely redesigned web experience in 2025, guiding users through the journey of unlocking crypto rails for cross-border settlement and institutional use cases.

Looking ahead to 2026

As 2026 begins, OVEX enters the year with its foundations firmly in place.

The focus now shifts from building rails to fully activating them:

- Deeper institutional adoption of stablecoins;

- Expanded corridor coverage and liquidity;

- Enhanced APIs and integration tools for partners; and

- Continued leadership in compliant crypto-fiat settlement.

The broader industry is moving toward a future where stablecoins are not an experiment, but core financial infrastructure. OVEX’s mission remains clear: to plug Africa into the global financial ecosystem using crypto as the settlement layer.

2025 was about building. 2026 is about scale.

Brought to you by OVEX.

Moneyweb does not endorse any product or service being advertised in sponsored articles on our platform.

#OVEX #Africas #stablecoin #moment