While AI continued to garner headlines in offshore markets, for those invested in our local bourse it was precious metals that stole the show.

Gold has continued to rally across multiple years, but platinum group metals (PGMs) – which include platinum, palladium and rhodium – all had a face-ripping rally in the last moments of 2025.

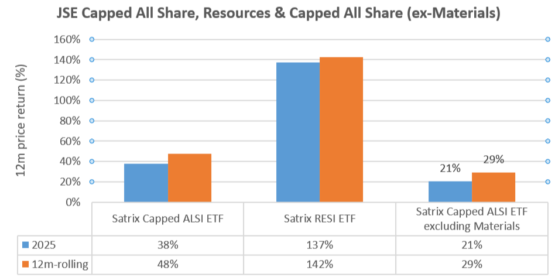

Combined, these two key commodities that South Africa (and our local market) is blessed to hold plenty of pushed our local Capped All Share Index (Capped Alsi) to an eye-popping 38% price return (add some dividends for the total return) for the year.

But what about the rest of the market?

At the start of 2025, materials made up 19% of the Capped Alsi – and by the end of the year made up nearly a third (around 29%).

Reverse this weighting out of the index, and we get non-resource sector performance on our local index at 21% in 2025.

Source: Various Satrix ETFs as index proxies, and analyst workings

Not too bad for an economy growing slower than the population.

ADVERTISEMENT

CONTINUE READING BELOW

Perhaps another way to look at this, though, is that the market is forward-looking and the market is expecting our South African growth rate to steadily pick up.

If the incredible strength in our local bonds – especially the mid-to-longer dated maturities that price in the new 3% inflation target – is anything to go by, South Africa is in a good place.

It is early in 2026, but the precious metals rally has started to widen to include other metals (and in time, probably other commodities).

The Resources Index (Resi) is up a further 13% or so in the first days of this year!

The rally of non-metal stocks on the JSE seems to be picking up pace too, as foreign buyers into our bond market also began to nibble on the larger local equity names last year.

While a 21% return for last year is excellent, these stocks in the Capped Alsi are up a further 4.8% since the start of the year, which annualises well higher than 2025’s (so far) …

Hence, indications are that the narrow rally in our market is starting to broaden. After all, equity bull markets tend to follow from bond market rallies (bonds rally, then equities rally).

So what to buy?

ADVERTISEMENT:

CONTINUE READING BELOW

I’ve written about a range of options in recent times:

There are also some other excellent SA Inc stocks that I have not written about recently: Bidvest Group (diversified industrial services and products with a growing international segment), Attacq (high-quality, predominantly Gauteng-based real estate investment trust that stands to gain from a positive Gauteng local election outcome), and AVI (high-quality, branded food and fashion house).

Bonds rally first. Equities rally second, though last year this was obscured by global events driving precious metals.

The rally in local equities does however seem to be broadening, and hopefully picking up pace with our improving local fundamentals.

Now all we need is the macroeconomic growth.

Keith McLachlan is CEO of Element Investment Managers.

* McLachlan and portfolios managed by him may hold investments in FirstRand, Standard Bank, Momentum, Pick n Pay, Clicks, Mr Price, Bidvest, Attacq and AVI.

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#shone #shine #JSE