Every few weeks, electricians, fitters and welders pass through Dublin Airport to get flights to construction projects for data centres across Europe.

They’re part of a cohort of Irish workers in high demand for their expertise in building and fitting out facilities. Their employer, Kirby Group, earned its reputation thanks to the massive investment in Ireland by the likes of Microsoft, Amazon.com and Alphabet’s Google that turned the country into a major data centre hub, one of Europe’s biggest.

The artificial intelligence race means Ireland should again be an investment winner, leveraging its longstanding relationships with US firms to bring in more money.

Instead, it’s missed out on much of the data centre boom as creaking infrastructure and a strained electricity grid put the brakes on projects. Companies have scrapped plans — or have been blocked by authorities — and officials estimate some €10 billion ($11.7 billion) of investment has been lost because of constraints.

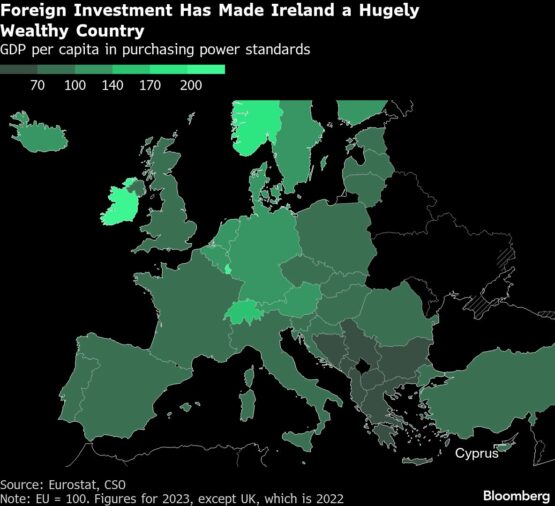

Ireland’s past success at luring the world’s biggest names in tech and pharma turned it into one of the richest countries in the world. If overseas companies start to turn away, the damage would be huge.

Aware of the risks, the government is making a fresh push to get back on the data centre bandwagon. It has outlined plans for special business parks where energy-devouring projects can have easy access to clean power, balancing energy constraints with the need to stay attractive for investment. The move follows a decision by the energy regulator on new rules for electricity grid connections after a long-running review that left businesses in limbo for four years.

ADVERTISEMENT

CONTINUE READING BELOW

“We risk missing an enormous wave of European AI and cloud investment,” Niall Molloy, chief executive officer of Echelon Data Centres, which operates facilities in multiple countries, said after the regulator’s announcement last month. “If they can’t locate in Ireland, we are running the risk of major problems in our foreign direct investment and our tax strategy.”

The country is already living under the cloud of Donald Trump’s “America First” agenda, and worries that the policy will damage investment. While the concern has so far proven unfounded, the uncertainty remains, meaning Ireland can ill afford to give businesses reason to have additional doubts.

It’s an especially pressing issue because of the economic risks. Foreign-owned multinationals drive growth, employ more than 600,000 people and are the main reason the government can run annual budget surpluses. Those companies accounted for almost 90% of corporate tax income in 2024.

The US government has taken note of the infrastructure squeeze. Last year, officials said that American companies see issues like energy constraints as a “major barrier to growth and further investment.”

The ‘Silicon Docks’ area of central Dublin. Photographer: Paulo Nunes dos Santos/Bloomberg

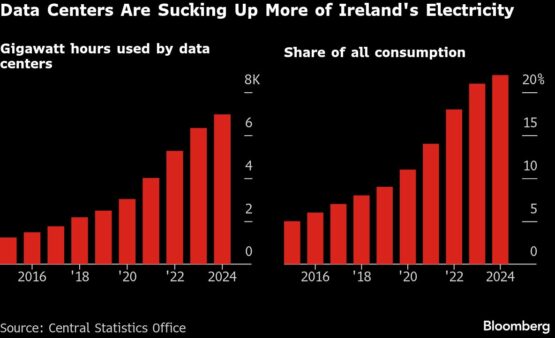

Data centres have been central to the energy issue. They consume about 22% of Ireland’s electricity, more than all urban homes, and up from just 5% a decade ago.

ADVERTISEMENT:

CONTINUE READING BELOW

The power tensions reached a head in 2021 amid growing concern about blackouts. The energy regulator, CRU, started a review, leading to a de facto freeze on data center grid connections around Dublin. Since then, only two centres secured a connection agreement from operators EirGrid and ESB Networks.

A final decision on connections was published by the regulator only last month. The clarity was welcomed by industry, but there are concerns about new strict requirements.

Operators will be required to install energy generation or storage capable of meeting their full demand, and 80% of each facilities’ annual electricity must come from renewable energy projects in Ireland.

That will put additional costs on businesses at a time when Ireland needs to be as competitive as possible to win back their trust.

“We’ve definitely not made it easy for data centres to then connect since we have both the capacity requirement and also the generation requirement,” Steph Unsworth, UK-based senior associate at Aurora Energy Research, said of the regulator’s decision. “It means there’s a lot of additional investment.”

ADVERTISEMENT:

CONTINUE READING BELOW

Government promise

The government has acknowledged it needs to do more, and last summer announced an infrastructure investment package worth €112 billion.

It has the money – thanks to corporate tax revenue –, but there are other roadblocks, from a shortage of workers to a cumbersome planning system.

Meanwhile, Kirby is going where there’s work. It built its first data centre in Ireland in 2007 and has seen rapid expansion in recent years. Revenue has more than doubled since 2020.

“A lot of it started in Ireland,” said CEO Henry McCann. But in 2026, “more than 65% of our revenue will be generated by projects outside Ireland.”

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Ireland #data #centre #bandwagon